ASX drifts lower as Asian markets weigh (BHP, OSH)

WHAT MATTERED TODAY

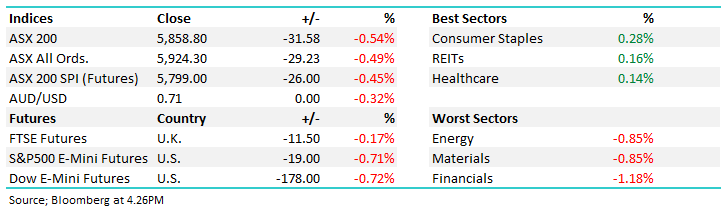

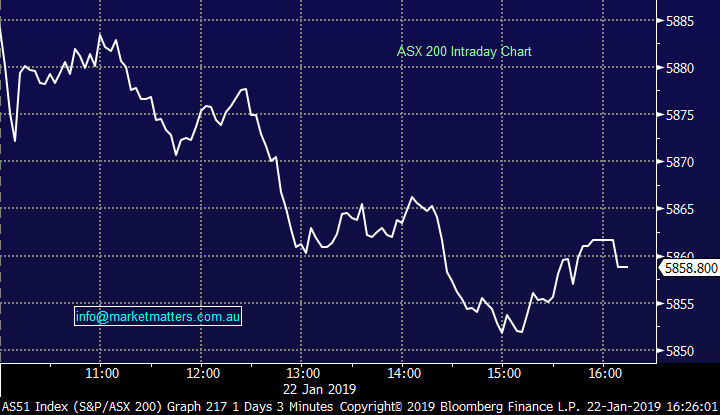

A weaker session today across the board with Asian markets trading in the red for much of the day, Hong Kong down around ~1.3% the hardest hit in the region while US Futures opened fairly flat, before sellers came in around lunchtime. Relative to yesterdays close, Dow Futures were down around ~70points during our time zone – certainly not a huge move in any respect however a negative influence all the same. The Aussie market actually tried to stay above water early before starting to drift away from around 11am into the close. We suggested yesterday that markets were showing initial signs of exhaustion and that gained momentum today – hardly surprising that some profit taking comes in after the aggressive (low volume) bounce we’ve had from the depths of despair on Christmas Eve.

Overall, the ASX 200 closed down -31points or -0.54% to 5858. Dow Futures are currently trading down ~100pts relative to this time yesterday.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; The notes are starting to filter out about potential capital management ahead of the likely change of Government and amendment of franking credit legislation. Those tipped to launch capital management initiatives include Woolworths Group, JB Hi-Fi, Wesfarmers and Flight Centre amongst others.

ELSEWHERE:

· Pact Group Cut to Neutral at Credit Suisse; Price Target A$3.85

· Woolworths Group Downgraded to Neutral at Citi; PT A$31.30

· Stockland Upgraded to Buy at Citi; PT A$4

· Lendlease Upgraded to Buy at Citi; Price Target A$15.06

· Dexus Downgraded to Neutral at Citi; PT A$11.05

· Abacus Property Upgraded to Buy at Citi; PT A$3.91

· Sims Metal Downgraded to Sell at UBS; PT A$8.50

· Oil Search Downgraded to Sell at Morningstar

· QBE Insurance Downgraded to Hold at Morningstar

· TPG Telecom Downgraded to Sell at Morningstar

· Flight Centre Downgraded to Sell at Morningstar

· Saracen Mineral Cut to Sell at Baillieu Holst Ltd; PT A$1.95

· Saracen Mineral Downgraded to Sell at Canaccord; PT A$2.40

· Saracen Mineral Cut to Sell at Argonaut Securities; PT A$2.10

· Wesfarmers Downgraded to Neutral at Goldman; PT A$32.50

· Brambles Upgraded to Buy at Citi

· OceanaGold GDRs Downgraded to Sell at Canaccord; PT A$4.30

· St Barbara Downgraded to Hold at Canaccord; PT A$4.70

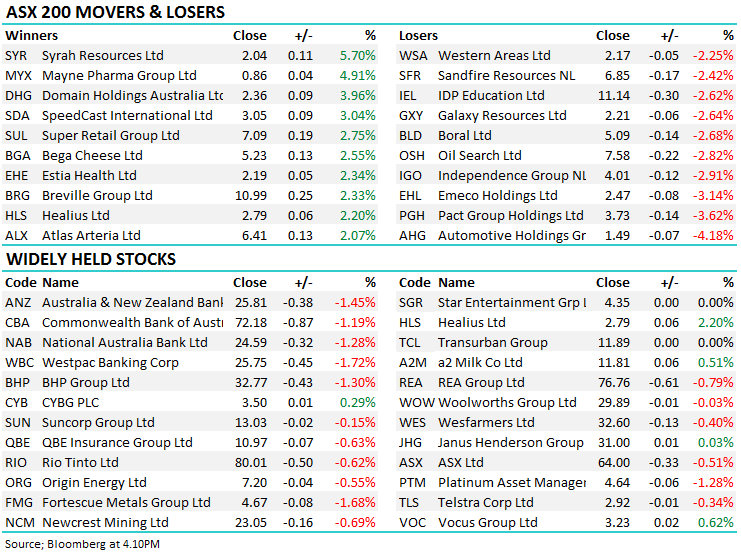

BHP Group (ASX: BHP) $32.77 / -1.3%; a soft day today, under performing peers and the market after the release of the 1st half production report. 6 months into the year, the company appears to be on track to hit guidance across the board despite being slightly behind in some areas. Petroleum production as strong, largely better than expected, while iron ore & copper came in a touch short of expectations. Iron ore was impacted by the train derailment back in November, while Copper was hit by outages at their Escondida mine.

Commentary also suggested that costs had crept up as a result of maintenance and outages, something that they expect to offset in the second after reiterating cost guidance. All in all not a bad a bad first half but some ground to make up in the second – not uncommon for BHP or other miners. We like BHP, but are looking buy at lower levels (sub $30) – and this report could be the catalyst to see BHP head lower.

BHP Group (ASX: BHP) Chart

Oil Search (ASX: OSH) $7.58 / -2.82%; Q4 production numbers out today and just like BHP, they were a tad light on. Production of 7.5 MMboe during the period (mkt looking for around 8MMboe) was a slight miss while full year guidance for 2019 is 28-31.5 which looks okay to slightly light on. Some in the market are above that level so could come as a weak spot for a few. We’d look at OSH again nearer ~$7.20

Oil Search (ASX: OSH) Chart

OUR CALLS

No trades today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.