Why choose Market Matters?

ASX Stock Recommendations Buy – What ASX stocks are Market Matters targeting to BUY, and why? Here is our rationale along with some previous BUY/SELL alerts and returns from our actual portfolio.

This is page “asx stock recommendations buy” is an extract from a Market Matters Morning Report – 3rd May 2021

RECENT ASX STOCK RECOMMENDATION BUY FROM MARKET MATTERS ASX 200 STOCK RETURNS CAN BE VIEWED BY CLICKING THIS LINK – INVEST NOW

MARKET MATTERS ASX STOCK RECOMMENDATIONS BUY/SELL

WHAT STOCKS, AT WHAT LEVELS, ARE WE LOOKING TO BUY – AND WHY?

“Sell in May & go away” – will 2021 be different?

– Latest Market Matters Report

ASX stock recommendations buy – The ASX200 kicks off the infamous May this morning having already enjoyed gains of 6.6% year-to-date. The Banking Sector leading the way following the sharp rise in global bond yields in Q1. Conversely, the local sector which has struggled noticeably in 2021 is IT. Where the higher yields might have some investors questioning the elevated valuations of some of these tech stocks. I.e. value stocks have finally been enjoying some outperformance compared to growth this year.

So what ASX stock recommendations buy?

We believe that the path for stocks, sectors & indices this year will continue to be dictated by the market’s perception of bond yields. Moving towards 2022, and beyond – a common phenomenon. Last week the Australian inflation data remained extremely supportive for risk assets:

- – The Australian CPI rose +0.6% in the March 2021 quarter, with the important core inflation coming in at 0.3% – both significantly below expectations.

- – Unemployment continues to fall in Australia but wages pressure hasn’t yet flowed through to the economy in a meaningful manner hence no worrisome rise by inflation.

If inflation pressures remain subdued

If inflation pressures remain subdued the RBA’s goal to keep interest rates anchored to 0.1% is looking realistic. Although I caution a lot can happen in 3-years, nobody had heard of COVID two years ago, let alone three! The RBA has said repeatedly they won’t increase rates until “actual inflation is sustainably within the 2% to 3% target range”. Last weeks numbers has the current annual rate at just 1.1%.

So with Australia’s economy throwing up no surprises

So with Australia’s economy throwing up no surprises at this stage. I can understand why some subscribers might doubt our call that a pullback is feeling a strong possibility. Remember the market looks at least 6-months ahead. Fundamentally we are questioning if the current post COVID economic backdrop is justifying the local equity market trading around its all-time highs. We believe situations such as India & Japan are illustrating that the risks moving forward should not be discounted to zero.

Fridays saw some weakness in the US tech large-cap stocks. The SPI futures weren’t concerned on Saturday morning as they closed down less than 10-points. A good result by Westpac (WBC) this morning should help the local market.

ASX 200

Winners – ASX stock recommendations buy

Westpac result strong – asx stock recommendations buy

Westpac has this morning reported 1H21 results ahead of ANZ on Wednesday & NAB on Thursday. The result is a strong one with the following metrics:

- Cash Earnings per share (EPS) 97.1c v 93c expected

- Dividend per share 58c v 54c expected

- Net Interest Margin (NIM) 2.09% up 2bp v 2.03% expected

- Tier 1 Capital 12.34% (incredibly strong)

As we have highlighted previously, we expect dividend payout ratio’s to be guided lower with banks transitioning to a more sustainable level of 60-65% of earnings. Westpac has done this today. On first read through, this is a strong result from Westpac.

