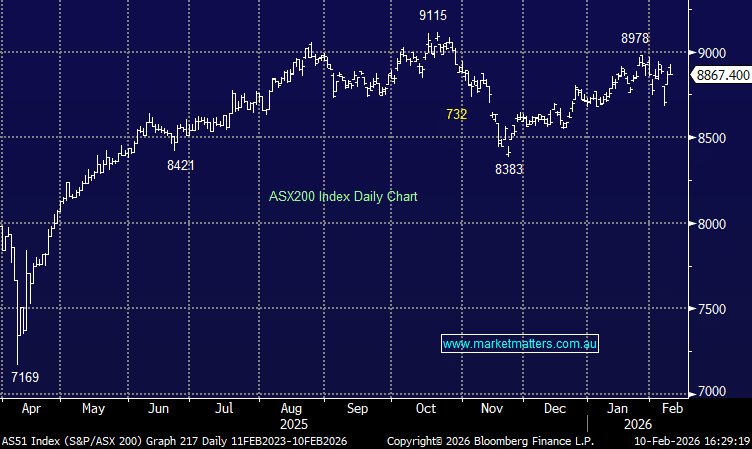

ASX200 now down 4.4% from recent highs (APT, NCK, RIO, OML)

WHAT MATTERED TODAY

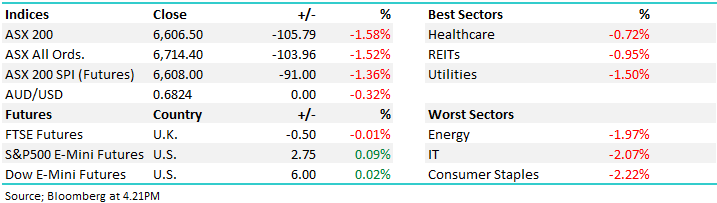

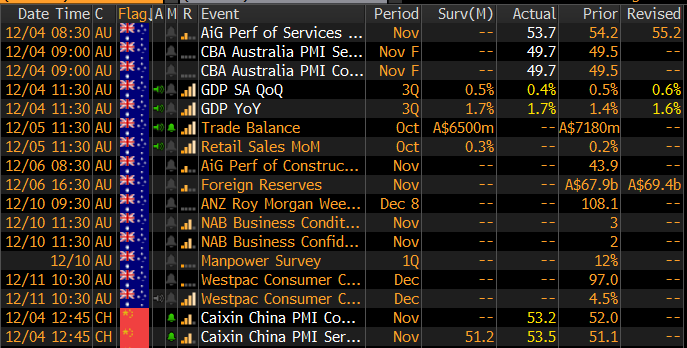

The market hit hard again today taking the total decline from the 29th November high of 6893 on the ASX 200 to -303pts / -4.4% to today’s low of 6590, a meaningful sell off although the low for today was put in at 11.30am this morning. After a hard sell-off in the first hour and half of trade, the market stabilised and ebbed and flowed for the remainder of the session. GDP data out at 11.30am this morning was a touch light on (as shown below) and that saw some selling in the Aussie Dollar - as has been the case in recent sessions, the movements in the AUD have been having a big influence on the broader market, weakness in the AUD = buying of stocks and vice versa. The AUD settled this afternoon at 68.24, down from a 68.60 high.

Economic data out today.

Source: Bloomberg

At a sector level today, more of the traditional defensives outperformed in Healthcare, REITs and Utilities while the supermarkets again struggled. Overseas, US Futures were muted throughout our time zone trading mostly higher, while Asian were mostly lower, down around ~1%

Overall, the ASX 200 lost -105pts /-1.58% today to close at 6606. Dow Futures are trading marginally higher by 9pts/0.03%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

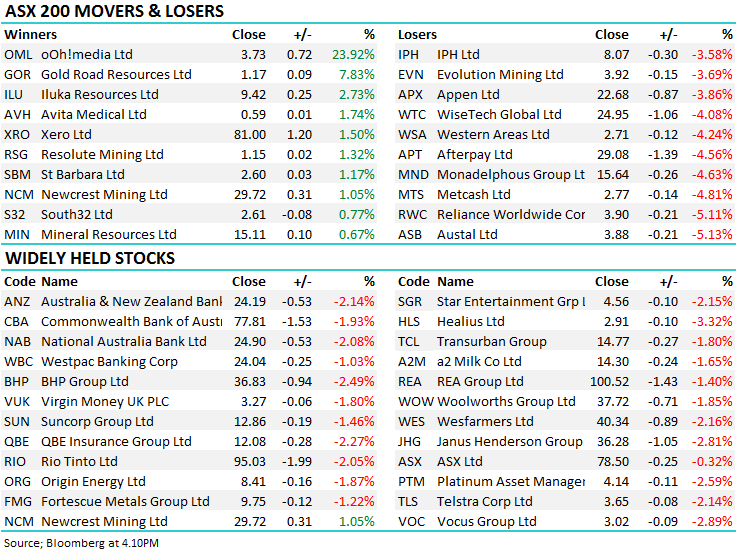

Stocks Moving: Large cap stocks moving that caught my eye today….

