Aussie Market rallies hard…Materials + Energy lead the charge today

A very strong session in Oz today fuelled by strong gains in Energy and Mining stocks on the back of a +4% rally in Crude and decent buying in other base metals overnight + we saw Iron Ore futures limit up in our session which tends to help. The volatility in the Iron Ore price has been massive and it seems that Chinese authorities, even though they’re trying hard to curb speculation, are clearly failing. Since traders became able to speculate in the Iron Ore space, the dynamics of the sector has changed and we see bigger price swings - more volatility and bigger swings in the underlying stocks. We’ve spoken about our short term view in the mining space - looking for a short term pullback, which started to play out last week however todays price action has clearly been strong. That said, we still think the risk lies to the downside (in materials) and to the upside in energy in the short term.

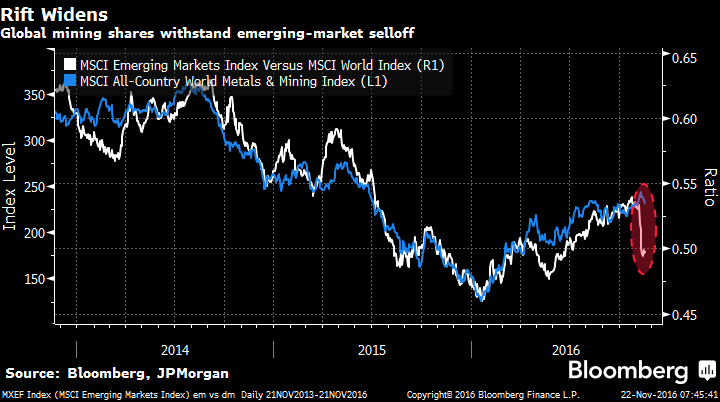

I’ve spoken about using Whitehaven has a proxy for the sector, insider selling, the rise of the $US as a headwind etc however perhaps the chart of the global metals and mining index overlayed with the emerging markets index provides the clearest indication…A note from JP Morgan highlighted this noting the -6.5% decline in the emerging market space versus the 0.4% rally in November for the metals, which typically doesn’t last. We’re not bearish resources, but they’ve run too hot and they’re no longer the contrarian trade as they were earlier in the year.

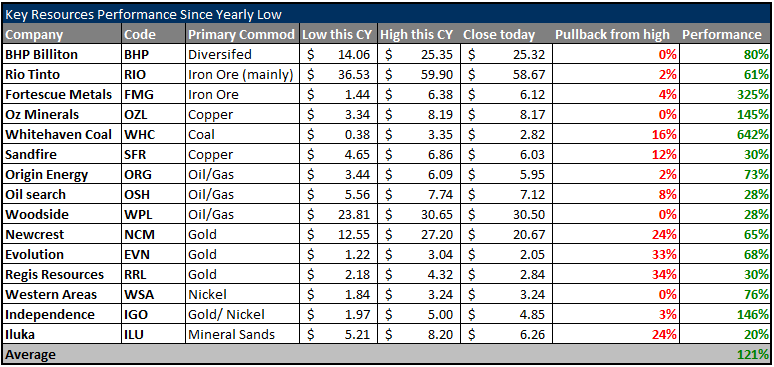

Here’s the table we put in last week updated to this afternoons prices which is a good illustration of why we’ve got this view in the short term…

Gold will become a contrarian trade soon on further weakness and that should see us active again in that space. Thinking about the likely path for the US Fed could give us a road map here. We see an interest rate hike in December of 0.25%, which we’ve called for some time now and the market has come around to our thinking - now pricing a 98% probability while we now see 2 more US interest rate hikes priced into the market for CY17. The issue now in the $US which is probably starting to make the Federal reserve nervous – a stronger $US is clearly a headwind for US earnings and will start to bite at some stage. To us, the $US will rally into the Dec hike, however when the Fed do eventually move, they’ll talk down the prospects of anything further - so we’ll see a situation where the $US falls on the Dec hike, and that’s when gold could be revisited…

Regis Resources (RRL) Daily Chart

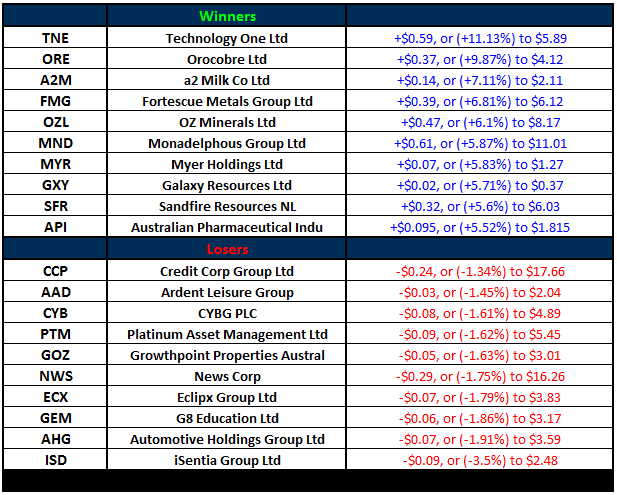

Elsewhere on the market today, A2 Milk (A2M) talked about good growth at their AGM – which they need to justify their high multiple and the stock put on +7.11% to close at $2.11. This dragged up Bellamy’s (BAL) which added +4.23% to close at $11.10 – I talked with Peter Nathan today, A2’s CEO for Australia/NZ and he highlighted the areas that you’d expect, however he talked about brand the most and reckons this is where A2 has a massive advantage. I asked him about the spread of earnings geographically and he was vague on detail, which is often the case when a company talks a lot about a theme (China for instance), sight it as a major opportunity but fail to earn much from it (yet). I bet that’s the case with A2 and China at the moment so we need to make assumptions. The market is bidding them up on the China theme, giving them a ‘China premium’ yet they need to deliver, and there-in lies the risk.

