ASX takes foot off the throttle

WHAT MATTERED TODAY

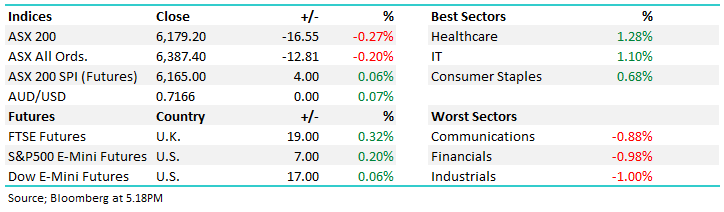

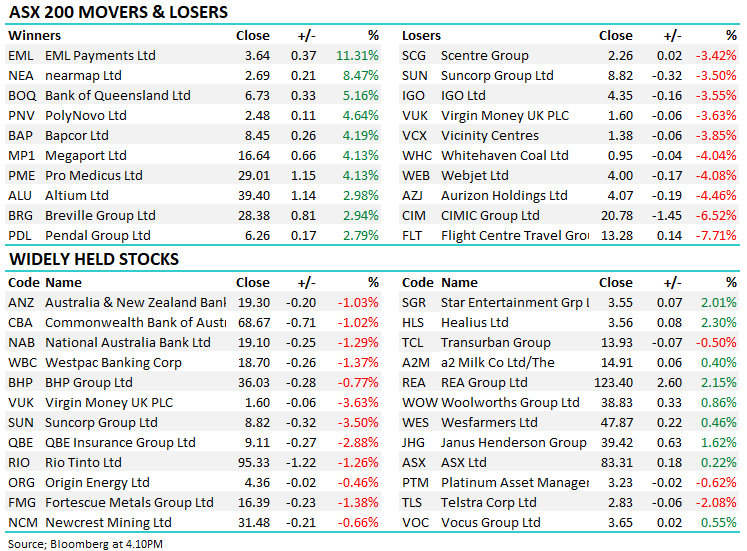

The ASX took it’s first backward step in over a week today, taking a breather after 7 consecutive sessions of gains. The local market did have another nudge at closing higher, coming back from early weakness though it eventually succumbed to the selling. The banks weighed on the market – US banks kicked off their reporting period overnight, and while earnings largely beat, investors remain concerned about the looming stimulus cliff and what that could mean for bad debts. On the other hand, JP Morgan actually released $600m of provisions after seeing the loan book hold up better than feared. Similarly, Bank of Queensland (BOQ) had a better than feared result but it wasnt enough to support the majors, seeing a bit of profit taking no doubt after some decent strength of late. Industrials were also on the softer side with travel stocks under pressure on setbacks for two vaccines.

On the flip side, healthcare was supported with heavyweight CSL tightening their guidance range at the company’s AGM today, though it didn’t do all the work itself with most of the sector closing higher on a soft day. Tech also outperformed – APT the standout which we mentioned in today’s Income Note.

In the region, Asian equities were mixed. Hong Kong was lower after reopening after a tropical storm kept markets closed yesterday. China is touting their 5 year plan which was little help to equities. President Xi was announcing his vision for growth in the region with a focus on South East China becoming a technology hub, though traders weren’t overly moved.

By the close, the ASX 200 fell by -16pts / -0.27% to close at 6179. Dow Futures are trading up 30pts/0.10%

ASX 200 Chart

ASX 200 Chart

BROKER MOVES

- Hub24 Raised to Neutral at Macquarie; PT A$22.50

- Afterpay Raised to Outperform at RBC; PT A$107

- Star Entertainment Cut to Hold at Morningstar

- Woolworths Group Raised to Overweight at Morgan Stanley

- Flight Centre Cut to Neutral at Credit Suisse; PT A$15.31

- Treasury Wine Raised to Neutral at JPMorgan; PT A$10

OUR CALLS

No changes today

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.