ASX drifts from early highs – Sims Group downgrades again (SGM, DMP, ORE)

WHAT MATTERED TODAY

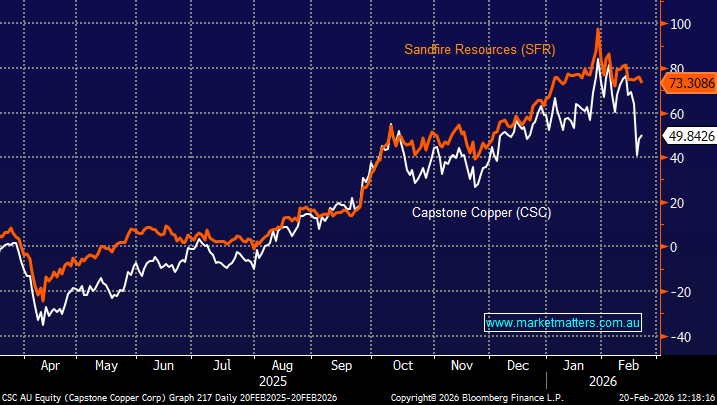

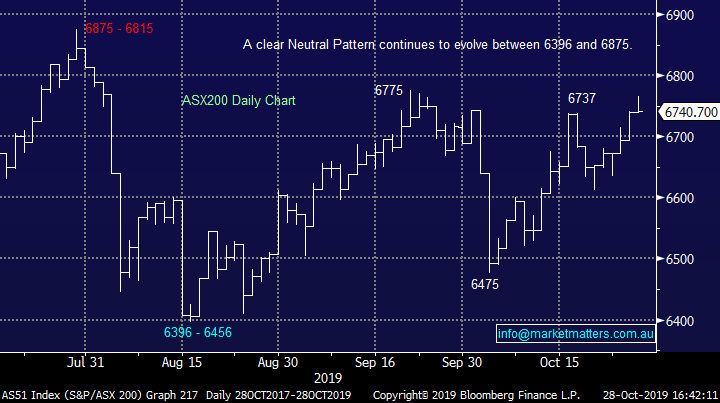

The market opened well in early trade up +25pts around the open before the lack of appetite to buy into any type of strength prevailed again, and the market drifted down throughout the session, to close more of less unchanged. The market continues to chop around in a trading range, the main difference today being that stocks failed to embrace the slip in the AUD during the session today. Asian markets were higher today, ditto for US Futures while at the sector level locally, the Industrial, Energy & Materials all provided decent support while the more defensive sectors of staples and real-estate lagged.

Overall, the ASX 200 closed +1pt higher today to 6740, Dow Futures are trading up +50pts/+0.17%.

ASX 200 Chart

ASX 200 Chart – technically bearish, now points to are-test of 6600 for the ASX 200

CATCHING MY EYE;

Talk of QE: We touched on this in recent reports however talk of Quantitative Easing (QE) by the RBA hit the front page of the Fin Review today while the Australian was reporting that the Government is actively urging banks to lend more to accelerate economic growth before the end of the year. Apparently Federal Treasurer Josh Frydenberg on Friday met leaders at ANZ & NAB and asked them to ease the flow of credit, the report in the Australian said. Frydenberg also asked what the government could do to make that easier, according to the newspaper. Interesting times after responsible lending got a big run in the Royal Commission. In any case, easier credit & any meaningful quantum of QE is bullish for asset prices overall.