On the downside, the crowded longs felt some pain. Ship builder Austal (ASB) broke support, ended down 5.13%, Supermarkets Coles (COL) –2.87% & Woollies (WOW) -1.85% – dragged the consumer discretionary stocks down hard for a second straight session, normally these are defensive however valuations are stretched making them more heavily influenced by market sentiment / hot money, the WAAAX stocks traded materially lower, although the X for Xero (XRO) showed why it’s the highest quality on the board ending up on the day on a broker upgrade, Wisetech (WTC) –4.08%, Afterpay (APT) -4.56%, Altium (ALU) –2.06% and Appen (APX) –3.86% all hit fairly hard in the last two sessions.

Afterpay Touch (APT) Chart

On the upside, always nice to have some green in a portfolio on a down day and there’s one way of ensuring that - holding a negative facing ETF which we did, although we cut it just before lunch. Failing that, other (legitimate) stocks that did well today were Ooh Media (OML) +23.92% which Harry covers off below , some of the smaller Gold companies did particularly well as bullion rallied, Gold Road Resources (GOR) the standout adding +7.83% while Newcrest (NCM) also joined the party adding a more modest +1.05% , Select Harvest (SHV) a stock we mentioned yesterday was a good relative performer putting on +1.32% while Nick Scali (NCK) also looked a treat in a weak market adding to yesterday’s gains by +0.62%. We previously held this in the income portfolio however it’s not a current holding – worth another look here, I think. Iluka (ILU)+2.73% also a solid performer on overnight reports that RIO was stopping production at their Sth African mineral sands operation – obviously bullish for ILU.

Nick Scali (NCK) Chart

One of the clear takeaways from the recent market sell off has been the relative outperformance of deeper value names, things that haven’t attracted hot money in the last 12 months which have proved defensive while there’s been more buying in the cyclical area of the market into weakness / resources / mining services for example – clear themes that we remain keen on in 2020. I was completing the SMA performance reports for the month of November – not great reading given we were defensively set in a strongly rising market in November meaning we underperformed by around 2% for the month, however in less than 3 days +1.5% of that relative performance has been re-couped. We’re now very conscious of positioning to gain strong upside from current levels, hence we closed our hedge.

The market will bounce, it showed signs of a low today and recent form suggests two days of aggressive selling has been it – hence why we closed our short position today. Also, worth revisiting yesterday morning’s note on seasonality – click here – which had 3 key conclusions

1 The risk / reward favours buying the ASX200 during December into weakness – potentially accumulate every 50-points after an initial 150-point decline.

2 – The ASX200 half of the time has corrected ~200- points in December before finding a springboard to rally strongly into the months end.

3 – Traders never want to be short stocks in the last 7-10 days of December – the best period to be long stocks all year.

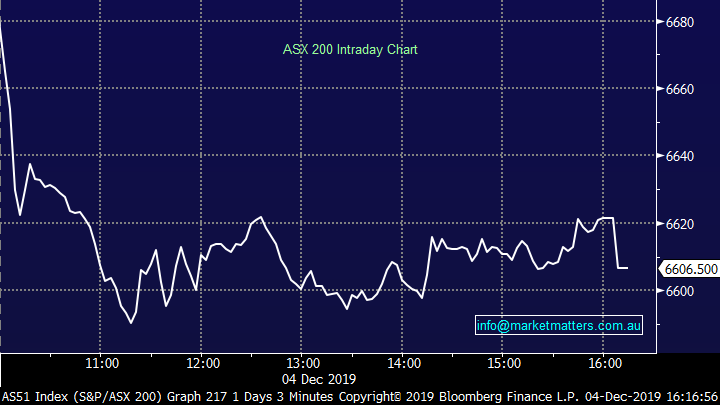

Rio Tinto (RIO) –2.05%; off today, but not more so than was expected given the equity weakness. They shut down their South African mineral sands operation at Richards Bay – one of two of their assets in the space which produces around half of their output – on the back of civil unrest which resulted in a worker shot and injured. It’s a drop in the ocean to Rio’s profit, however it is a big deal in the rutile market with Rio around a third of global supply. While there was no time frame on restarting work, Rio may have the capacity to catch up the difference, although they did guide to the lower end of the range. The announcement was to Iluka’s (ILU) benefit with shares trading +2.73% higher.

