ASX shakes early weakness (EML, AAC, SYD)

WHAT MATTERED TODAY

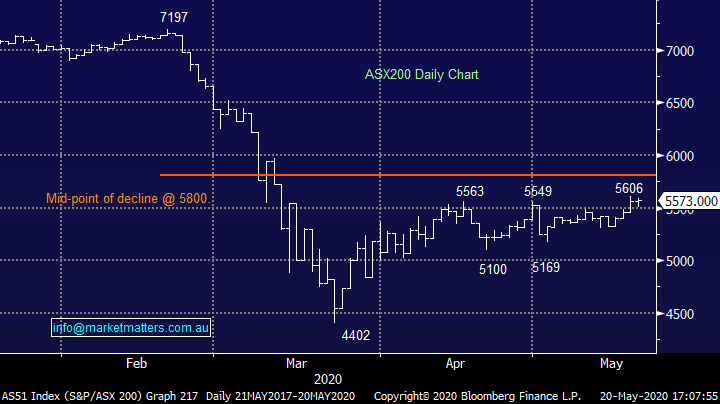

The index started bottom right and finished top left today – early on the ASX200 sold off following overnight markets lower, but hit an early session low down 52 points just 15 minutes in. From there nothing could stop the Aussie market from climbing the wall of worry, slowly but surely ending the session 1.3% from the low. Last night’s focus was on the economic downturn, today’s rally focused on the reopening of economies, a more glass half full approach. Banks found intraday buying, but it was tech names that performed best overall with the market happy to take on some more risk.

Overall, the ASX 200 added +13pts / +0.24% today to close at 5573 - Dow Futures are trading up 100pts/+0.41%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

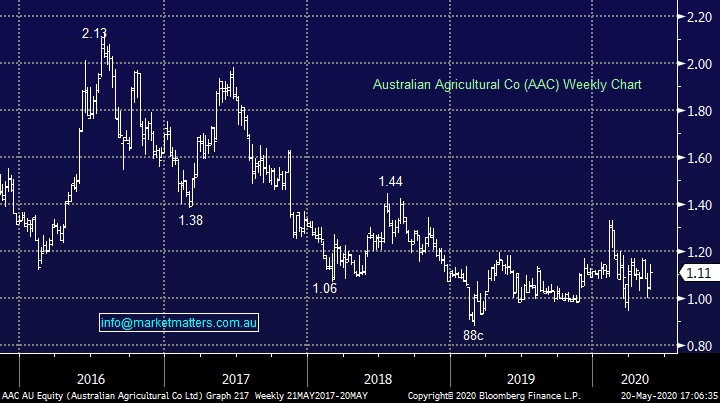

Australian Agricultural (AAC) +3.26%: This integrated cattle and beef company started life back in 1824 and now runs the largest herd of Wagyu Beef in Australia. It’s a stock I’ve always looked at with an eye to buy given its exposure to a growing Asian middle class and their rising consumption of beef, however it’s always had its challenges and the technical picture has been muted.

Today they delivered an improved FY20 result and while its not a well-covered stock (only Bell Potter cover it I think), today’s result was well ahead of their expectations. AAC said they had a record year of Wagyu meat sales +19.7% plus prices were also up by 8%. They saw growth across all key regions: Asia +19%, Europe/ME +17%, NA +34%, Australia +16% and they delivered their strongest operating cash flow since FY17, achieving positive cash flow in four out of the last five halves. This better backdrop flowed through to a increase in net assets which were up 8% to ~$913M. There pastoral properties valuation increased $63.6M, the value of livestock increased by $49.6M dropping down to an NTA per share of $1.53 per share vs $1.42 this time last year. Gearing always an important issue with a business like this and pleasingly, gearing ratio was 30% post accounting standard changes within the targeted 20-35%, although at the higher side. The stock closed today $1.11. Well worth a deeper dive in our view.

Australian Agricultural (AAC) Chart

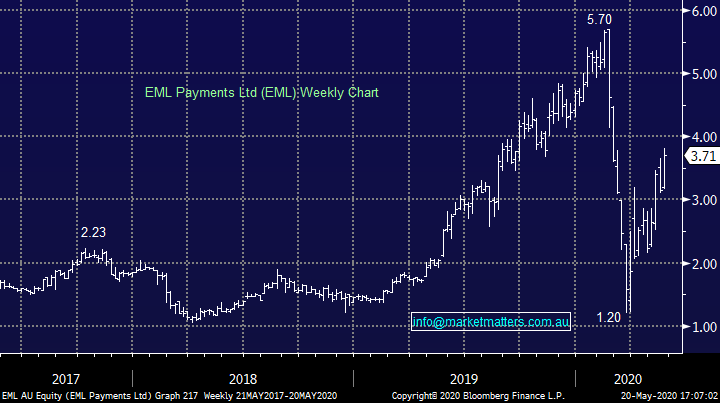

EML Payments (EML) +12.77%: traded to a 10-week high today, now 300% higher than the low set in March. They provided a trading update talking to the impacts of COVID-19 as well as the completion of the PFS acquisition in April. With EBITDA at $27m through the first 9 months of the year, EML is on track to exceed the $35m expected by the market however a large portion of earnings comes from gift & incentive which has fallen substantially given the closure of retail stores across EMLs 1,100 programs. G&I saw a 29% fall in March into a 53% fall in April based on last year’s numbers, with uncertainty remaining around the rebound in Gross Debit Volume.

