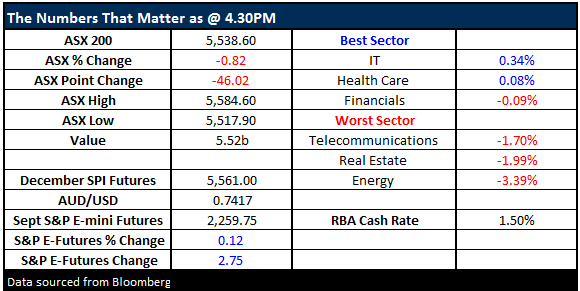

Aussie market drops on Fed hike; Santos raises equity

What Mattered Today

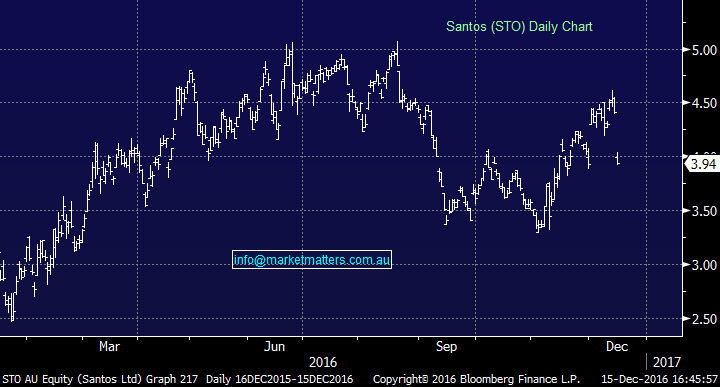

This morning’s move by the US Federal Reserve to increase rates was widely expected however the projections for 3 hikes in 2017 was above the 2 the market was pricing…That saw some late selling in the States which trickled into Oz this morning and we ended a soggy session near the lows. Santos didn’t help things with its move overnight to launch a capital raising after a good run up in share price - understandably we saw Santos weak, but so too were the other energy coys as the institutions reduced exposure to other energy plays to fund their discounted stock in Santos.

The raise is $1.5bn, of which just over $1bn was raised from institutions at $4.06 overnight – and they claim it was oversubscribed but I’d be very sceptical of that being the case…Anyway, they’ll do a retail component for the rest at the same price as the insto placement, however given the shares closed today at $3.93 they’ll be very little appetite to take up shares at $4.06 + the retail component is not underwritten so unless the stock bounces – which is a big call now given that insto’s a probably full to the gills with it, then STO will struggle to get the rest away.

The other baffling thing about the deal was the timing. Why on earth would any board launch a raise the night the US Fed was going to raise rates – there’s simply no upside is doing that? I’ve met STO management on a number of occasions and unfortunately, they don’t inspire confidence.

Santos (STO) Daily Chart

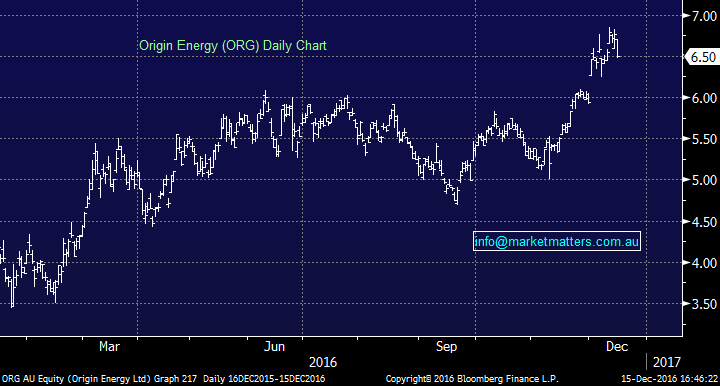

As suggested above, the money going into Santos meant that funds came out of the other energy companies, like Origin (which we hold) – however for now we still target $7 for ORG…

Origin Energy (ORG) Daily Chart

Resources stocks were once again weak, largely on the back of strength in the $US…Important to note though that some have stretched valuations, while others don’t. There’s a lot of discrepancy within this broad sector. For now, we remain negative the sector generally and have no exposure in our portfolio HOWEVER we’re flexible and that may change in time…

