Aussie bourse struggles as banks weigh – Metcash roars & G8 whimpers (MTS, GEM, TLS, NAN)

WHAT MATTERED TODAY

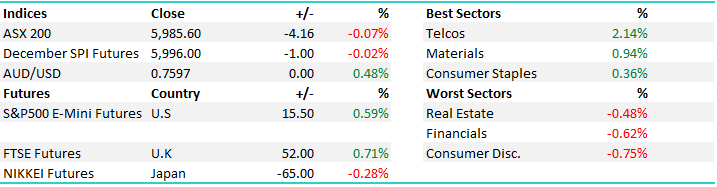

Despite S&P Futures in the US trading up +16pts (+0.65%) the Aussie market struggled to hold above water today with the banks providing most drag – the big 4 detracting around 10.5 index points from the ASX 200. The miners did OK on the back of decent buying in the commodity complex on Friday + we saw Iron Ore FUTURES trade up +4.4% in Asia today and clearly the recent flow of better manufacturing data globally (US ISM out Friday) is creating some buying within the sector. Metcash, the ugly duckling of the Australian Supermarkets sector has been anything but this year, and reported another set of decent numbers today – with the stock up +9.09% as a result. On the flipside, G8 Education (GEM) was sold, and sold hard after downgrading guidance with the stock having its worst day in 8 years falling by 23.08%. We looked at this today as a potential BUY in the income portfolio into the prevailing weakness, however it’s still hard to get excited on current multiples and tough 2018 ahead. More on this below.

On the mkt today, the early buying was soon offset by selling in the banks, and therefore the index struggled. The Materials did well, but not well enough - a reasonably tight range today of +/- 21 points, a high of 6000, a low of 5979 and a close of 5985, off -4pts or -0.07%.