Post the acquisition, EML’s General Purpose Reloadable (GPR) business counts for more than half of revenues. This side of trade has yet to see significant impacts given the stability of the salary packaging vertical offsetting a small drop in online gaming GDV. All in all a reasonable announcement and the market enjoyed the focus on diversified earnings of the company. EML did flag insider selling of stock with the Chairman set to sell over $1m worth of shares in the coming weeks. Despite this, we do like the business, potentially one to pick up on any weakness on the back of the selling.

EML Payments (EML) Chart

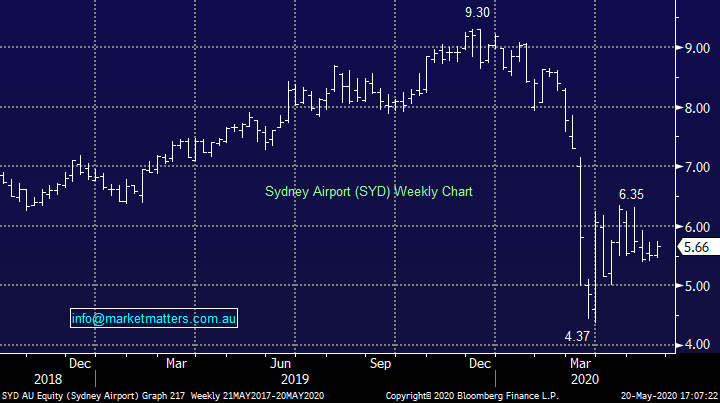

Sydney Airport (SYD) +1.07%: traffic numbers for April painted a grim picture for the airport with less than 100,000 passengers making their way through the terminals, down 97.5% on April 2019. They are not yet in a position to guide to any travel rebound though the travel names did find some buying today with NSW Premier Gladys Berejiklian encouraging people to start booking domestic getaways with the state easing restrictions from June 1. We recently added SYD to the income portfolio.

Sydney Airports (SYD) Chart

BROKER MOVES:

· Baby Bunting Cut to Neutral at Citi; PT A$3.35

· Silver Lake Cut to Hold at Canaccord; PT A$2.25

· Evolution Cut to Hold at Canaccord; PT A$5.85

· Super Retail Cut to Hold at Morningstar

· Carsales.com Cut to Hold at Morningstar

· oOh!media Cut to Hold at Morningstar

· Appen Cut to Neutral at Credit Suisse; PT A$30

· AP Eagers Cut to Neutral at Credit Suisse; PT A$6.45

· ALS Raised to Outperform at Credit Suisse; PT A$8

· Abacus Property Raised to Outperform at Credit Suisse

· ALS Raised to Neutral at Goldman; PT A$6.90

· Evolution Cut to Equal-Weight at Morgan Stanley; PT A$4.70

OUR CALLS

No changes to portfolios today.

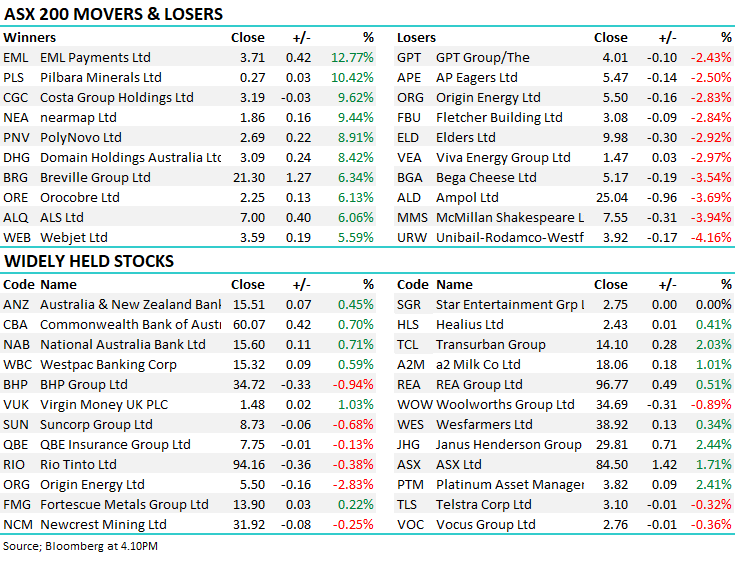

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.