MM remains bullish Westpac (WBC) targeting ~$30

Westpac (WBC)

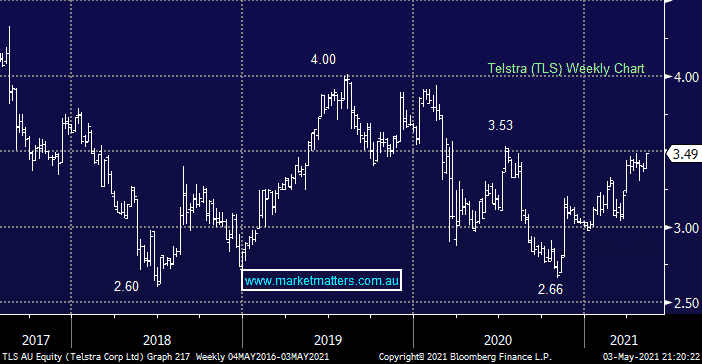

Telstra (TLS) is bullish – asx stock recommendations buy

Australia’s main telco Telstra (TLS) enjoyed a strong session yesterday rallying almost 3% on a day when over 65% of stocks declined. We like the risk / reward with TLS which fits our defensive preference over the coming months, our target is 15-20% higher. We’ve been long in our Income Portfolio for the last 10-months which is working nicely but it’s now tempting as short-term “active” play in our Growth Portfolio.

MM is bullish Telstra (TLS) targeting ~$4

Telstra (TLS)

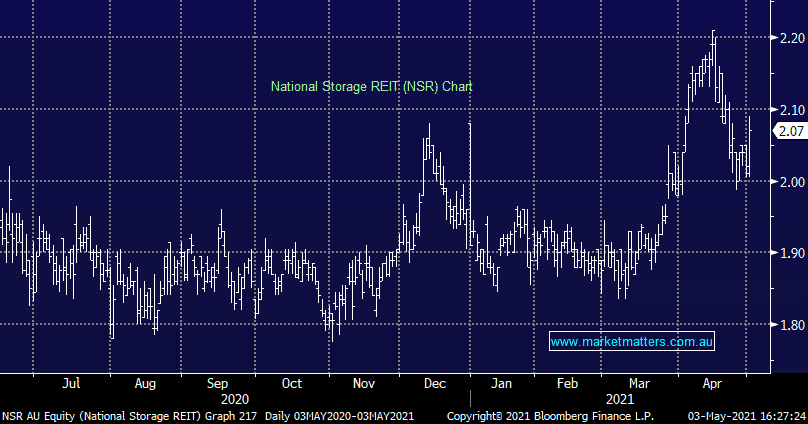

National Storage (NSR) is a takeover target – asx stock recommendations buy

A little over a year ago, the owner of around 200 storage assets in Australia & New Zealand was the subject of a 3 way takeover tussle, with 2 bidders offering $2.20 per share while a 3rd, the Large US listed Public Storage went in hard at $2.40. The deal looked like getting done however along came COVID and the extreme market volatility saw the bid pulled. Now there’s talk of a revitalised bid and private equity firm Blackstone is also being thrown into the mix.

Abacus (ABP) is also a player in this game, they own Storage King and have made it clear that self-storage is an area of focus for them. They also own 9.9% of NSR, although we doubt they will actually make a full tilt at the company, it’s more an opportunistic position.

MM remains bullish NSR targeting ~$2.35

National Storage REIT (NSR)

