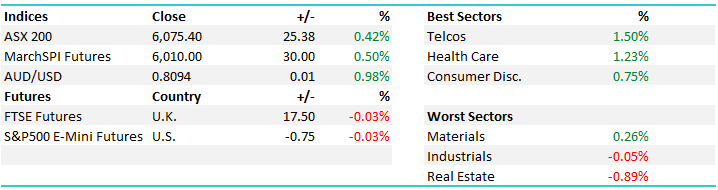

ASX to 6600 this year according to Citi (CBA, ORE, KDR, WEB, Z1P, ILU)

WHAT MATTERED TODAY

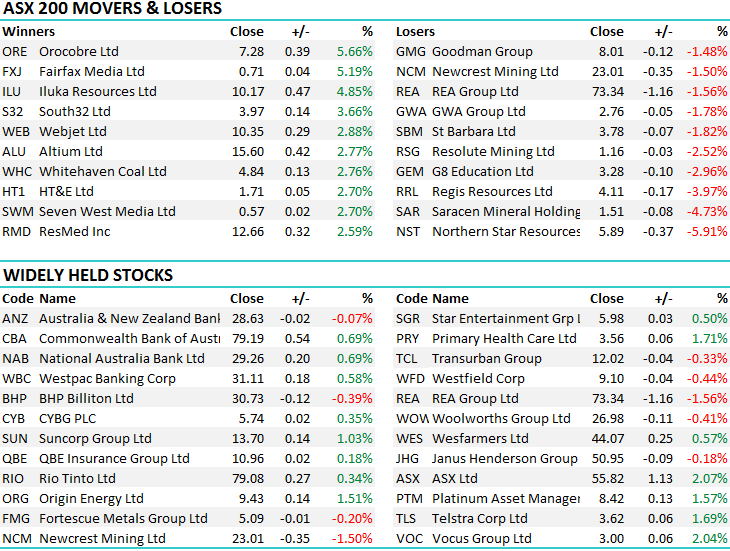

A positive start to a very busy week for markets with the Telco’s leading the charge higher today. CBA in focus with the announcement of a new CEO, an internal candidate and the stock ticked up as a result while Iluka (ILU) delivered a strong set of production numbers ahead of a busy week for the local miners – seven company scorecards (FMG, NCM, ILU, EVN, SFR, SYR, IGO) in the space of three days!! We talked about the $US this morning, but more comprehensively in the weekend report and this theme is getting a lot of airtime today. Most reckon the AUD is overvalued however the upside momentum is strong, while the flipside is true for the US currency. As mentioned this AM, we think the short term drop in the $US is nearing completion, a shorter term bounce likely with the catalyst being more hawkish comments from the outgoing Fed Reserve Chair Janet Yellen later in the week.

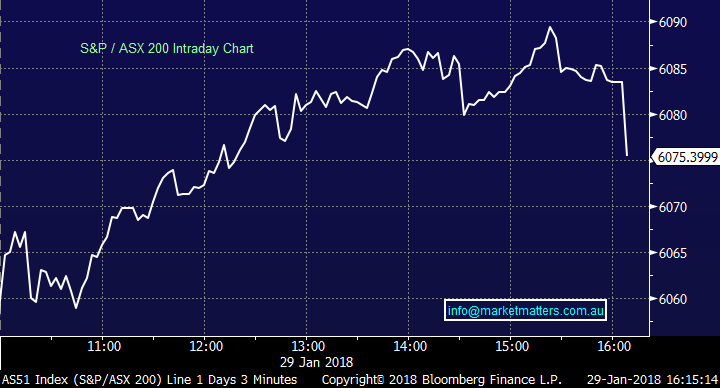

For the day the S&P/ASX 200 index rose 25 points, or 0.4 per cent, to 6075 while the All Ordinaries climbed 22 points, or 0.4 per cent, to 6187. Currency traders continued to buy the Australian dollar, which traded at US80.96c late Monday as it continued to hover around multi-month highs against the greenback. Citi has become more bullish local equities upping their CY yearend target for the ASX to 6600 up from 6400 – bullish call on a bullish day!! Elsewhere in the banking sector, Westpac climbed 0.6 percent to $31.11 and NAB rose 0.7 per cent to $29.26 while CBA put on 0.7 per cent to $79.19. The Healthcare stocks were also good with CSL, up 1.6 per cent to $149.84, and ResMed, which lifted 2.6 per cent to $12.66.

