ASX underperforms on weak banks (MPL)

WHAT MATTERED TODAY

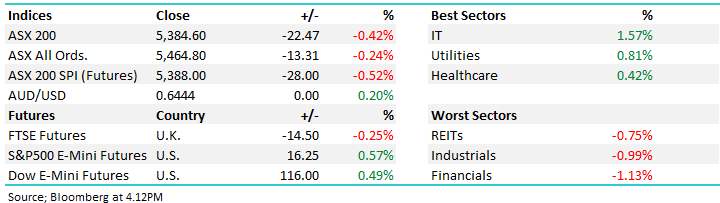

The local market eased back today in an orderly fashion but did spend the afternoon rallying from the lows of the day. Banks were the soft spot, giving up nearly 12 points between them. Energy names were mostly higher as the oil market finds some support – OPEC+ cuts, companies lowering guidance and some signs for increased demand with economic activity picking up helping support energy markets. Tech was far and away the standout thanks three off the bigger names trading significantly higher – Afterpay, Wisetech and Appen which we discuss below. Despite our market lower against a decent performance form the US overnight, the Dow futures traded higher throughout our session with the ASX continuing to underperform.

Overall, the ASX 200 fell -22pts / -0.42% today to close at 5384 - Dow Futures are trading up 261pts/1.11%.

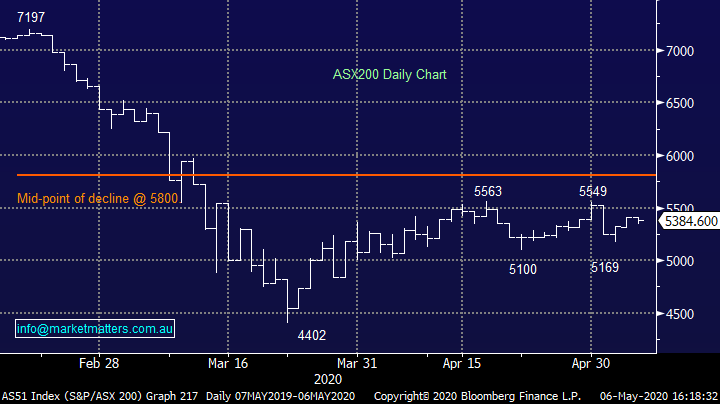

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Macquarie Conference: Day 2 of 3 of the conference today with one of our holdings taking to the virtual lectern. Tomorrow has Caltex, Perpetual and Beach energy among the big names, but today presenter Bingo (BIN) initially traded higher before tracking lower through the afternoon. The company-maintained margins above 30% through the third quarter, on track to reach previous guidance despite talking down the fourth quarter as the COVID impact takes hold. Bingo has been trying to push through price increases across the portfolio and the virus appears to have put this on the back burner for the moment. The balance sheet remains robust with plenty of debt headroom as well as un-utilized land that looks set to be sold. Despite that, we have noted before that Bingo is not cheap and doesn’t have much wiggle room from the market for its shares to keep moving higher. Competitor Cleanaway (CWY) took over the conference a short time later with their shares performing a little better. The Toxfree acquisition remains on track for a June completion despite the continuing market issues, while they noted smaller acquisitions may become available over the next few years.

Appen (APX) seemingly presented well, with shares now better than pre-virus levels. The company talked up its resilience, noted in the recent reconfirmation of guidance in mid-April, while talking up their workplace flexibility and customer base. Shares edged higher throughout the day to close nearly 9% better.

Medibank Private (MPL) had the floor just before lunch with their presentation talking down policy growth as a result of closed stores, but also talking up retention. While Medibank has provided a $50m support package aimed at delaying premium increases and payments, it has also seen claims drop significantly with procedures being put off. The virus may be a wake up call for many Australians without private health insurance as the ‘rainy day’ event becomes more front of mind, though with the economy going backwards, the discretionary spend of insurance may be pegged back.

Medibank Private (MPL) Chart

BROKER MOVES:

· Reliance Worldwide Cut to Hold at EL & C Baillieu; PT A$2.75

· Adairs Cut to Hold at EL & C Baillieu; PT A$1.40

· Collins Foods Raised to Buy at UBS; PT A$8.95

· Mirvac Group Cut to Neutral at Macquarie; PT A$2.21

· Orica Raised to Buy at Citi; PT A$19.40

· Nick Scali Raised to Outperform at Macquarie; PT A$5.20

· Charter Hall Social Infrastructure Raised to Buy at Canaccord

· NRW Holdings Cut to Market-Weight at Wilsons; PT A$3

· Kathmandu Raised to Overweight at Morgan Stanley; PT A$1.10

· Janus Henderson GDRs Cut to Hold at Morningstar

· James Hardie GDRs Cut to Underperform at Jefferies; PT A$18.50

· Qantas Raised to Positive at Evans & Partners Pty Ltd

OUR CALLS

No changes to portfolios today.

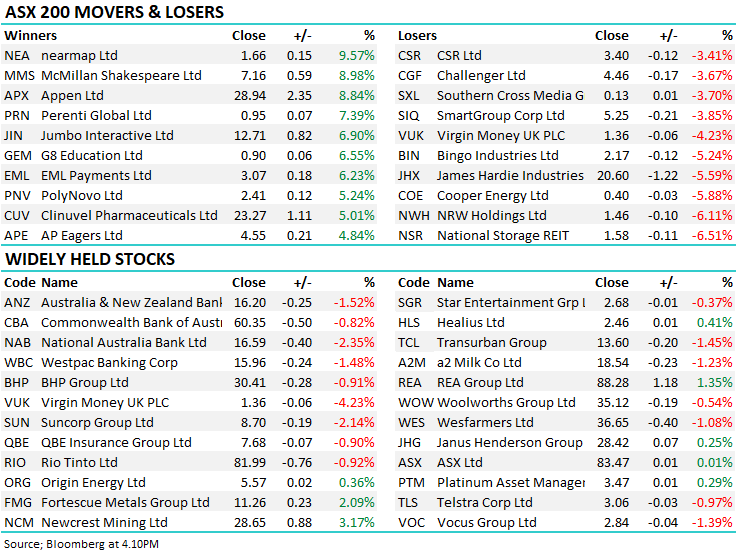

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.