ASX 200 Intra-Day Chart

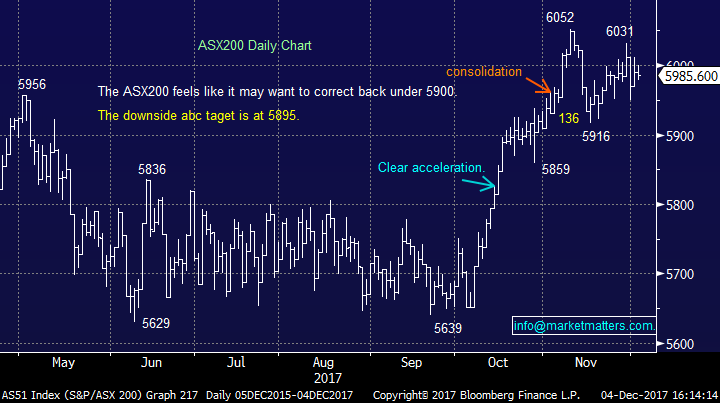

ASX 200 Daily Chart

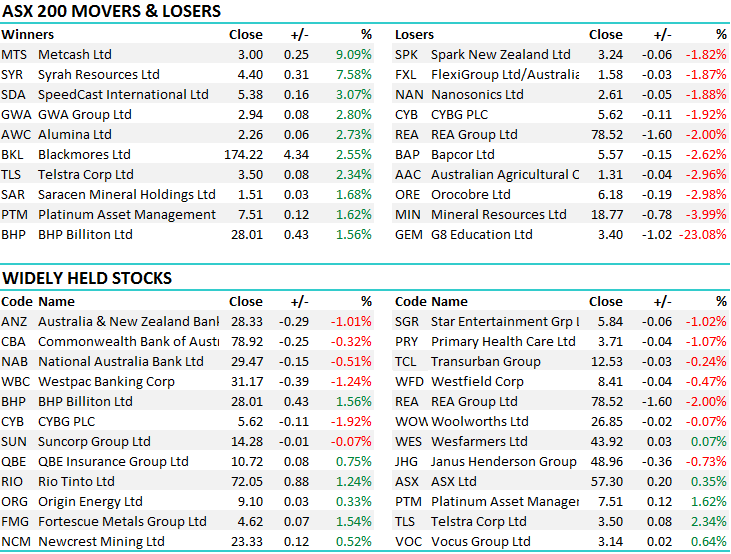

TOP MOVERS

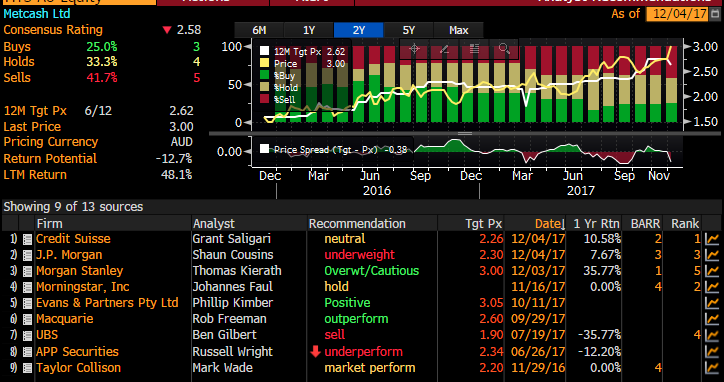

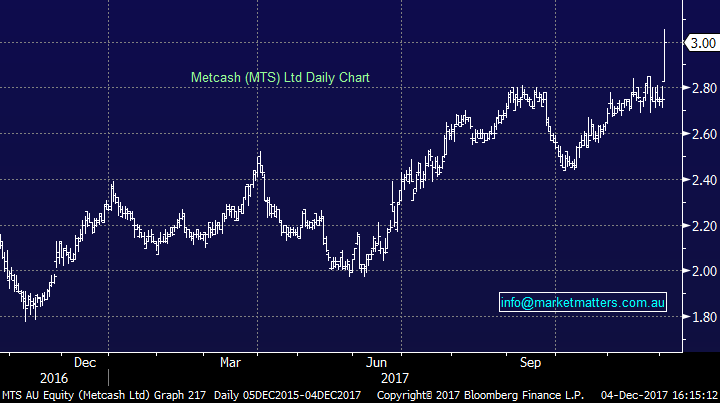

1. Metcash (MTS) - rallied 9.09% higher to $.3.01 after reporting its 1H17 numbers with a $92.9m net income (up 24%) slightly above most analyst’s expectation and an interim dividend of $0.06/a share. Clearly, the uptick in sales was driven in part by the Market Matters Christmas Party on Saturday night, with supplies being purchased from the IGA bottle shop in Balgowlah Heights for the annual end of year festivities at my place!

Expect upgrades on their expected full year result to flow through overnight despite the BIG run up in price experienced over the past 12 months – versus the more fancied WOW & Coles. MTS have beavered away in the background fixing up their business, deleveraging their balance sheet, and bedding down their hardware operation which is doing better than the market was positioned for. Food still difficult however liquor sales were good. I’ve often thought / rated MTS strategy of differentiation, targeting convenience over price – obviously price matters and they need to be in the ballpark , but it’s not as crucial as it is with the big guys that are traditionally in shopping centres (versus IGA that is typically not).

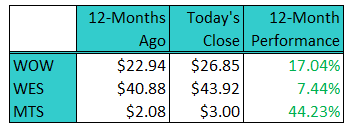

The last 12 months have been stellar for MTS, while WOW has also outperformed the broader mkt. WES has underperformed by around 3%.

Brokers are still negative MTS, and upgrades now will be very begrudging…consensus price target @ $2.62 before today’s result.

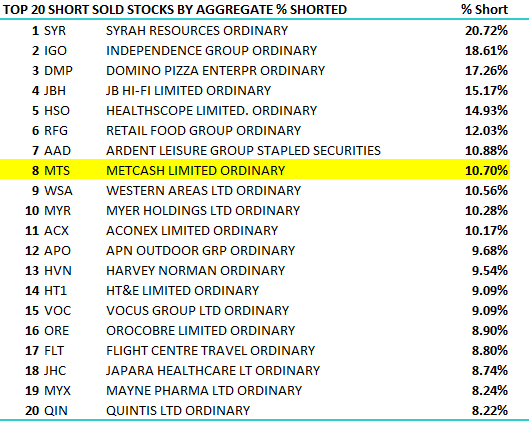

Source; Bloomberg

…and MTS remains in the top 10 shorts. It used to be higher so shorts have been capitulating to some degree but still 10% of the float short sold, or about 100m shares. We’ve spoken recently about shorts being covered into Christmas, we’ve seen this play out in a few stocks of late, and MTS could certainly be another that sees sustained buying – its trading on 14.22x forward versus WES / 17.41x & WOW / 21.16x.

