ASX follows Asian markets into the red (AXL, MNY)

WHAT MATTERED TODAY

A quieter day on the reporting front with some of the smaller companies out with results - still we had some big moves in underlying stocks prices today with companies that miss suffering more than simply on the day of the miss while those that beat have seen some sustained buying. This suggests that fundies are holding back until results are reported, understandable given the longevity of the current bull market i.e you wait to back the companies with good micro trends rather than backing the market generally to do the heavy lifting – that fits with the MM view at the moment.

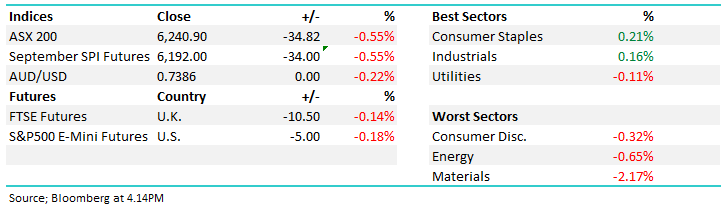

It seems Mr Trump is posturing ahead of further discussions with China, saying the US is weighing whether or not increase the proposed tariff on $US200 billion of Chinese goods to 25% from 10%, stepping up pressure on Beijing to change its trade practices. That saw the majority of Asian markets down sharply today and as one trader suggested on Bloomberg, the 35pt/0.55% decline for the Aussie index actually felt like a good result relative to Japan down -1.25%, Hong Kong down -2.22% and China off by -2.5%.

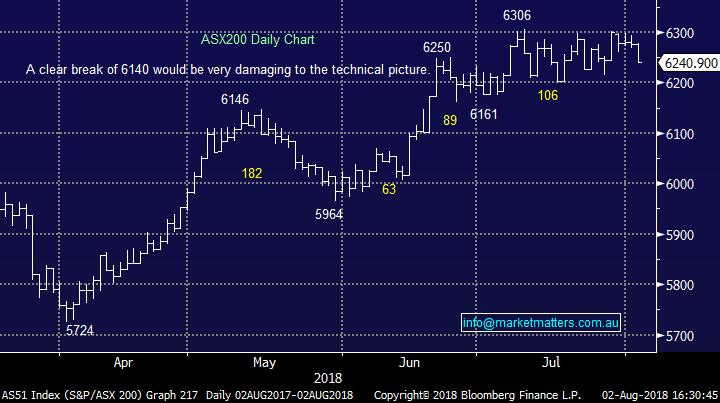

Overall, the ASX200 lost -34 points today or -0.55% to close at 6240 – Dow Futures are currently trading down -79pts. We are now neutral the ASX200 given the drop below 6250 today, with a break of the 6140 point required to turn us outright bearish.

We’ve commenced domestic reporting season and subscribers can view a list of companies reporting dates over the next few weeks here. Click here to view the reporting season calendar

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves;

· Meridian Energy Cut to Underperform at First NZ Capital

· BWP Trust Cut to Sell at Moelis & Company; Price Target A$2.95

· ALS Upgraded to Neutral at JPMorgan; PT A$8.17

· Alacer Gold Downgraded to Neutral at Macquarie; Price Target C$3

· Alumina Downgraded to Sell at Morningstar

· Janus Henderson GDRs Cut to Neutral at Evans and Partners

· Janus Henderson Downgraded to Hold at Deutsche Bank

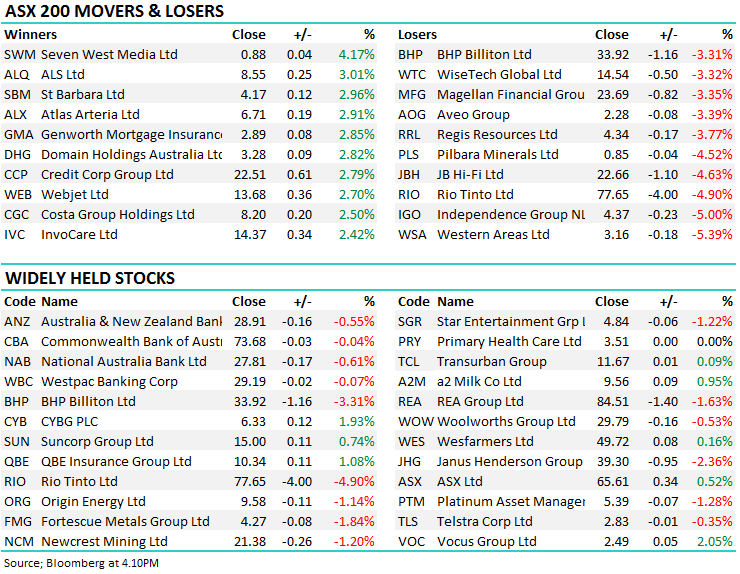

Rio Tinto (RIO) $77.65 / -4.9%; RIO came back online today after yesterday’s result and opened reasonably well considering the miss however selling was sustained throughout the session. When a company misses we’re seeing sustained moves in the direction of the miss for some days…so we expect some further downside in RIO. Our eventual target sits at $74 - we covered our views in more detail this morning. click here

Rio Tinto (RIO) Chart

Axsess Today (AXL) $2.44 / +5.4%; jumped after announcing FY18 numbers and FY19 guidance. NPAT for the year gone was in line with guidance (but slightly below consensus) however the highlight was a strong FY19 NPAT guide of $12.5m-$13m, representing 80% growth and above most analyst numbers, while also noting additional capacity headroom following the recently listed bond that we hold in the Income Portfolio trading under AXLHA. AXL was up 5.4% today to $2.44.

Axsess Today (AXL) Chart

Money 3 (MNY) $2.07 / +2.48%; Credit provider MNY was out today with an earnings update for FY18. The result was a slight upgrade on the profit line from 31mto 32m and above their initially provided guidance for FY18 at FY17 result of $29-$30m. The final dividend to be at least 4.5cps (fully franked likely), following a first half dividend of 4.5cps. FY18 dividends now likely to total more than 9cps. MNY is an interesting business with further growth to come by the look of it.

Money 3 (MNY) Chart

OUR CALLS

No trades across the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here