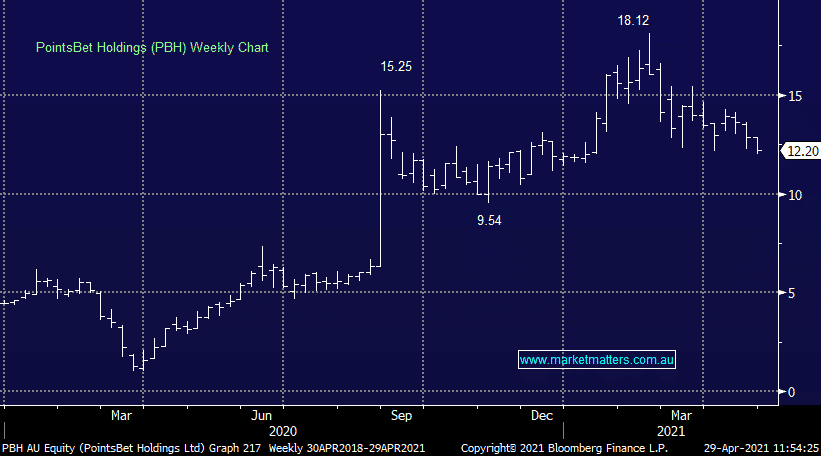

Pointsbet Holdings (PBH) – we are buying – asx stock recommendations buy

Pointsbet is a sports betting platform that operates out of Australia and the US. They are pushing very hard into the US sports betting market which is starting to see relaxation of wagering laws across the country. PBH has won key partnership agreements with key e-sports and sports leagues, including the NHL, placing them in the driver’s seat in a market that is set to boom. We’re particularly interested in the massive opportunity available via e-sports, a topic that deserves more discussion from MM.

MM is buying Pointsbet (PBH) targeting ~$18

Pointsbet Holdings (PBH)

Losers

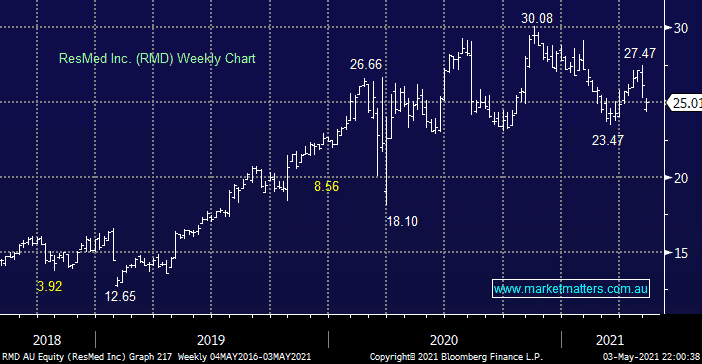

Why has ResMed (RMD) fallen? – asx stock recommendations buy

Yesterday’s worst performer was sleep disorder business RMD which has fallen around 10% following its 3rd quarter result which clearly missed expectations. The $US223m profit is both solid and up 3% but we feel investors had got ahead of themselves following the bumper COVID performance, the market might even be caught a touch long, this is a great company but its not cheap and we wouldn’t be surprised to see a test lower, closer to the $20 region.

MM is neutral RMD at present

Resmed (RMD)

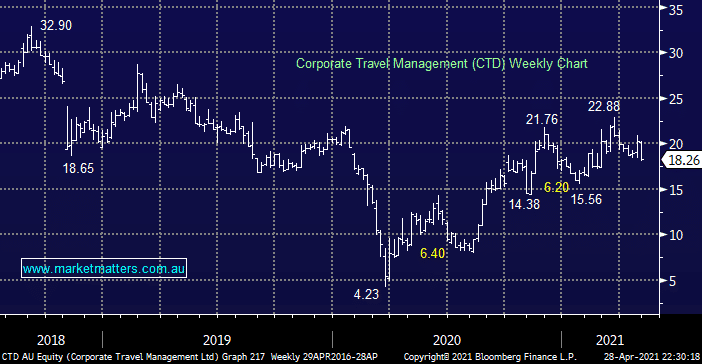

Corporate Travel (CTD) rewards our patience – asx stock recommendations buy

CTD continues to reward our patience after breaking to fresh 9-week lows yesterday with the COVID news out of India / Japan weighing on the travel & tourism stocks. At this stage our preferred entry remains ~10% lower, most definitely not out of the question for this volatile stock which has already fallen 20% from its 2021 high.

MM likes CTD down at ~$16.50

Corporate Travel (CTD)

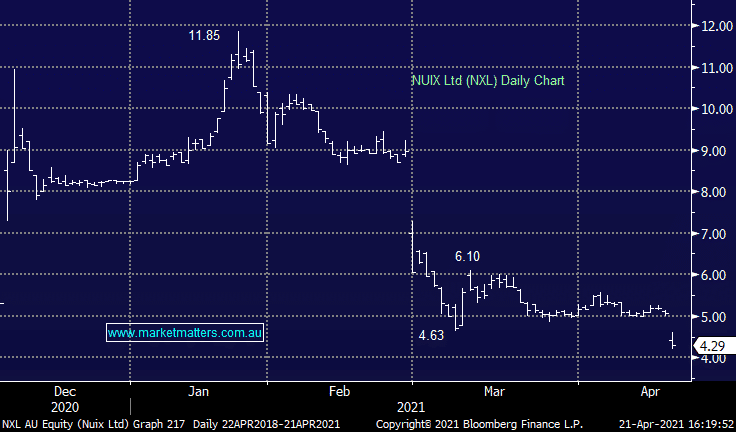

Last year’s hottest IPO, Nuix (NXL) continues to slide – asx stock recommendations buy

