ASX pings back towards the 6000 magnet – most stocks lower (CIP, COF)

WHAT MATTERED TODAY

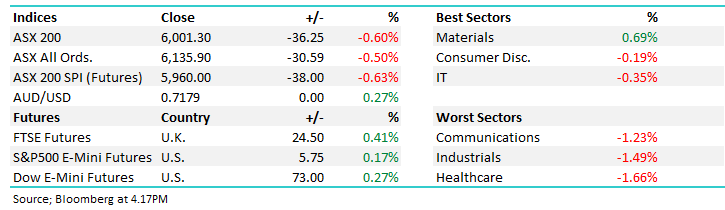

Another choppy session today as the virus continues to create concerning headlines, Victoria again topping the 700 mark in terms of new cases as QLD moves to shun all NSW residents, not just us Sydney siders! Gold the place to be today after topping $US2000/oz, although the Gold stocks have not been as bullish as the precious metal would imply suggesting to us that it’s a bit of a crowded trade.

Around the region today, most Asian market edged marginally higher with the exception of Japan while US Futures ticked around par for much of the day.

Overall, the ASX 200 fell -36pts / -0.60% to close at 6001. Dow Futures are trading up +73pts / 0.27%

A very quiet day in terms of reporting, it really kicks into gear next week, although we do have a few out tomorrow, Mirvac (MGR) in the property space, Nick Scali (NCK) in the retailers both reporting full year numbers while Resmed (RMD) release a quarterly update, look for sales of respirators to more than offset the decline in their sleep apnea products given the issues around elective surgeries at the moment.

A busy day for Centuria today reporting earnings and launching a capital raise in one of their REITs. We had them in the office today and Harry outlines his thoughts from the presentations below.

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

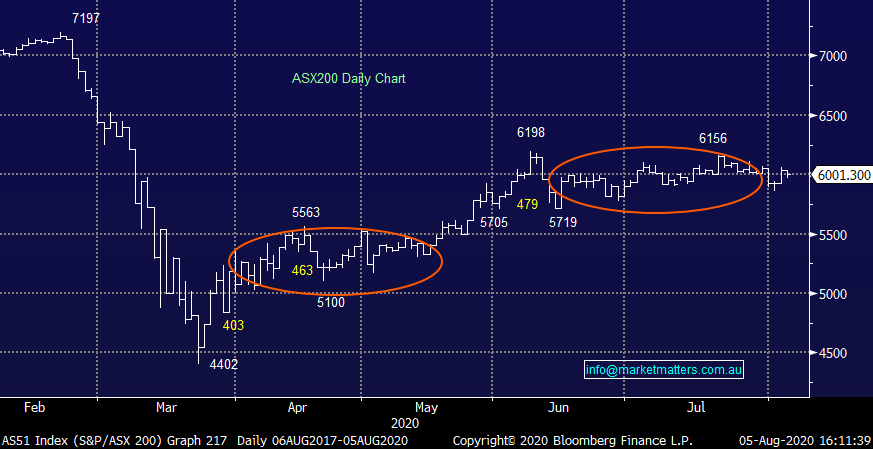

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

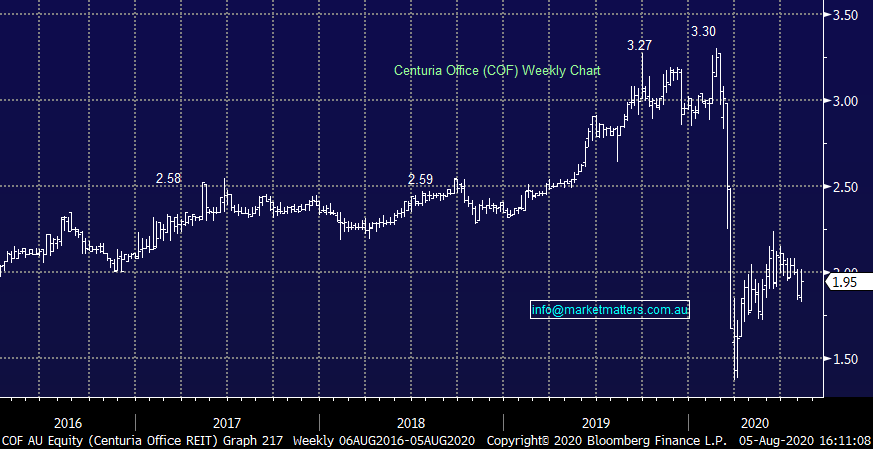

Centuria Trusts: it was a busy day for the two listed trusts managed by Centuria – which are currently in the Shaw offices reporting, some insights from my time with them below. Firstly, Centuria Office REIT (COF) +7.38%, reported full year earnings which were surprisingly upbeat despite all the doom and gloom in the office landlord space. The trust owns and operates 23 high quality office buildings across the country with 98.1% of the space leased at the end of the period and a WALE of 4.7 years. Despite the negativity surrounding rent collections, COF managed to collect 92% of lease commitments through the last quarter of the financial year thanks to nearly 80% of the income “derived from, multinational, ASX and government tenants.”

