ASX puts on another 3% as banks join in

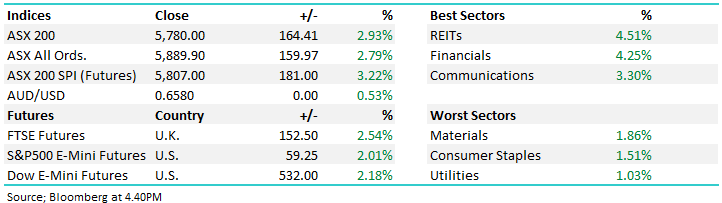

WHAT MATTERED TODAY

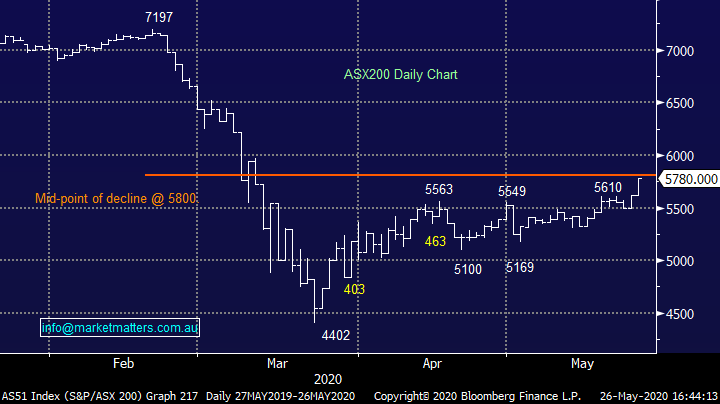

Another bullish session for the ASX today with the market opening higher and building on those gains throughout the day. Another session of broad-based buying with the index heavy weights (banks) joining the chindig today, Westpac (WBC) adding more than 6% a clear standout on the session, although the entire sector was strong. Clearly, we’ve had a better outcome from a health perspective and now we’re seeing signs that the economic outcome could also be better and that’s providing support for stocks. Banks have lagged and are now due some catch-up in our view. As we suggested this morning, if banks find some love the index could be at 6000 in the blink of an eye.

US Futures were very strong through our time zone today, up more than 2% implying a strong open to US trade tonight after a long weekend. Asian markets also came to the party today finishing higher across the board.

Today the ASX 200 added +164pts / +2.93% to close at 5780 - Dow Futures are trading up +532pts/2.18%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

PM’s Address: Scott Morrison stepped up to the mic at the National Press Club around lunchtime which helped the market climb higher into the close. He was keen to announce plans to “take the economy off life support” insisting Australia was ready to stand on its own two feet after many government incentives and protections roll off later in the year. The main focus was in upskilling the labour force, focussing on a TAFE funding overhaul.

Scomo was also keen to see travellers do their bit, and continues to talk to progress with NZ over a potential travel bubble. He was also keen to shoot down calls for greater protectionism, saying that the Australian economy would be a keen player in global trade, although he did touch on the need for greater stability in the region. The business focus was welcomed, as was the pressure to reduce travel restrictions, and the market pushed higher.

DIRECT FROM THE DESK: A wrap of the days trade with a focus on the banks

BROKER MOVES:

- Eclipx Raised to Outperform at Macquarie; PT A$1.29

- Monadelphous Raised to Buy at Citi; PT A$14.35

- Downer EDI Cut to Neutral at Citi; PT A$4.90

- City Chic Collective Ltd Cut to Neutral at Citi; PT A$2.85

- Atlas Arteria Cut to Sell at Morningstar

- MAQ AU Rated New Positive at Evans & Partners Pty Ltd

- SmartGroup Raised to Add at Morgans Financial Limited

- Insurance Australia Raised to Outperform at Credit Suisse

OUR CALLS

No changes

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.