ASX peppered with landmines today (NUF, FMG, ECX, PTM)

WHAT MATTERED TODAY

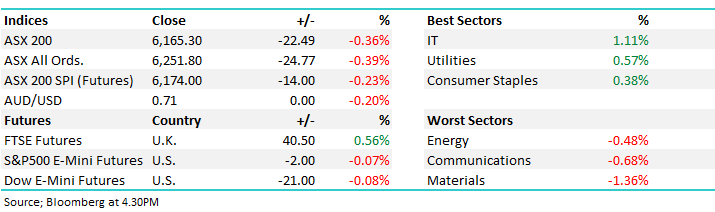

The ASX oscillated in a 30 point range today and was again choppy under the hood – however a more bearish day overall with Materials (for a change) leading the fall. US Futures traded in the red for most of the session while Asian Markets tracked a similar path – China off more than 1%.

Tomorrow should be an interesting session kicking off with the US Federal Reserve decision on interest rates at 5am our time with Jerome Powell heading the media soon after while locally, employment data will be released at 11.30am Sydney time – should be a widely watched print given the RBA have hung their hat on strong unemployment as the primary reason to sit tight on interest rates, a weak number tomorrow will obviously open the door for the central bank to act and that would likely be a short term positive for the market. What would worry me is if the number is weak and the market sells off which implies the concern around the local economy is trumping the sugar hit of lower rates. Expectations are for an unemployment rate of 5.0% with 15k jobs added.

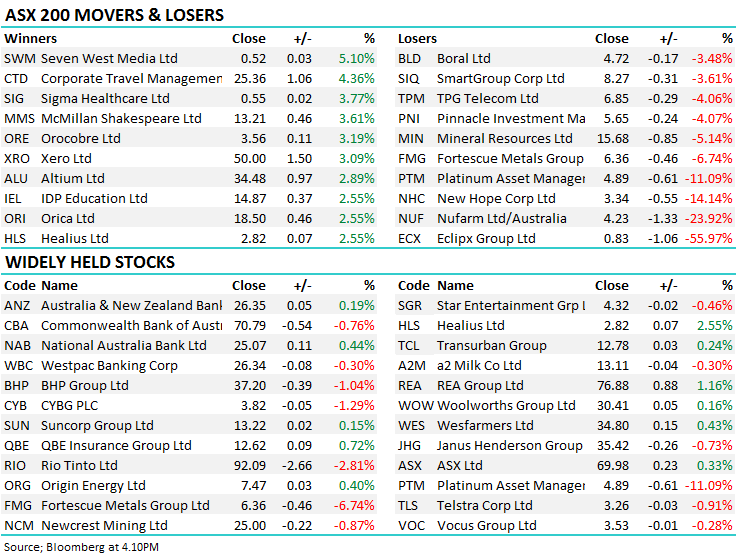

Overall today, the ASX 200 lost -19points or -0.32% to 6165. Dow Futures are down -16pts / -0.06%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

A lot of stock news today – most on the negative side with two big earnings downgrades from Eclipse (ECX) and Nufarm (NUF) while New Hope Coal (NHC) was slotted again today, down another 14% after falling 11% yesterday after reporting first half earnings while saying that Australian coal cargoes are being diverted away from China while research out this morning was focussing most towards the rise in costs.