Metcash Daily Chart

2. G8 Education (GEM) – Stock whacked today 23% to close at $3.40 on a material downgrade and very weak commentary. The initial weakness was sharp, then some bargain hunting came in but that didn’t last and the stock closed near enough to the lows. The main issue here is around occupancy at a time when regulatory costs are rising therefore earnings under pressure, and that should continue into next year. Average like-for-like occupancy for FY2017 forecast to be circa 77%, compared to 79.7% for FY2016. We don’t expect an improvement in FY18 and that’s the issue, although on 13x forward, it’s starting to get cheap. That said, the thematic of rising regulation, the need to pay more for acquisitions of scale (given GEMS size) and deteriorating occupancy and it’s hard to see GEM’s share price to bounce back strongly.

G8 Education Daily Chart

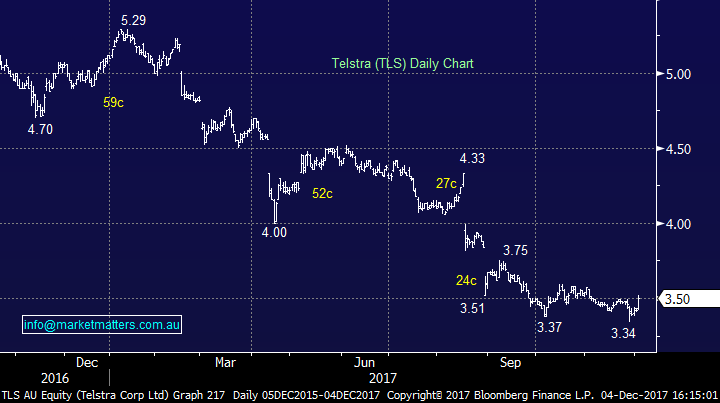

3. Telstra (TLS) – Broker moves helped TLS rally 2.6% higher today to $3.50, one of the best performers in the ASX 200. The revision to guidance announced last week has been deemed as “modestly financially positive” despite a near term downgrade, Macquarie noting that Telstra will “benefit from sweating its legacy assets for longer, out-weighing the time value of delayed NBN payments.” We spoke at length last week around the guidance revision, and also regarding a large line of stock that was crossed just prior, noting that “history shows that big lines of stock often transact at / near the low.” We hold TLS in both the Income and Growth portfolio’s, and are near even on both holdings, however we are targeting a reduction in our weighting for the Growth Portfolio should it tick up towards $3.65

Telstra Daily Chart

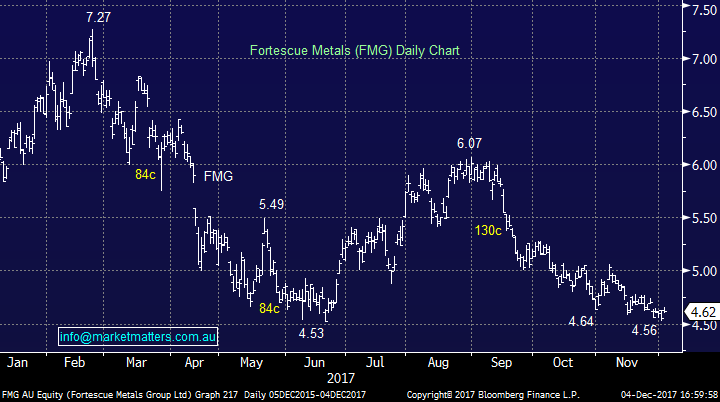

4. Fortescue Metals (FMG) – rallied 1.54% to $4.62 as Iron Ore was all systems go, rallying 4.4% in Asian market and back into bull market territory, still FMG continued to lag other miners with the stock on the nose given their lower quality Ore. We bought last week at $4.60…

Fortescue Daily Chart

OUR CALLS

Nanosonics (NAN) - we revised our SELL price on NAN to be around $2.70, and the stock lingered around $2.60 today, looking stronger early before being sold off, but volume was light (only about 650k shares), which shows a lack of conviction now on the sell side. We maintain our SELL level of around $2.70.

Nanosonics Daily Chart

Telstra (TLS) – We will look to reduce TLS by 5% into prevailing strength for the Growth Portfolio, around $3.65, leaving a 5% holding to capture higher levels should it prevail. Or in other words, we remain comfortable owning TLS, we’re just uncomfortable with the current 10% weighting in that portfolio.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/12/2017. 4.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here