Last year’s hottest IPO has taken a steep fall from grace. The analytics business Nuix was the worst of the index today on the back of soft revenue guidance that missed prospectus forecasts. Annualised Contract Value (ACV) is expected in the range of $168-177m, well below the $199.6m the book runners used to value the business coming into the December listing. The miss was blamed on customers transitioning to consumption based licence which the company hopes will reap longer term benefits, but weigh on short term income. The stock had been languishing since the first half results in Feb, and traded below the $5.31 issue price since last week.

MM has no interest in NXL here

Nuix (NXL)

Conclusion

-

Telstra (TLS)

Bullish

-

Westpac (WBC)

Bullish

-

Pointsbet (PBH)

Bullish

-

Resmed (RMD)

Neutral

-

Corporate Travel (CTD)

Neutral

-

Nuix (NUI)

Bearish

Market Matters Investment Approach

About James Gerrish

Author of Market Matters

James is the Author of Market Matters and a Portfolio Manager at Shaw and Partners, one of Australia’s leading financial services firms with approximately $20 billion of assets under management.

His style is pragmatic, his investment approach active. He’s straight-talking, concise, well informed and calls it as it is. James is one of the most credible financial voices in Australia, regularly appearing on CNBC Asia, Sky News, Ausbiz, and the ABC.

Our Values

What is ‘Opinion + Action’?

At Market Matters ‘Opinion + Action’ is more than just the way we deliver our service, it’s a commitment to our members. Every day we bring our personality, our expertise, our honesty and our unique approach to the latest financial developments. But just as importantly, we back these up with our actions.

We tell members what we’re doing in the market, not what we think they should do. We invest in our own portfolios and approach because we believe in them whole-heartedly. We give our members clear and considered decisions to help them form their own.

Opinion + Action is the Market Matters experience.

Confident in our wins. Open in our losses.

We believe in transparent and accountable decisions. It’s fundamental to ensure members can have total confidence in our service. It’s why you can see our portfolio percentage returns, or review our past decisions in uncompromising detail. It’s also why we celebrate our wins and acknowledge our losses.

It’s this integrity, together with our know-how, that has helped Market Matters become a service that is trusted and recommended by 9/10 of our members. We wouldn’t have it any other way.

Full complimentary access for 15 days

Full access to all our content. No payment details required.

learn moreWhat our customer say

Meet the Market Matters Team

The Big Calls We Got Right.

- 2014 - We were unpopular, but correct, when we called significant declines in much loved household names BHP Billiton (BHP) & Woolworths (WOW).

- 2015 - Our favourite three stocks were Regis Resources (RRL) which rallied over 80%, Challenger Group Financial (CGF) which rallied 75% and Telstra (TLS) which rallied 17% - a nice trifecta.

- 2016 - We suggested a major reposition around resources, becoming bullish after an extended period of weakness, which proved to be a great call with heavyweight BHP Billiton (BHP) rallying 40% & many stocks we held up significantly more.

- 2017 - Interest rates were a key influence this year and we highlighted this ahead of time, giving subscribers the early heads up on repositioning for this changing dynamic.

- 2018 – We called and navigated two major stock-market corrections, proving reassurance to subscribers and a practical & profitable road map to follow.

- 2020 - While we failed to foresee the Pandemic, our bullish positioning as the recovery unfolded saw us outperform the market by more than 23% from March through December. Our top three calls for the year were Oz Minerals (OZL), Sims Group (SGM) & Tencent (700 HK) which rallied between 30% & 95%

- 2021 - Join Market Matters today to find out.