Aussie stocks end down -3.37% for May

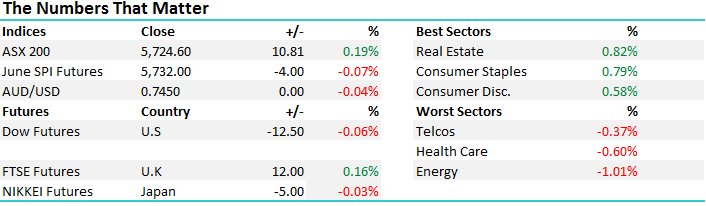

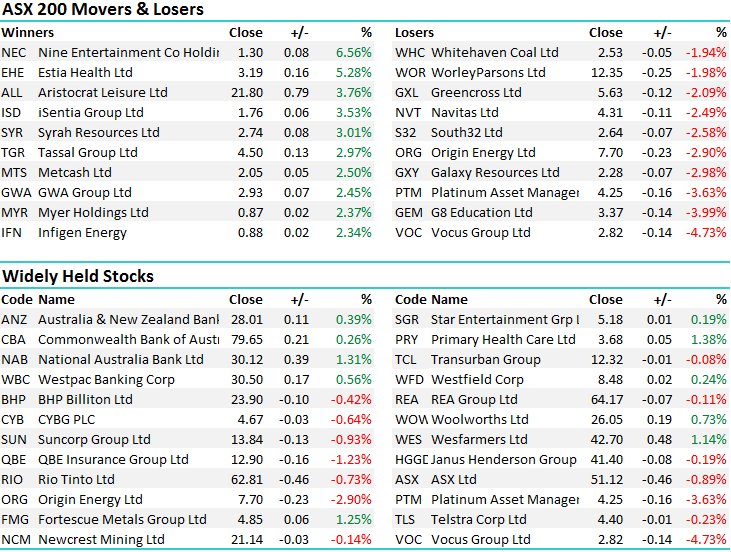

No doubt many will be happy to see the end of May this year with the ASX 200 down by -3.37% since topping out on the 1st May at 5956 – finishing at 5724 this afternoon in what proved to be a fairly choppy session overall. The -4.57% underperformance by the ASX in May is largely a result of the significant bank weightings in the Aussie index, with the sector down 11% for the period. Yesterday we saw signs of life in the banks with a decent turnaround from the lows and today the trend continued – for the morning session at least – before sellers once again saw them close well below their best. NAB the best of them adding +1.31% to close at $30.12. The consumer staples and real estate sectors were best, while Health Care and the Energy sector were weak – we’ll discuss healthcare in more detail below.

As suggested, the market was strong early on, but tracked down off earlier highs by the close. A range of +/- 31 points, a high of 5740, low of 5708 and a close of 5724, up 6 points, or +0.12%.

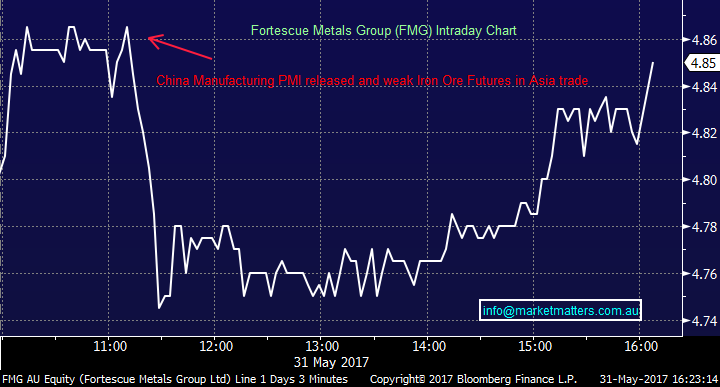

Chinese Manufacturing data was out at 10.55am this morning (seems they got a little trigger happy and released it 5 mins early), it printed stronger than expected – slightly – however Iron Ore Futures didn’t seem to care dropping ~3% and dragging down our miners in the process. The Russians were also trigger happy today with a Russian frigate, submarine, stationed in Mediterranean Sea, launching 4 cruise missiles on Islamic State targets around city of Palmyra!

Fortescue Metals (FMG) Daily Chart – was hit on PMI and weak Iron Ore Futures but recovered in afternoon trade. Starting to see appetite to BUY this play!

