ASX trades at 11 year highs (APT, VOC, AGL, SGR)

WHAT MATTERED TODAY

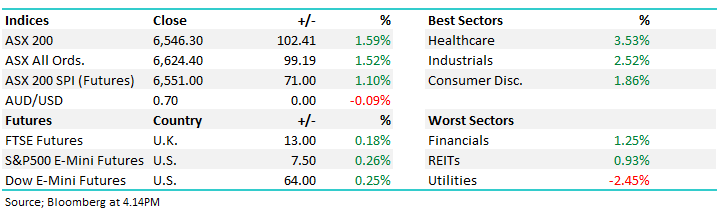

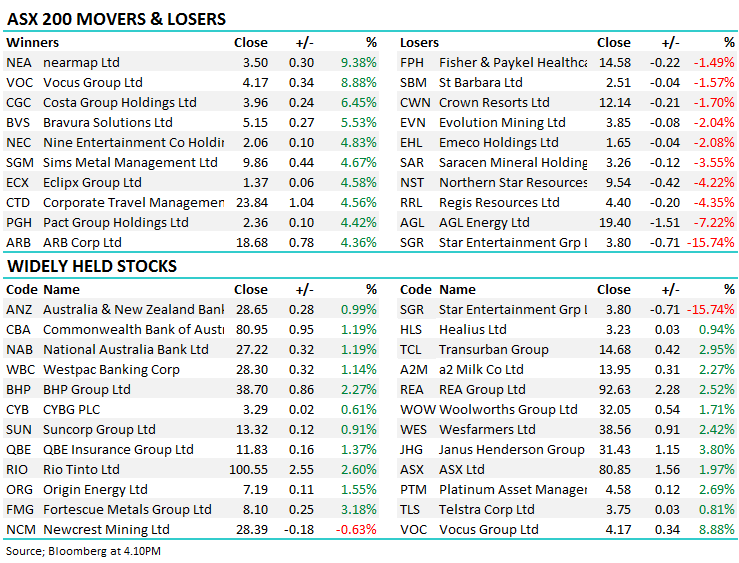

After a long weekend, the Australian market had to catch up on two bullish sessions out of the US which we did - and then some with the market now trading at its highest point since December of 2007. Buying was broad based today as you’d expect from a rally of ~100pts at the index level. The banks were well bid, CBA & NAB the best of them adding 1.19% a piece while the large cap resources had a day in the sun, BHP +2.27%, RIO +2.60% & FMG +3.18% ditto. It wasn’t all good news, with Star Entertainment (SGR) downgrading earnings while AGL launched a bid for Vocus (VOC), although the market clearly has some ?? over it, AGL down, VOC up but nowhere near the $4.85 bid price. More on these below.

The market opened higher, but not materially so however it went on to grind higher all day – closing on the highs of the session. A lack of selling or any substance the obvious trend throughout the session. Healthcare had a stellar day led by CSL and Resmed (RMD), the latter of which we sold into today’s strength taking a ~30% profit, while the more defensive REITs and Utilities were the weakest links.

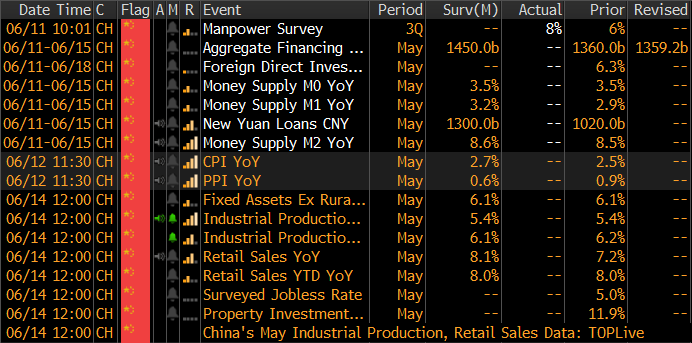

US Futures were trading higher, while Asian markets had a good day – China up ~2.5% ahead of a big week of economic data from the region…inflation, industrial production, retail sales etc will be important.

Chinese Economic Data this week

Source: Bloomberg

Overall today, the ASX 200 added +102 points or +1.59% to 6546. Dow Futures are trading up +64pts / +0.25%.

