ASX grinds higher, Cross Counter wins the cup & RBA holds rates again (RIO, COH)

WHAT MATTERED TODAY

No luck in the cup today for the MM team although we certainly didn’t lose as much as Ladbrokes and Sportsbet who’s websites had major issues on the biggest betting day of the year. Hard not to feel for the IT teams from both operations this afternoon! Congratulations to Cross Counter for a cracking race, as was the case last year, a Northern Hemisphere three-year-old took out the honours in the $7.3m gallop around Flemington.

Once again the RBA has played second fiddle to other events keeping rates on hold for a record 25th time at 2.30pm this afternoon. The market was positioned for it and we saw very little movement across currency markets, while stocks simply grinded strongly higher – climbing the wall of worry.

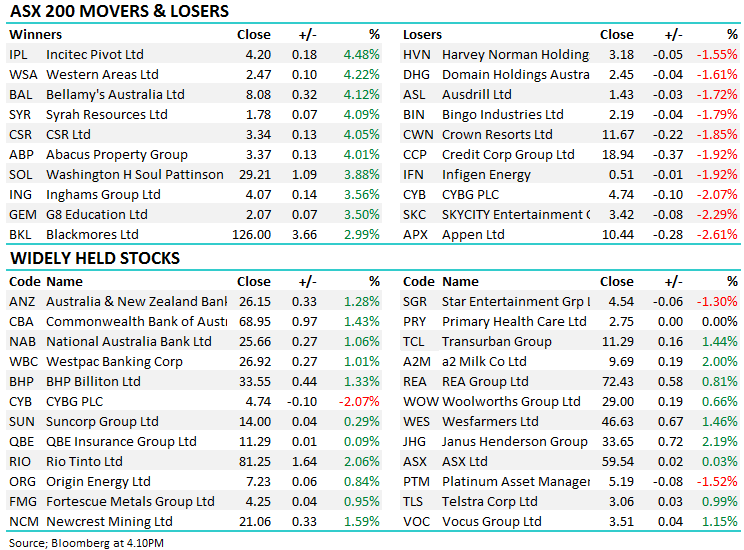

Banks continued to trend up after ANZ, NAB and more recently Westpac (WBC) delivered full year results in the past week or so that were void of any large negative shocks while two of our holdings in the resource space, Rio Tinto (RIO) & Western Areas (WSA) were strong again adding 2.06% and 4.22% respectively.

Rio Tinto (RIO) Chart

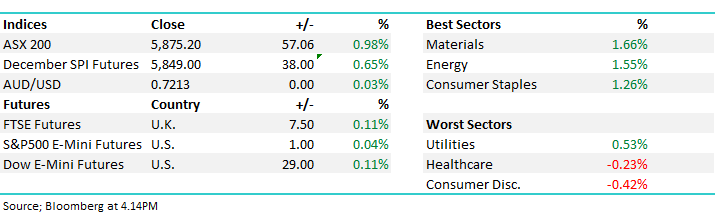

A good day for stocks overall bucking some weakness across Asian markets and a fairly muted read coming from US Futures. Overall, ASX 200 closed up an impressive +57points or +0.98% at 5875. Dow Futures are currently up +30 points or +0.12%.

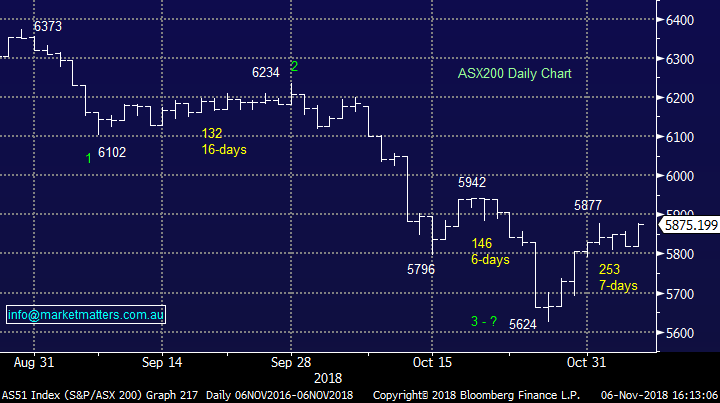

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Not typically that active on cup day however we saw a few flow through this morning. The Macquarie Quant team once again failed to deliver the winner, although they picked 2 out of the top 5 ponies in their top ranking horses we covered this morning.

RATINGS CHANGES:

• Cochlear Upgraded to Buy at Citi; PT A$202

• Woodside Upgraded to Neutral at Citi; PT A$32.91

• Oil Search Upgraded to Neutral at Citi; PT A$7.42

• CSR Upgraded to Buy at Deutsche Bank; PT A$3.70

• Corporate Travel Upgraded to Buy at Ord Minnett; PT A$30.30

• Treasury Wine Upgraded to Outperform at Macquarie; PT A$18.22

• ASX Upgraded to Hold at Deutsche Bank; PT Set to A$58.50

• Growthpoint Downgraded to Sell at Morningstar

• Santos Upgraded to Buy at Morningstar

• Sims Metal Downgraded to Sell at Morningstar

• Independence Group Raised to Equal-weight at Morgan Stanley

• Galaxy Resources Raised to Overweight at Morgan Stanley

• Incitec Upgraded to Outperform at Credit Suisse; PT A$4.33

Cochlear (COH) $171.74/ -0.57%; Yesterday Cochlear was on the wrong side of a patent infringement ruling from a US District Court and the shares traded, and fell again today (slightly). While this is not new news, the size of the infringement has increased from $131mn to $268m, which is obviously a reasonably big number. As means of background, COH have been fighting these claims for around 5 years with the hearing implant company being found guilty in 2014 of having wilfully infringed four claims across two patents and was awarded ~US$131mn against it, which has subsequently being increased to US$268mn.

COH will appeal and that will likely take more than 2 years to complete, however in the meantime they need to lodge a US$335 million insurance bond with the Court to secure the judgment amount, and any interest and costs. That bond will cost COH about ~A$2mn a year. If we assume that they lose that appeal and they need to debt fund the cost, Morgan Stanley numbers suggest it would have a ~3.5% impost on earnings. MS downgraded COH PT to $175 however Citi have today upgraded them to a buy with PT of $202. We own COH in the Growth Portfolio

Cochlear (COH) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and

Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.