Aussie battler fares better than most (NCM, IFL)

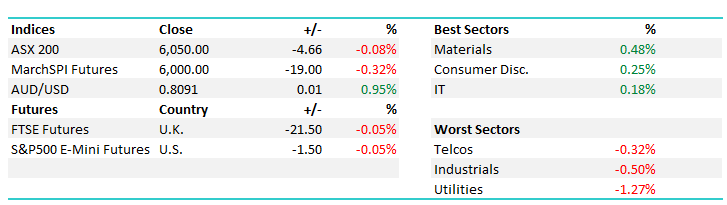

WHAT MATTERED TODAY

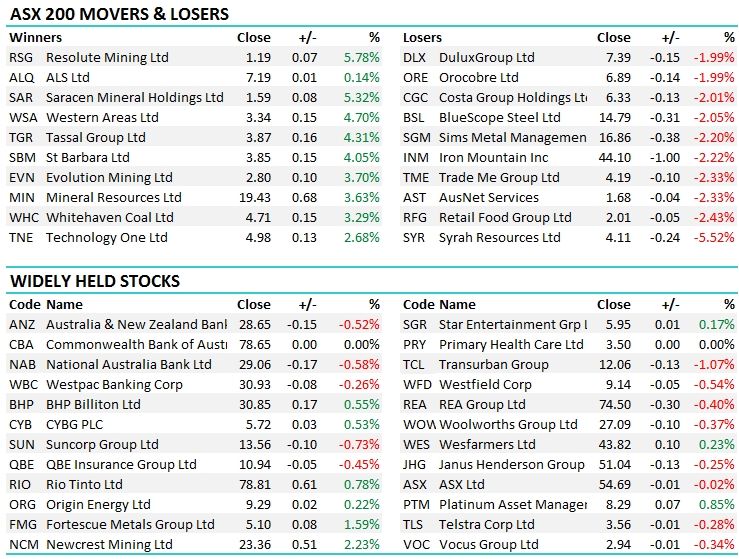

The local market followed overnight leads lower today, however buying kicked in and we fared better than most international markets. Banks were weak, and materials were strong however volumes were light as market players take a 4 day weekend.

Overall today, a range of +/-26 points, a high of 6056, a low of 6029, close of 6050, down 26 pts, or -0.08%.

S&P/ASX 200 Intra-Day Chart

S&P/ASX 200 Daily Chart

CATCHING OUR EYE

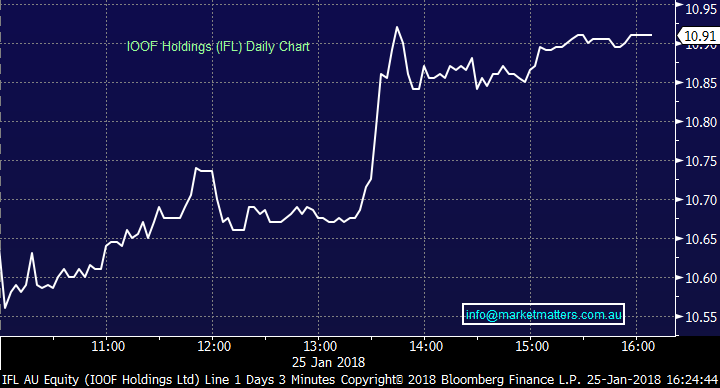

1. IOOF (IFL) $10.91 / 2.06%; IFL turned a weak morning into a solid day today, well outperforming the market after a poor open. IFL followed the market lower on the open, howver a note from Morgan Stanley turned the fortunes around. A lot has been written about the fund manager this week, as analysts digest the ANZ Wealth merger and there appears to be a lot of disparity in the numbers, Bell Potter cut their target level yesterday quoting the issues with merging two underinvested businesses, however Morgan Stanley noted that the cost synergies and well-priced purchase of the ANZ wealth will guide IFL into a multiyear upgrade cycle. We are on Morgan Stanley’s side here, believing that IFL has completed a merger that gives them a platform to grow and gain market share in years to come. We own IFL in the Growth Portfolio.

IOOF Holdings (IFL) Daily Chart

2. Newcrest Mining (NCM) $23.36 / +2.23%; a holding we have been watching closely here, NCM rallied strongly as Gold pushed into territory not seen since August of 2016.. Heading to $US 1,360, Gold traders were supportive of the price following the comments from Davos overnight. We are continuing to watch gold closely, and may see this strength as an exit point in days/weeks to come. We hold NCM in the growth Portfolio.

Newcrest Mining (NCM) Daily Chart

OUR CALLS

We were not filled on our CBA order today, we remain in the market below $78.

Z1P order remains unfilled.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/01/2018. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here

WHAT MATTERED TODAY

The local market followed overnight leads lower today, however buying kicked in and we fared better than most international markets. Banks were weak, and materials were strong however volumes were light as market players take a 4 day weekend.

Overall today, a range of +/-26 points, a high of 6056, a low of 6029, close of 6050, down 26 pts, or -0.08%.

S&P/ASX 200 Intra-Day Chart

S&P/ASX 200 Daily Chart

CATCHING OUR EYE

1. IOOF (IFL) $10.91 / 2.06% ; IFL turned a weak morning into a solid day today, well outperforming the market after a poor open. IFL followed the market lower on the open, however a note from Morgan Stanley turned the fortunes around. A lot has been written about the fund manager this week, as analysts digest the ANZ Wealth merger and there appears to be a lot of disparity in the numbers, Bell Potter cut their target level yesterday quoting the issues with merging two underinvested businesses, however Morgan Stanley noted that the cost synergies and well-priced purchase of the ANZ wealth will guide IFL into a multiyear upgrade cycle. We are on Morgan Stanley’s side here, believing that IFL has completed a merger that gives them a platform to grow and gain market share in years to come. We own IFL in the Growth Portfolio.

IOOF Holdings (IFL) Daily Chart

2. Newcrest Mining (NCM) $23.36 / +2.23%; a holding we have been watching closely here, NCM rallied strongly as Gold pushed into territory not seen since August of 2016.. Heading to $US 1,360, Gold traders were supportive of the price following the comments from Davos overnight. We are continuing to watch gold closely, and may see this strength as an exit point in days/weeks to come. We hold NCM in the growth Portfolio.

Newcrest Mining (NCM) Daily Chart

OUR CALLS

We were not filled on our CBA order today, we remain in the market below $78.

Z1P order remains unfilled.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/01/2018. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here

Harrison Watt

Associate Advisor

![]()

Level 15, 60 Castlereagh Street Sydney NSW 2000 Australia

T: +61 2 9238 1306 | M: +61 420 698 813 | [email protected]

www.shawandpartners.com.au | Follow us ![]()