Newhope Coal (NHC) Chart

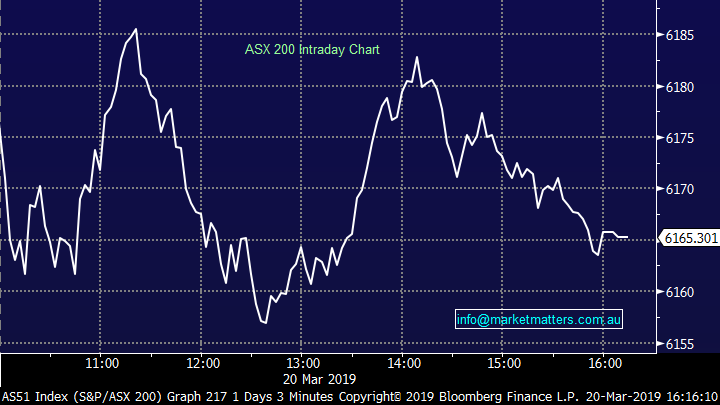

Eclipse (ECX) -55.97% After a two-day trading halt ECX was out today with a pretty astonishing downgrade and the stock reacted accordingly + the proposed deal with rival McMillan Shakespeare (MMS) has been canned. ECX said profit for the first 5 months of the current financial year was 42% lower than a year earlier + they walked away from their full year guidance. In any merger like this there a “material adverse event clause” and a 42% drop in earnings would clearly fit that bill. We’d expect them to cut the dividend and also need to test the carrying value of goodwill in their upcoming results …a poor day for ECX and we don’t see any long term value in the stock at this stage.

Eclipse (ECX) Chart

Fortescue Metals (FMG) -6.74% down today after a Brazilian court issued a ruling to allow Vale, the world’s largest iron ore producer, to resume operations at a tailings dam and a mine that was shut on 6 February as a precaution after a deadly tailings accident in the region. This news is an incremental positive for the tight Iron Ore market that moved from sub $US75/tonne before the disaster to above $US90/tonne. We’d expect a more volatile period to now play out ranging between $70-90/t.

This means the iron ore names will likely pull back from recent near 52 week highs with our call on FMG over the weekend looking a good one. That said, there are a few ways to play FMG from here 1. BUY when FMG heads back to $6/sh or 2. HOLD if you are just sitting in on the medium term EPS upgrades and dividend story. Either way the vale iron ore story is yet to play out and any meaningful weakness would present a buying opportunity.

Fortescue Metals (FMG) Chart

Nufarm (NUF) -23.92% another big hit after downgrading FY19Ebitda expectation to $440 million-$470 million down from $500 million-$530 million + they have temporarily suspended their dividend as they prepare for a tough second half. At the mid-point it’s an 11% downgrade however given the poor guidance and cut of the dividend the stock was hit harder.

Glad we avoided NUF and it was largely a result of the MM community being on the ground operating in various industries around the country.

Nufarm (NUF) Chart

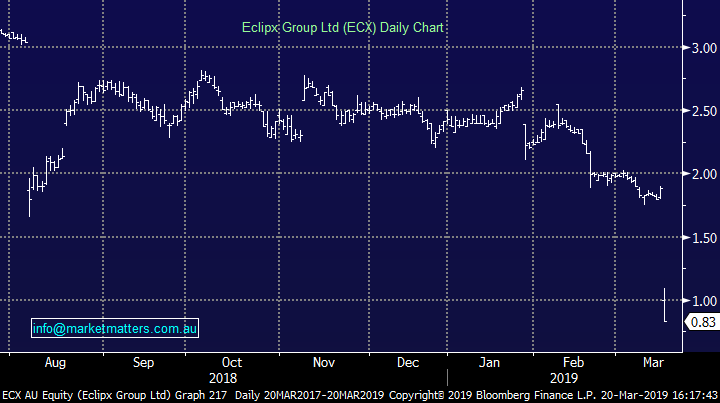

Platinum Asset Management (PTM) -11.09% hit today after Kerr Neilson and his wife Judith sold 60m shares in the asset manager he co-founded many moons ago at a 9.10% discount to the last traded price – the trade valued at $300m. It looked like there were two buyers in the transaction however he’s far from bailing out on PTM – he still owes more than $1.2bn worth of stock in PTM .

Platinum Asset Management (PTM) Chart

Broker Moves:

· ResMed Upgraded to Buy at Deutsche Bank; PT $125

· oOh!media Rated New Add at Morgans Financial; PT A$4.08

· Warehouse NZ Upgraded to Outperform at Macquarie; PT NZ$2.85

· nib Upgraded to Buy at Morningstar

· New Hope Cut to Neutral at Credit Suisse; Price Target A$4

· SG Fleet Upgraded to Equal-weight at Morgan Stanley; PT A$2.60

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.