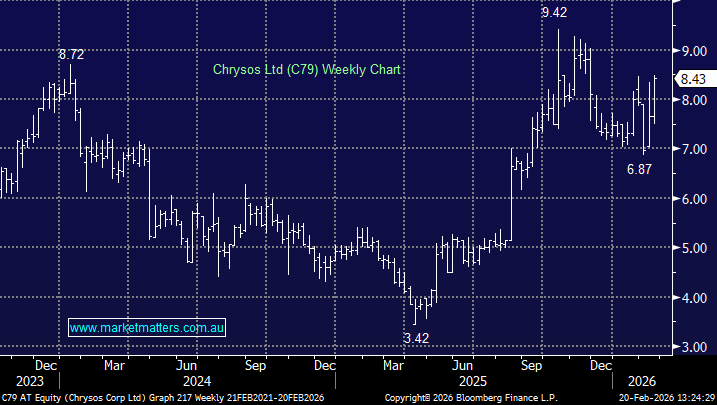

Lithium Stocks: All ripped higher today on the back of supply disruptions in Chile as protesters block access to some of SQM and Albermarl’s operations – obviously bullish for lithium prices and some more positive news for a sector that’s been under pressure for a while now. Pilbara (PLS) the best of them adding +10.71% to close above the recent raise price of 30c while Orocobre (ORE) added +5.63% to close at $2.44.

Orocobre (ORE) Chart

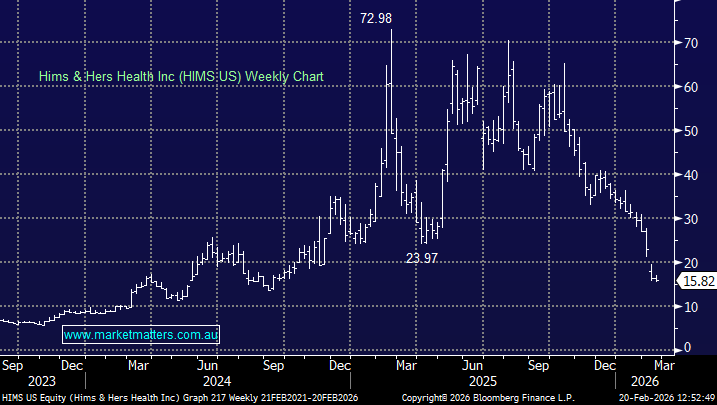

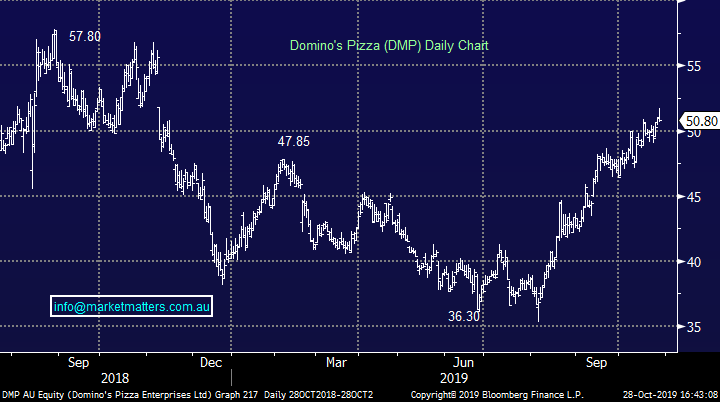

Dominoes (DMP) -0.29%: Held their AGM today and also issued a trading update with total network sales up +10.6% on the prior year, +4.14% on a same store basis which is a touch light on what we were expecting. In terms of guidance, nothing to hang ones hat on however they did say “At this time our outlook for the medium term is unchanged; we expect to open new stores at the rate of seven to nine per cent of our Group network annually and grow Group Same Store Sales at the rate of three to six per cent.”

The stock was firm in early trade, hitting a high of $51.75 however sellers came in post the AGM and the stock closed marginally lower. We took profits on DMP last week ahead of this AGM.