Rio Tinto (RIO) Chart

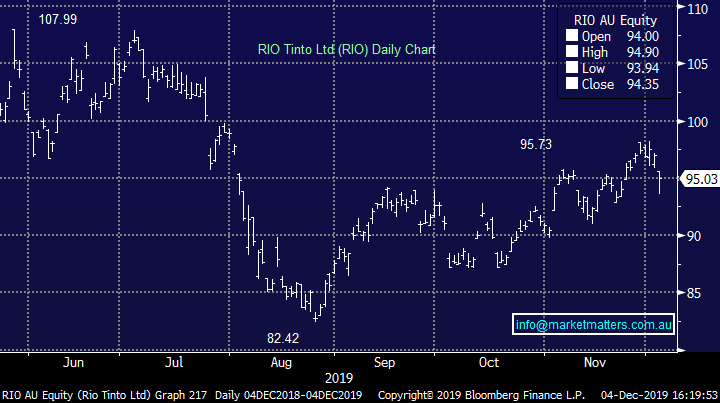

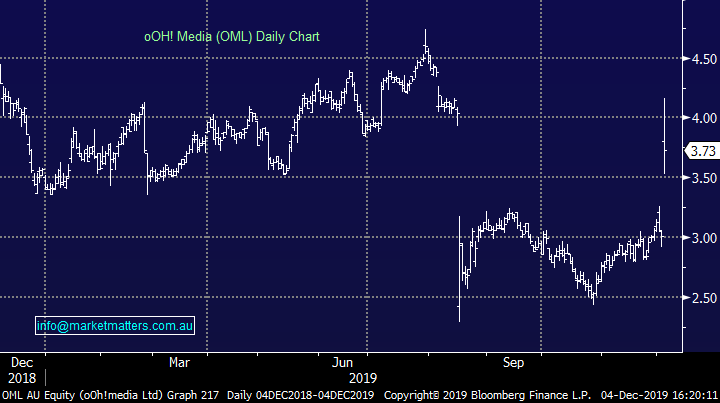

oOh!media (OML) +23.92%; upgraded guidance overnight with EBITDA expectations for the calendar year end to $138-$143m, an 8% beat to both previous guidance and where consensus was sitting. The upgrade comes despite what the company called a soft third quarter of advertising bookings followed by a strong recovery into the back end of the year. Operational expenditure is tracking within expectations, while CAPEX spend was talked towards the lower end. Synergies have also helped with the integration of the Commute business going to plan.

Advertising spend fluctuates significantly, but OML appear to be doing well in gaining market share while keep costs down. Shares are trading much better than an 8% beat would suggest given the negativity around the company while shares have tracked lower through the year. Risk/reward isn’t compelling at this level for us.

oOh!media (OML) Chart

Broker moves; A few brokers moves that interest us. At Shaw, we have a new small cap resources analyst who is said to be good – a few initiations reports this week as per below.

· Xero PT Raised to A$90 from A$65 at Morgan Stanley

· Bubs Australia Rated New Buy at Citi; PT A$1.40

· Santos Raised to Buy at Citi; PT A$8.90

· oOh!media Raised to Buy at Canaccord; PT A$3.50

· Magellan Financial Raised to Hold at Morningstar

· Altium Rated New Outperform at RBC; PT A$45

· Meridian Energy Raised to Buy at Deutsche Bank; PT NZ$4.76

· Genesis Energy Cut to Sell at Deutsche Bank; PT NZ$2.78

· Contact Energy Raised to Buy at Deutsche Bank; PT NZ$8.16

· Bingo Industries Rated New Outperform at Credit Suisse

· Caltex Australia Cut to Neutral at JPMorgan; PT A$34

· Metro Mining Rated New Buy at Shaw and Partners

· Atrum Coal Reinstated Buy at Shaw and Partners

· Stanmore Coal Rated New Buy at Shaw and Partners; PT A$1.31

OUR CALLS

No changes to the portfolios today.

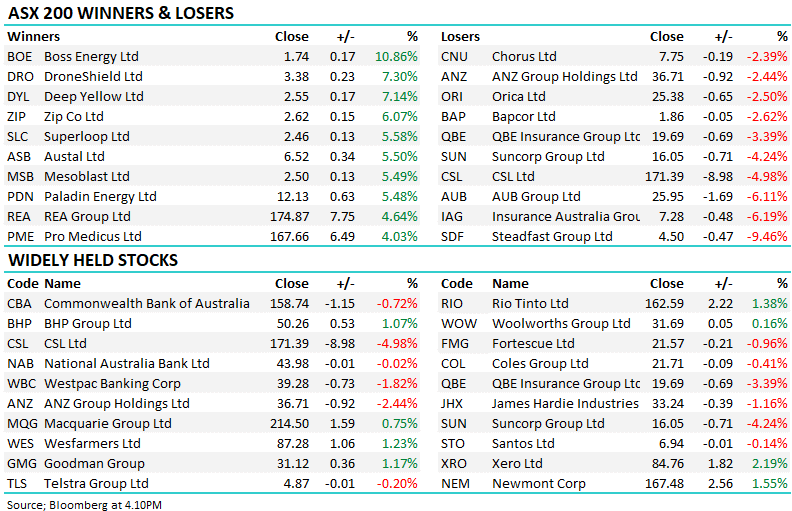

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.