In terms of stocks on our radar, Zip Co (Z1P) had a corker adding +22% to close at $1.16 on the back of a good quarterly report, Webjet (WEB) rallied 2.88% to $10.35 going against a recent tactical bearish note from Morgan Stanley saying that risks to earnings are high ahead of their Feb 22nd interim result (we disagree and own the stock from $9.54), Lithium names were again strong with Orocobre (ORE) up +5.66% to $7.28 while Kidman Resources (KDR) also saw some love late in the day following our alert. The stock did move quickly however a lot of shares were done around the $1.87 level before it started to rally.

ASX 200 Intra-Day Chart – BIG Futures sell off on the close – index whacked 10pts

ASX 200 Daily Chart

CATCHING OUR EYE

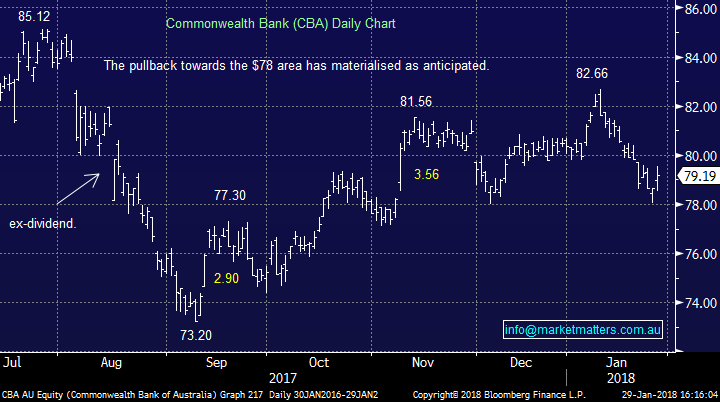

1. Commonwealth Bank (CBA) $79.19 / +0.69%; A new CEO for Australia’s largest bank is always a big deal with lots of scrutiny, talking heads having their say and the market weighing up the pros and cons of the decision. Firstly, and this isn’t because I’m told we look alike, I’m sad to see Ian Narev leave. I’ve met lots of CEO’s over the years however have never met one that was as articulate & accurate, sharp and succinct in their communications, and one that has clearly done an exceptional job leading a hugely complicated organisation through a very difficult period – the bank is in better shape for his efforts. I certainly understand the issues with Financial Planning and the AUSTRAC investigation and feel for those that may have been impacted - these are the issues that dominated the media headlines towards the end of his tenure however he’s been responsible for so much more.

The news was dropping this morning as I was on air for Sky Business

In terms of Matt Comyn, he’s reasonably young at 42 (as was the case with Narev) he’s smart, exceptional with numbers, he’s been with the bank ~20 years and has headed up the retail bank division very successfully. He was Narevs preferred hire and after a global search, he got the nod. In my view it would have been easier for the Board to appoint an external candidate and pin the blame for recent issues to Narev. They didn’t do that and I think it’s a strong move giving the position to an internal candidate, a move that supports the view that CBA is a strong organisation despite the external pressure.

CBA Daily Chart

2. Iluka Resources (ILU) $10.17 / +4.85%; A good set of production numbers today with the company increasing production in a strong pricing environment. Strong free cash flow and lower debt while they were upbeat about future pricing .You’ve got to start taking it seriously when a company highlights “structural supply deficits”.

Zircon; Reference Price was increased to US$1,230 per tonne effective from 1 October for a six month period. It is understood that some competitors have increased prices by ~US$125 per tonne in the first quarter 2018; Iluka’s next pricing review will be effective from 1 April 2018 and this has been well accepted by the market.

Minerals sands (high grade – rutile); Iluka has advised customers of an 8%, or US$70 per tonne, increase in the rutile price effective from 1 January 2018 to 30 June 2018, with contracts now in place for 60% of first half 2018 rutile production. In addition, similar to zircon, Iluka has received enquiries exceeding supply for rutile and will be allocating the remaining production on a spot basis over the year.

We like Iluka

Iluka Daily Chart

OUR CALLS

We sold Orocobre (ORE) today at $7.27 switching into Kidman Resources (KDR) at $1.87.

Orocobre Daily Chart

Kidman Resources Daily Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/01/2017. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here