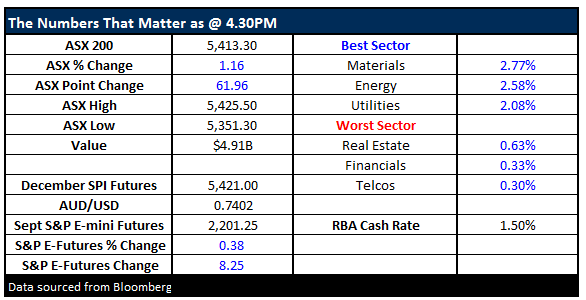

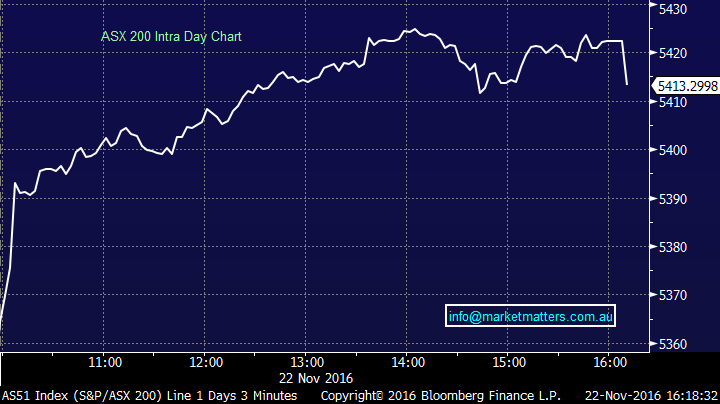

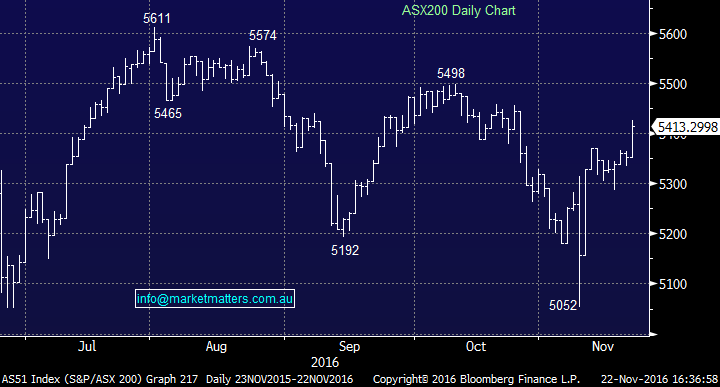

We had a range today of +/- 62 points, a high of 5425, a low of 5363 and a close of 5413, up +62pts or +1.16%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

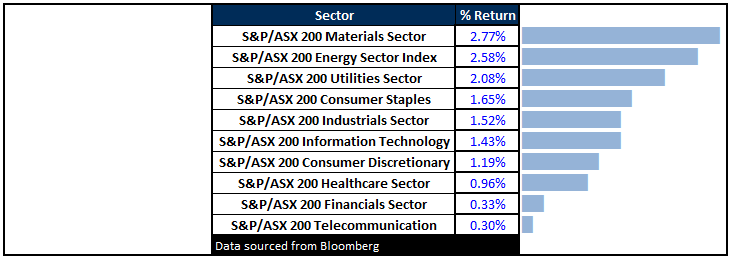

Sectors

ASX 200 Movers

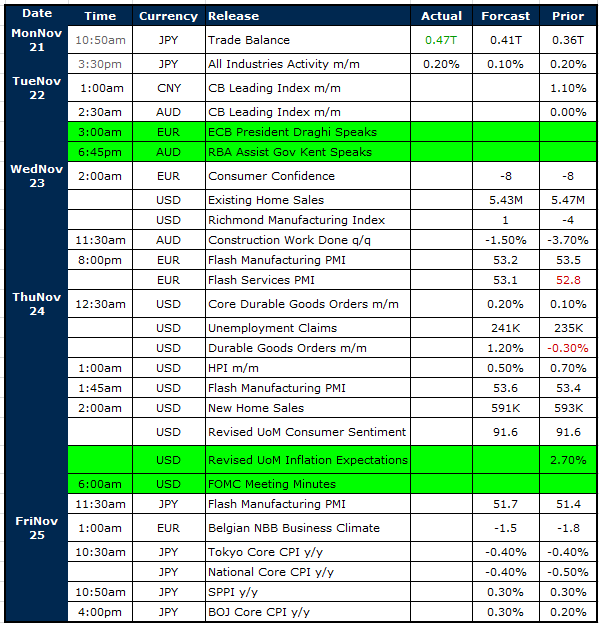

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

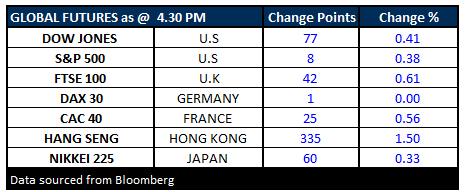

FUTURES higher…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/11/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions.

You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here