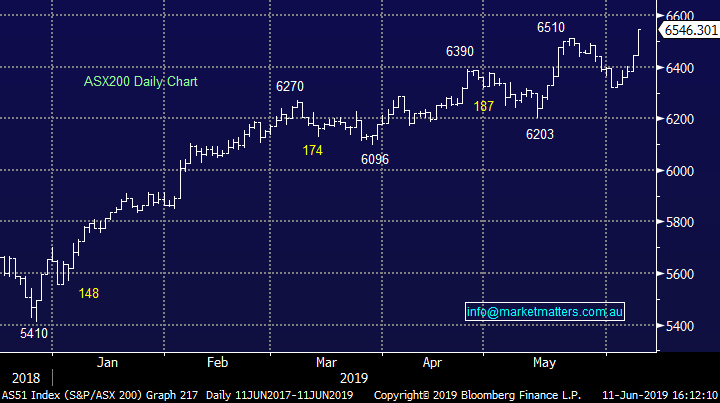

ASX 200 Chart

ASX 200 Chart – Bang!! Mkt scorches higher – lack of selling throughout the day

CATCHING OUR EYE;

Big movers today: Big moves today in some of the beaten down names of late, and a few we hold found some buyers – CGC +6.45%, Pact Group (PGH) +4.42%, Bingo +4.28%, Iluka +3.92%, even Ausdrill rallied from early weakness to close up +3.01% - the only poor performer was Emeco which fell 2.08%. The fund managers were also well big, not surprising in a bullish mkt particularly those on the cheaper side of history, JHG +3.8% a clear example.

Afterpay (APT) – trading halt: News today that the super successful buy now pay later platform APT is raising $300m in fresh equity plus the founders are attempting to sell down ~$100m worth of stock. The raising is being done in a few different parts and we’ll go through them below. In terms of the use of funds, APT is a lending business, so more growth = more requirement of capital and by raising $300m this should allow them to grow their book 4 fold. It’s a big raise.

Terms; A placement to institutions at a price set by demand, but not less than $21.75, which is a 10% discount to the last closing price. A minimum of $300m will be raised through insto’s and the deal is underwritten. Retail holders will then get the chance to buy up to 15k worth of stock at the same price as institutions, or if the price of APT drops post placement, the average price of the shares in the 5 days before the offer is closed. The retail component will raise ~$30m.

The ~$100m of founder shares is being bought by two US investors, Tiger Management & Woodson Capital – neither of which are current holders from what I can see today. The sell down by the founders Eisen & Molnar equates to about 1.3% of the company each, leaving them holding a combined ~16% of the group, down from ~19%. They won’t sell anymore for another 4 months. One condition of this sell down is that placement must be fully subscribed for, which seems very likely.

The good: The placement is being done to underpin growth amid strong US demand for their product. By raising $300m, they can substantially grow their book. Two US funds are cornerstoning the placement of founder stock so they are likely to be longer term holders + the story is obviously resonating in that market.

The bad: When founders start selling this can create ongoing overhang in the stock + of course the insto placement saps natural demand. They’re also raising money now given the strength in recent share price – its opportunistic but hard to fault the rationale from the company (or the founders for that matter).

Our take: As we wrote this morning, our problem is the amount of optimism build into current prices is high, and while the sector is about growth in users / customers rather than profits the reality is, growth at some point needs to drop into earnings. GARP (Growth at a realistic price) as opposed to GAAAP (Growth at any price) is how we like to invest at MM and at current levels we believe fundamentals are being forgotten within the group pushing the stocks well and truly into GAAAP territory

Afterpay Touch (APT) Chart

Vocus (VOC) +9.38%; rallied strongly today after AGL confirmed a non-binding takeover proposal for $4.85 a share. The offer is significantly below the EQT bid that was walked from last week, but AGL represents a much more willing and likely dealmaker. The local energy name has apparently been mulling a proposal and was rumoured to have stepped back when EQT came knocking but today VOC confirmed it had granted AGL due-diligence following the bid.

Shares closed at a 16% discount to the bid price. The market has clearly become a little dizzy with the offers coming at Vocus and has priced in a deep discount to the current tilt. The outcome is now starting to look a little binary to us. Either AGL push on after almost a month’s worth of due-diligence, or another suitor walks suggesting there are big problems underneath the company’s bonnet. We would be selling into any strength that takes VOC to near $4.50

Vocus (VOC) Chart

AGL Energy (AGL) Chart

Star Entertainment Group (SGR) -15.74%; Confession season hit another victim today with casino operator Star out with updated EBITDA guidance at $550m to $560m for the year, which would be around a ~3% decline on the FY18 figure. The guidance comes in around 8% below consensus numbers for the full year hence the big re-rate of the share price today. Star blamed falling VIP spend for the hit to EBITDA with turnover from the high roller segment down more than 30%.

Sluggish economic growth also hurt Star, dragging the domestic discretionary spend down. To offset some of the pain from lower revenue, Star has brought forward a number of planned cost saving measures to help lower costs by around $50m for the year.

The downgrade continues a tough year for Star which has seen fallen over 30% since the FY18 result with the stock now trading at 4 year lows. The hit today was almost double the downgrade which potentially creates a buying opportunity – but not yet.

Star Entertainment Group (SGR) Chart

Broker moves:

Not a lot happening from broker sphere post the long weekend…

· Treasury Wine Upgraded to Outperform at Taylor Collison

· Healius Upgraded to Neutral at Goldman; PT A$2.93

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/06/19

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.