ASX200 Intra-day Chart

ASX200 Daily Chart – support holds for now

The healthcare stocks have been in focus of late with some decent selling pressure in the likes of Healthscope and to a lesser degree Ramsay Healthcare. We didn’t get a chance to write about this yesterday, however there was a leaked report that suggested the Govt planned to abolish the private health insurance rebate with consumers charged more for extras cover and more funding would be required from the states. Stocks were hit on the back of it yesterday however the Govt was quick to reject the leaked plan however it does highlight regulatory risk in the sector.

Clearly the Govt is looking for money and the healthcare space is a large cost centre for Govt, so naturally it will be an area where savings could be found. Ramsay obviously has less exposure to it than Healthscope given their international business accounts for a larger proportion of their earnings but a stock on 30x is clearly susceptible to a decent correction if we do see some change in Govt regulation. Healthscope on 20x is more reasonable however as we’ve made mention of recently, the price action in HSO is concerning. At Market Matters live last night Charlie Aitken highlighted this (meaning healthcare stocks) as one of the major risk sectors in the Aussie mkt at present.

Ramsay Healthcare (RHC) Daily Chart

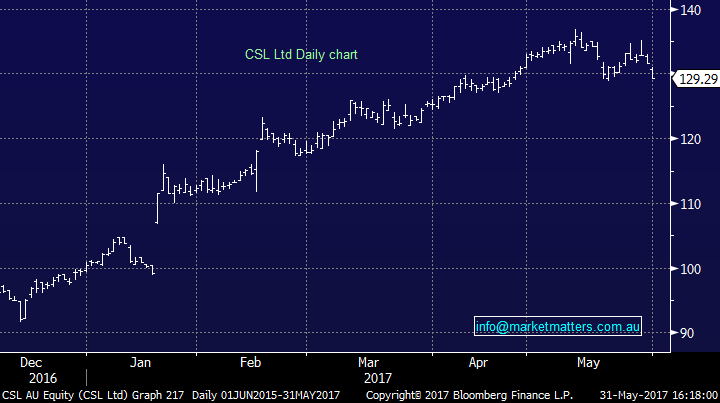

CSL also looks interesting here and from the price action we’re seeing , it seems starting to roll over. A very difficult stock to short given the huge earnings momentum in this business but again, on 40x massive upside to earnings is built in to the price – anything from left field here and the stock will trade sharply lower. One to be cautious on our opinion.

CSL Ltd (CSL) Daily Chart

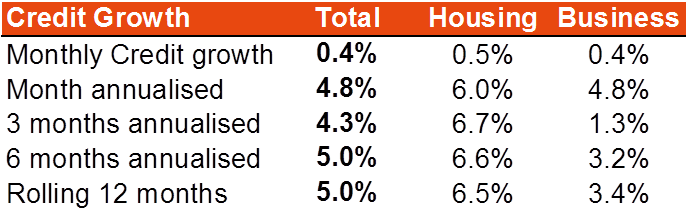

Some data out today in terms of credit growth and we see housing still growing at a healthy rate, around 6.5%. Business loan growth not great but a better monthly number – growing around 2-3%. As it stands, we’ve now gone to 20% of the MM portfolio across NAB, CBA and WBC with NAB and CBA being our larger positions. This is a level we remain comfortable with at this, but would add to into further weakness.

Source; Shaw and Partners

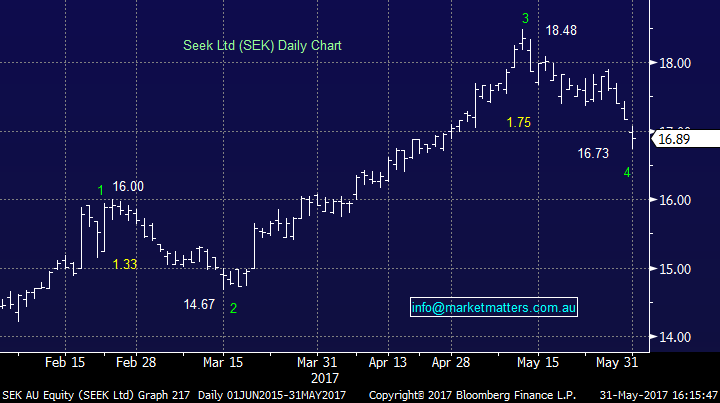

Today we added Seek to the MM Portfolio allocating 4% to the position around $16.89 as a shorter term investment. Recent weakness from a high around $18.50 has brought SEK back into our targeted range below $17.00 as discussed in recent reports. Seek is a high growth high P/E stock with a strong platform for expansion overseas. SEK understandably has a high correlation with the Nasdaq, which we remain bullish on in the short term.

Seek Ltd (SEK) Daily Chart

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/05/2017. 5.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here