ASX makes another new all-time high (WOW)

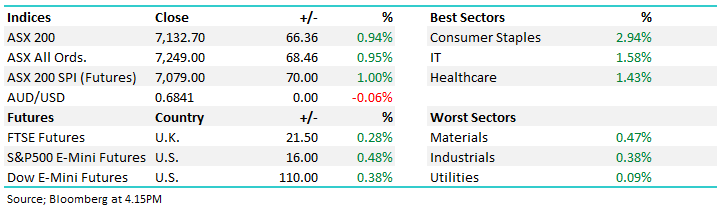

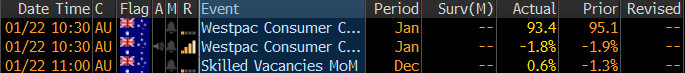

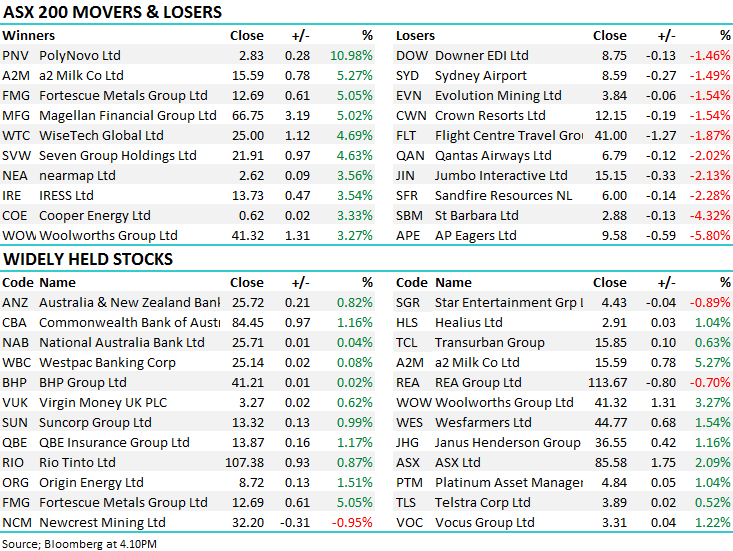

There was a clear turning point mid-morning today with the market swivelling 180 degrees a little after 10.30am post the release of the Westpac Consumer Confidence which came in soft. The market was looking for a marginal fall in confidence, they got a reasonably significant hit of nearly 2% which sent the Australian dollar lower, and the relative value of the ASX200 higher – hence the buying power pushing the index up to (another) all-time high. A rebound in skilled vacancies further spurred the buyers with the index finally settling in well above the7100 mark.

Source: Bloomberg

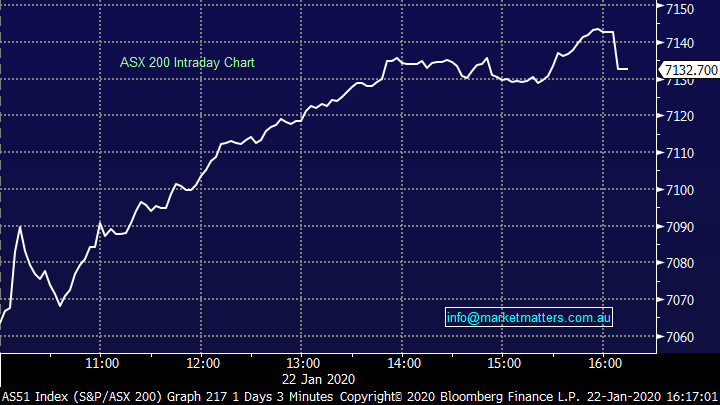

The broad-based buying helped all sectors finish in the black today although there was a tendency towards the riskier end of stocks with Tech one of the standouts. The exception to the rule was Consumer Staples, often a more conservative sector but topped the boards today thanks reports Kaufland was departing without ever really arriving which helped the staples names up – more on this below.

Overall, the ASX 200 rose 66pts / +0.94% today to close at 7132. Dow Futures are trading higher by 110pts/0.38%

S&P/ASX 200 Chart

S&P/ASX 200 Chart

CATCHING MY EYE

Woolworths (WOW) +3.27%; We covered WOW in the income note earlier today however it kicked higher, particularly late in the session, after a report emerged that Kaufland had informed Australian employees it would be withdrawing from Australia without yet opening a store. The email to employees quoted acting CEO Frank Schumann in apologizing to the 200 employees saying the company would look to focus on its core European brand.

The news helped supermarket shares higher on less competition than the market was preparing for. We flagged this issue in today’s Income Report, and although one potential participant has dropped out, others are or soon will join the Australian supermarket landscape making it difficult to buy WOW, particularly on such a light yield.

Woolworths (WOW) Chart

Broker moves; if there was ever proof that analysts tended to be reactionary, today was the day. Credit Suisse upgraded FMG to the equivalent of a hold today, bumping their price target up a whopping 47% from $7.50, the day FMG hit new all-time highs. The report titled “Let the good times roll” – though the music stopped for Credit Suisse clients some time ago with the sell rating on one ASX’s best performer of late – they talked to an increased iron ore price deck following the house view on Chinese steel production was revised higher.

· Domino’s Pizza Enterprises Cut to Sell at Citi; PT A$48.60

· Suncorp Cut to Neutral at Citi; PT A$14.30

· QBE Insurance Raised to Buy at Citi; PT A$15.20

· Rio Tinto Cut to Market Perform at BMO; PT 4,650 pence

· AP Eagers Cut to Hold at Morgans Financial Limited; PT A$11.96

· Fletcher Building Cut to Hold at Morningstar

· Perseus Rated New Buy at Cormark Securities; PT C$1.15

· Mirvac Group Raised to Neutral at JPMorgan; PT A$3.20

· Dexus Raised to Overweight at JPMorgan; PT A$13.50

· Stockland Cut to Underweight at JPMorgan; PT A$4.30

· Char Raised to Overweight at JPMorgan; PT A$3.65

· Char Raised to Buy at Goldman; PT A$3.57

· Hub24 Raised to Add at Morgans Financial Limited; PT A$13.35

· Fortescue Raised to Neutral at Credit Suisse; PT A$11

· Goodman Group Raised to Neutral at Goldman; PT A$13.28

· Flight Centre Cut to Neutral at Credit Suisse; PT A$44.83

· Resolute Mining Cut to Hold at Baillieu Ltd; PT A$1.14

OUR CALLS

We added Tencent (700.HK) to the international equities’ portfolio today.

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.