BHP Daily Chart

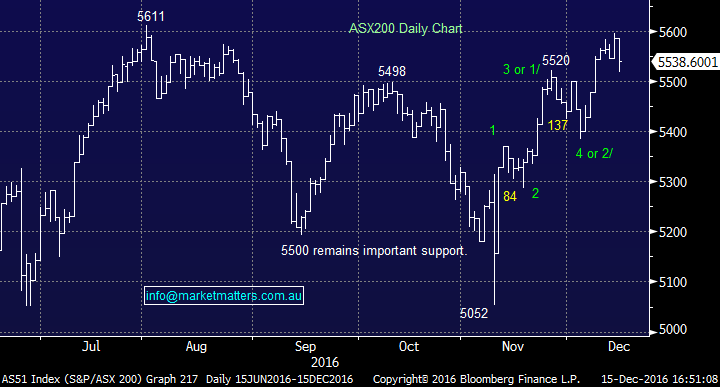

We had a range today of +/- 63 points, a high of 5580, a low of 5517 and a close of 5538, off -46pts or -0.82%.

ASX 200 daily chart

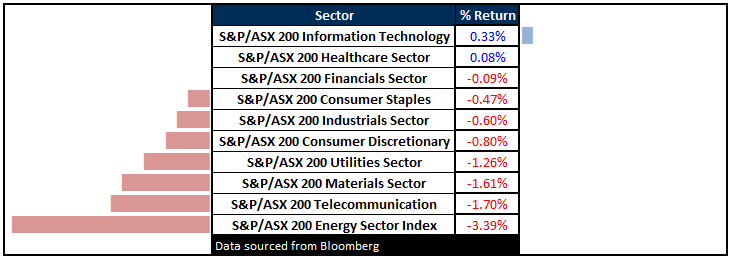

Sectors

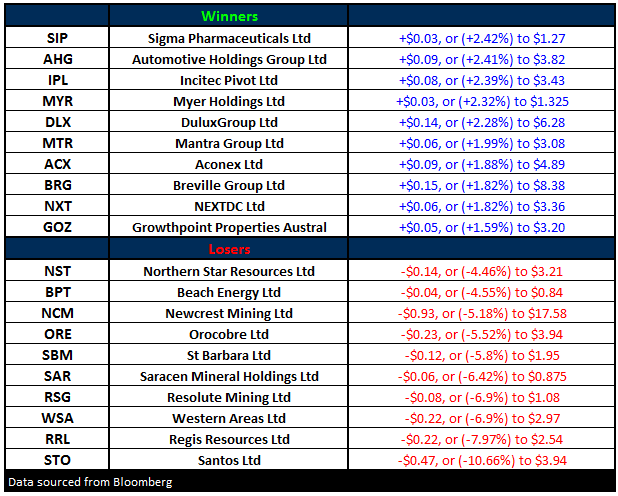

ASX 200 Movers

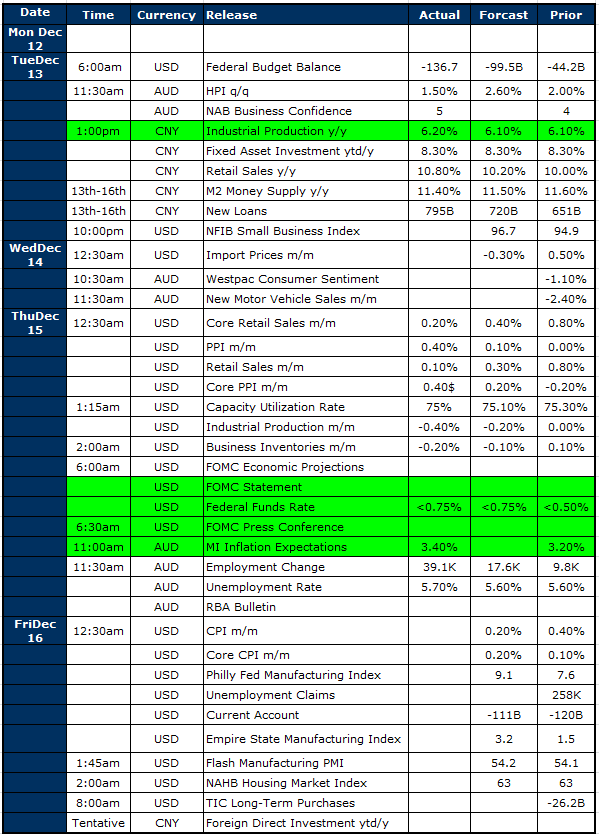

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

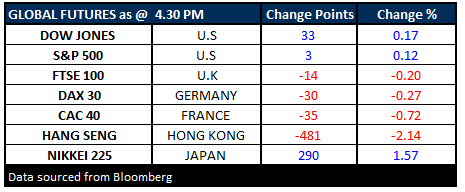

FUTURES mixed….

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/12/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here