Stocks react to BofA survey, views on Australian Banks

Australian Stocks from here

Two weeks ago we said “it feels like some underweight fund managers have been forced to commit some of their cash into Australian stocks”. We also pointed out that in the recent Bank of America (BofA) Fund Manager survey fund managers allocation to stocks was sitting at an 18-month low – certainly not bearish stuff at the time. However things have changed dramatically in the latest June BofA survey. Illustrating a sharp reversal in market sentiment i.e. from pessimism to optimism.- Fund managers have increased their exposure to equities by 16% to the highest level since March 2017.

- The move back into equities has been triggered improving profit outlooks with allocations to commodities at an 8-year highs and energy a 6-year high.

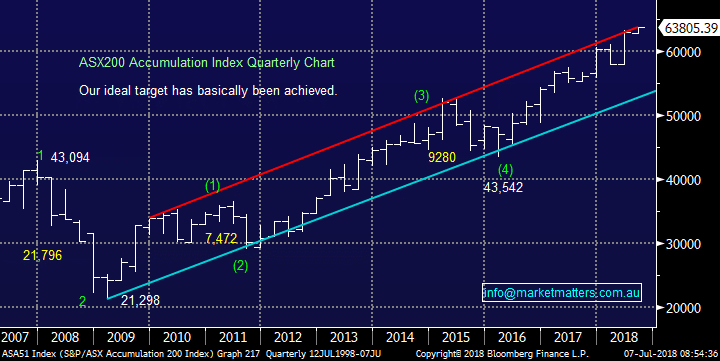

ASX200 Accumulation Index Quarterly Chart[/caption]

ASX200 Accumulation Index Quarterly Chart[/caption]

Top in Equities

As subscriber know we’ve been anticipating a top for equities in 2018 /9 – since the GFC the ASX200 Accumulation Index has experienced 2 meaningful pullbacks of around 20% and 18% respectively. Two things are catching our eye when we consider the position of today’s market:- The ASX200 Accumulation Index has clearly reached overhead technical resistance but it can sit here climbing a wall of worry for months, just look at 2010.

- The market has not experienced a decent pullback since February 2016, over 29-months ago, it’s fairly easy to say a correction is overdue – not a particularly good reason to sell for MM

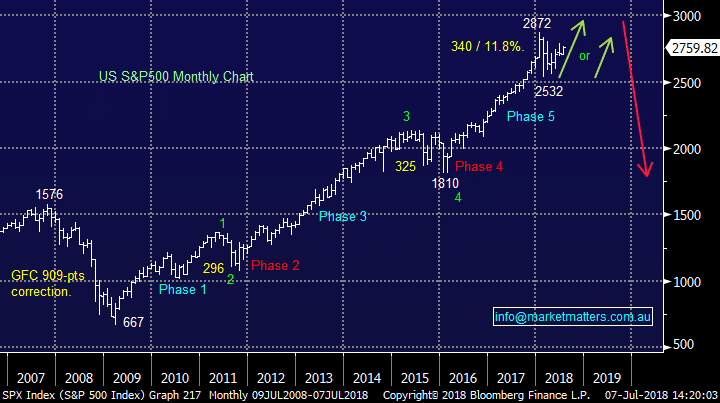

- We expected the most watched US S&P500 index to trade between its January high-February low for a number of months – this has proved correct.

- Then we expected the S&P500 to attempt a rally potentially to fresh all-time highs– this is currently unfolding and will theoretically follow one of the below 2 green arrows with fresh all-time highs ~4% higher.

- Lastly we expect the S&P500 to experience a meaningful correction in 2018/9, obviously time will tell if this proves correct.

US S&P500 Index Chart[/caption]

US S&P500 Index Chart[/caption]