Gearing remains reasonable at 34.5% with interest cover over 6x. Funds from operations (FFO) at 18.6c/unit was slightly behind guidance provided at the half year, however the total distribution for the year at 17.8c was in line. Centuria continue to talk up the office market despite the obvious concerns around absorption of space. While the change to office leases may not be as drastic as, say, the impact on retail landlords, demand for square meterage will go through a structural shift as people return to the workplace after the pandemic. As a result, risks remain around future earnings and they opted against providing FFO guidance for the year ahead. COF did guide to 16.5c of distributions through FY21, which puts it on a very attractive yield of 8.5% at today’s close.

Centuria Office REIT (COF) Chart

Sister fund Centuria Industrial REIT (CIP) didn’t trade today as it looks to raise $340m to fund three acquisitions, the largest of which is a $416.7m purchase of a Telstra data centre in Victoria on a cap rate of 4.25%. The deal is significant, with the asset to make up ~20% of the total asset value in the trust. The purchase comes with a lease back agreement, on a triple net lease of 30 years with an option to extend for Telstra. The site is near to the telcos main operations site, and remains key to their service while Centuria were talking up their new partnership with Telstra, providing an opportunity to offer more space across the portfolio. CIP also acquired two smaller assets – a $16.4m industrial facility in NSW and a $14m distribution centre in the outskirts of Melbourne. The raise at $3.15/share is a 4.8% discount to last close, a tight margin but it also represents a 11.7% premium to NTA.

Alongside the raise, CIP announced their full year result with FFO per unit at 18.9c and distributions of 18.7c for the year in line with guidance, albeit at the lower end. The book is currently 97.8% occupied with WALE of 7.2yrs and geared at 27.2%. Rent collections for the hairy last quarter came in at 97% with nearly all tenants operating through the period. Valuation for the portfolio grew in the period despite the headwinds to asset values. CIP guided to 17.4c FFO per unit for the year ahead and 17c to be distributed representing a 5.1% yield on last close.

Centuria Industrial REIT (CIP) Chart

BROKER MOVES:

* Village Roadshow Cut to Neutral at Citi; PT A$2.32

* Monadelphous Cut to Neutral at UBS; PT A$8.45

* Tabcorp Cut to Neutral at Macquarie; PT A$4

* Monadelphous Cut to Market-Weight at Wilsons; PT A$8.40

* United Malt Rated New Buy at Jefferies; PT A$4.80

* St Barbara Raised to Overweight at JPMorgan; PT A$3.80

* IGO Raised to Overweight at JPMorgan; PT A$5.60

* Saracen Mineral Cut to Underweight at JPMorgan; PTA$4.90

* Incitec Raised to Add at Morgans Financial Limited; PTA$2.35

OUR CALLS

No changes today

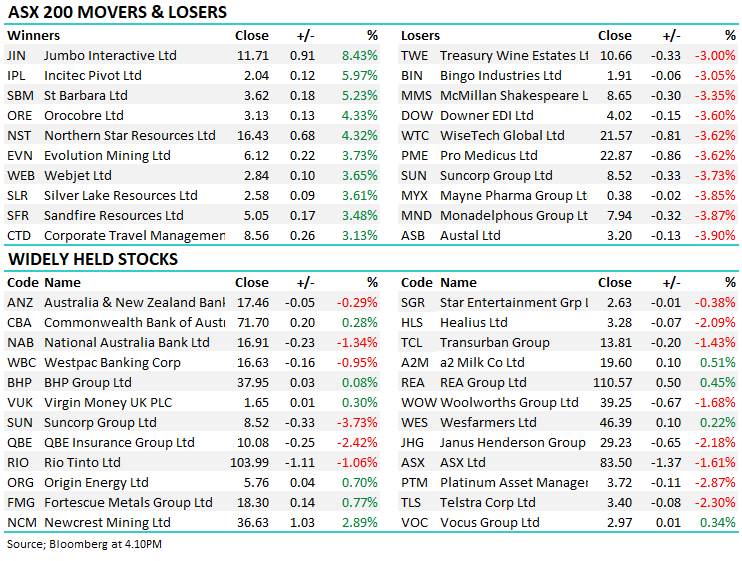

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.