Australia shrugs off global turmoil (A2M)

WHAT MATTERED TODAY

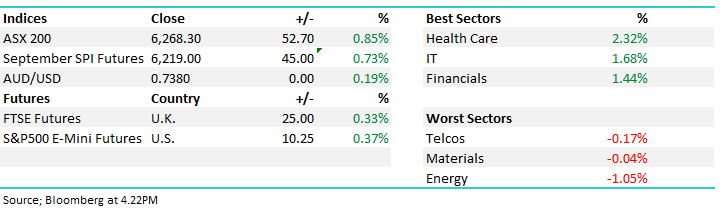

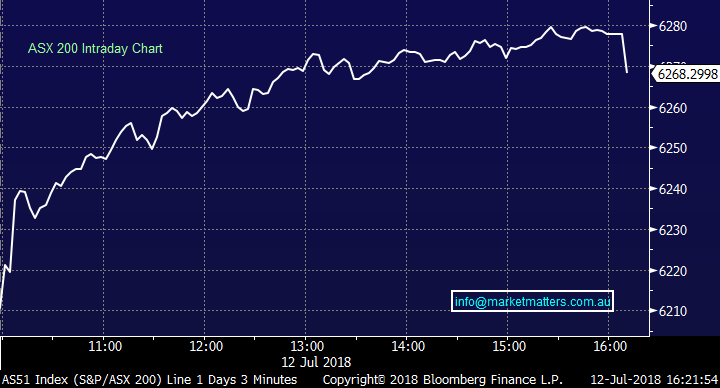

The local market shrugged off weakness seen overseas to rebound strongly today, recovering all of yesterday’s losses and some! The market grinded higher, albeit on low volumes as has been experienced all week. Banks were the main driver of the index, but CBA’s daily volume was 28% lower than the 20 day average! For the first time, CSL cracked the $200 mark, gaining 2.6% to $200.60. AGL and Origin rebounded from recent declines as investors absorb what an ACCC crackdown in the energy sector could mean for the pair, with JP Morgan saying shares price action had overshot the mark. Energy names however – not of the retail supplier kind – didn’t fare as well, as oil slumped. Energy being the worst sector in the market today.

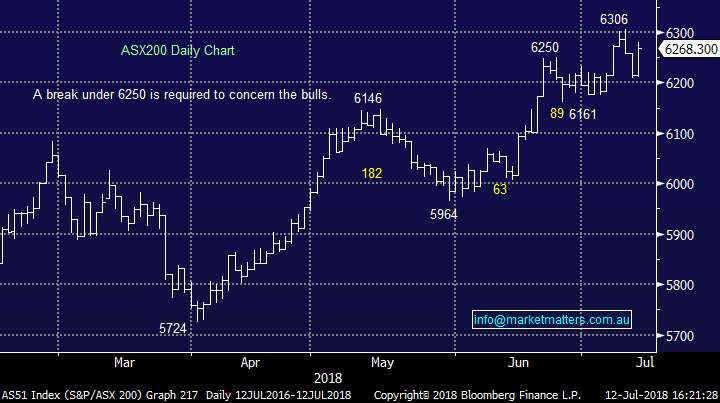

Overall, the ASX200 added 52 points, or 0.85% to close at 6268 – or 10 points higher than when Trump took to twitter for his detailed communication regarding further trade restrictions!

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· Insurance Australia (IAG AU): Insurance Australia Reinstated Sell at Shaw and Partners; PT A$7

· Lovisa (LOV AU): Lovisa Downgraded to Underweight at Morgan Stanley; PT A$9.50

· Spark Infrastructure (SKI AU): Spark Infrastructure Cut to Underperform at Credit Suisse

· Sydney Airport (SYD AU): Sydney Airport Cut to Underperform at Credit Suisse; PT A$6.75

· Telstra (TLS AU): Telstra ADRs Raised to Outperform at Bernstein; PT Set to $14.94

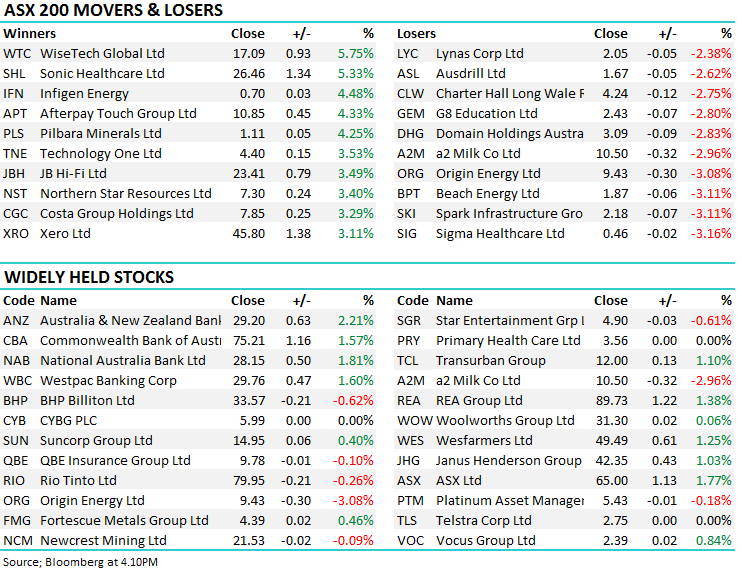

A2 Milk (A2M) $10.50 / -2.96%; A2 released an unaudited revenue number for FY18, beating expectations with $922m vs $914m expected, up 68% for the year. The release also signalled that EBITDA will be around $276m, ~30% of revenue, above consensus estimates of $270m – so in all respects the stock should be up right? Well, investors sold into the result because of shady guidance for current financial year, with the company saying they expect to continue to grow but will realize a number of one off costs as new CEO Jayne Hrdlicka steps into the role from Monday. A2 Milk has been notoriously vague when providing an outlook for the year ahead, and that theme continued today. The announcement lacked clarity around any forward estimates, and detail is something the market loves. Investors should expect “further growth in revenue particularly in respect of nutritional products.”

A2 Milk (A2M) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here