1 Suddenly everyone wants the banks.

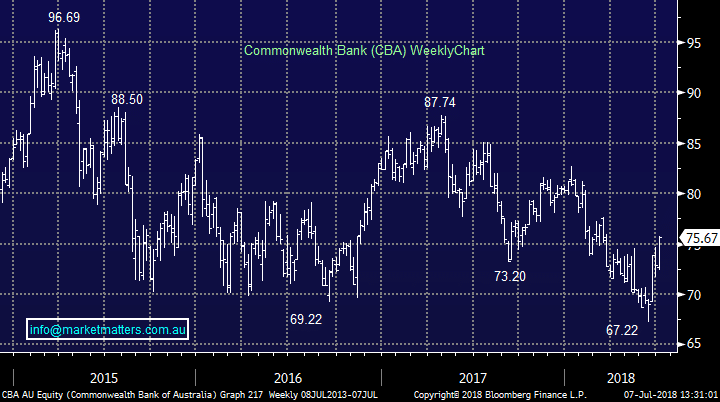

We hold the “Big 4 Banks” hence we’ve thoroughly enjoyed the impressive return to favour of the Banking Sector. Recently our tune has been the banks are cheap and paying excellent yields hence we felt it was just a matter of time before this strong recovery occurred i.e. the elastic band as we like to say was stretched way too far and subsequently snapped back with CBA rallying 12.6% in just 4-weeks. Importantly now is what we think comes next, today we’ve looked at 3 banks and they all remain constructive to various degrees.Commonwealth Bank (CBA)

Technically the failed break below $70 is overall bullish with a potential target around the $87 area. The short-term picture will remain rosy while $74 holds for CBA. [caption id="" align="alignnone" width="720"] Commonwealth Bank (CBA) Chart[/caption]

Commonwealth Bank (CBA) Chart[/caption]

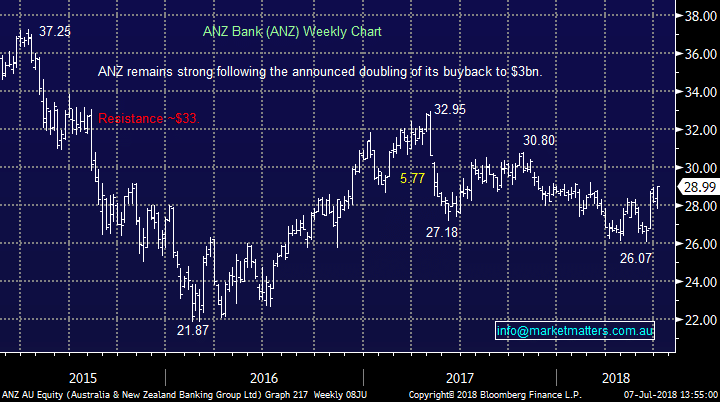

ANZ Bank (ANZ)

Technically ANZ is looking great with an initial target around $30, or 3.5% higher. Seeing a break back below $28.70 would cloud the picture short-term. If we were to consider increasing our already large banking exposure in 2018 ANZ would be the likely candidate. [caption id="" align="alignnone" width="720"] ANZ Bank (ANZ) Chart[/caption]

ANZ Bank (ANZ) Chart[/caption]

Second Tier Banks

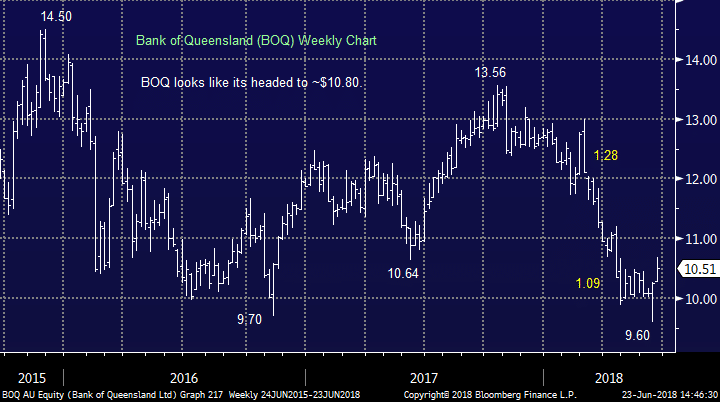

Second tier banks were also strong last week. BOQ has now bounced over 9% from its low, an expected reaction we had outlined in earlier reports.- We think BOQ will at least challenge the $10.80 area before this recovery may encounter selling i.e. ~ 3% higher.

View the earlier reports providing detailed reasoning by clicking below:

- Income Report; Are bank dividends sustainable? (CBA, NAB, WBC, ANZ)

- BOQ reports soft half year numbers (BOQ, OZL, VRL)

- Subscriber Questions (MQG, BOQ, IVX, MIN, AGO, MMI, TLS)

Bank of Queensland (BOQ) Chart[/caption]

The individual banks look good which suits the MM portfolio mix. This does raise the question if a top for the ASX200 can be close at hand.

Bank of Queensland (BOQ) Chart[/caption]

The individual banks look good which suits the MM portfolio mix. This does raise the question if a top for the ASX200 can be close at hand.

- Out current plan is to maintain our banking exposure, given the view remains they will outperform over the next year.