Dominoes (DMP) Chart

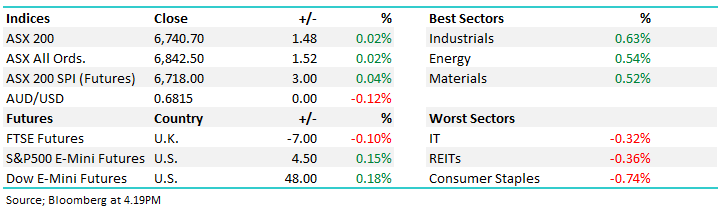

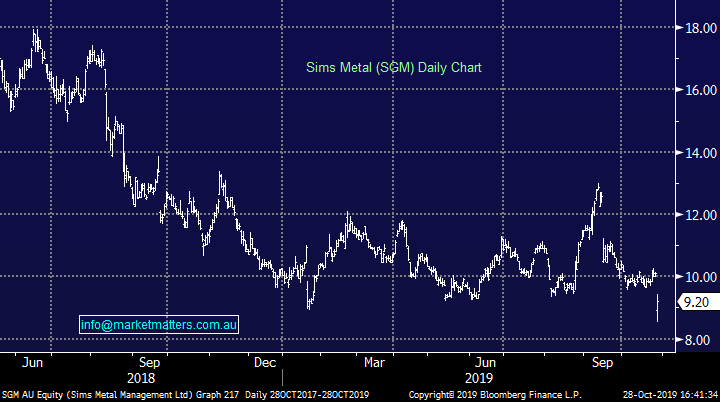

Sims Metals (SGM) -8.82%; downgraded guidance for the second time within 2 months today saying “the scrap price crash will be worse than originally anticipated.” The company noted rising inventories, particularly in the UK, will provide a significant drag on first half profits given this inventory will be sold at a loss. In the medium term, suppliers are reducing volumes to the market in the hope of a recovery in prices resulting in margins contracting for Sims. The company blamed auto sales, global growth and manufacturing and trade wars as the drivers of the markets weakness.

As a result of the issues, EBIT is now expected to fall into a loss for the first half of $20-$30m before recovering in the second half for a full year EBIT of $20-50m in FY20. This compares to market expectations which had SGM priced for a $151m full year EBIT. This guidance also relies on scrap prices stabilizing at current levels or rising from here. The company also noted that the strong balance sheet will help SGM navigate the current weakness in the market while also putting it in a stronger position when it stabilizes.

SGM did well to finish a long way from the day’s low but it would take a brave trader to step up and buy on the current move. The downgrade cycle continues, however a trade resolution could provide the tailwind Sims needs. Keep this stock on the radar for a recovery if a resolution between US / China trade is managed.

Sims Metal Management (SGM) Chart

Broker moves;

· Incitec Rated New Underperform at Jefferies; PT A$3.10

· Santos cut to Hold at Morningstar

· Centuria Capital Rated New Neutral at JPMorgan; PT A$2

· Centuria Industrial Rated New Overweight at JPMorgan; PT A$4.20

· Cleanaway Raised to Neutral at Credit Suisse; PT A$1.80

· Coles Group Cut to Underperform at Credit Suisse; PT A$13.23

· Regis Resources Raised to Hold at Canaccord; PT A$5.05

· BHP Raised to Outperform at RBC; PT A$39

OUR CALLS

No changes today

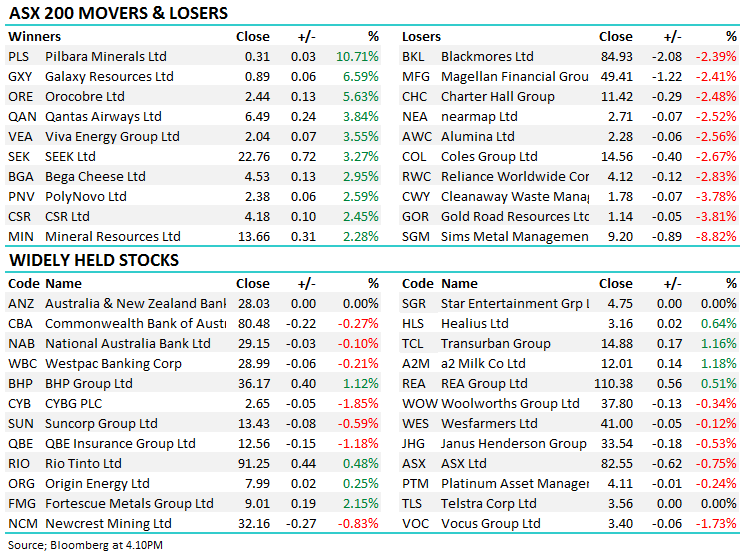

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.