ASX down but rallies from lows…(CYB, WES)

WHAT MATTERED TODAY

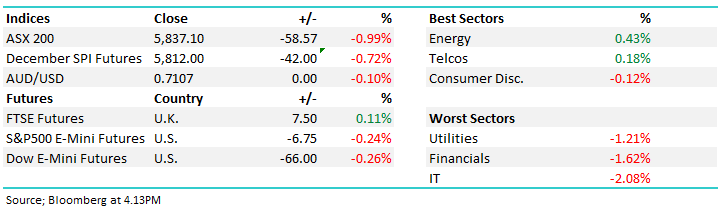

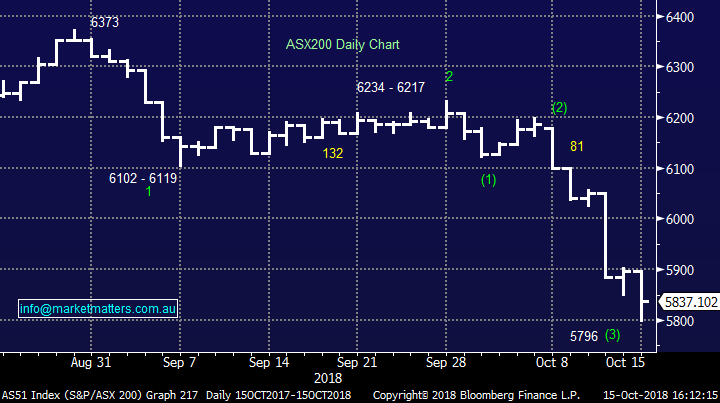

Another volatile session for Aussie equities with the market opening better than the Futures foreshadowed however it was short lived and at 11am markets caved in, losing ~45points until the midday low and taking the index down around ~90pts. It was an Aussie centric theme - US Futures were little changed and Asian markets were okay. The anti- Australia call was led by selling in the futures market which gets hedged through stocks and there was a void of buyers in early trade – hence the weakness that played out.

Seems like most were sitting back on Monday morning but the depth of the weakness and the targeted nature (i.e. Australia) was enough to get a few off the sidelines. Once that played out though, natural buyers of stock stepped in and the market rallied well from then on. Although we closed down -58points the market did show some backbone today with strong buying obvious into weakness. Ideally, we want to see the market rally from here to the ~5900/5950 region where we can increase some cash / and or increase our hedges.

The US will clearly be key and on our close US Futures were down around 0.4%. Quarterly earnings season continues and that will have a decent impact on sentiment this week. Markets tend to focus on one thematic at a time – right now its trade and Trump and rising yields however US earnings could provide the circuit breaker if they’re a lot better than expected. Markets are clearly glass half empty right now so beats will need to be big. We think we’ll see choppy trade for a while and having some flexibility will remain key.

Today the ASX 200 closed down -58 points or -0.99% at 5837. Dow Futures are off -74pts/-0.37%

ASX 200 Chart

ASX 200 Chart

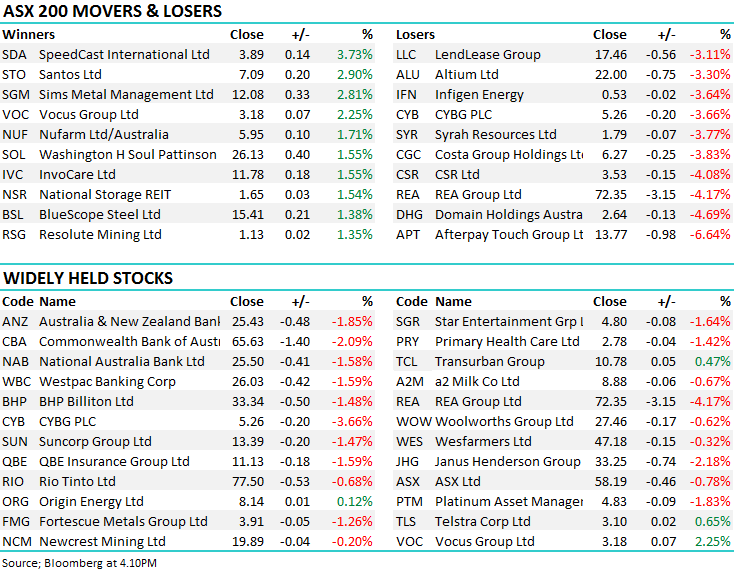

CATCHING OUR EYE

Broker Moves; Bells were out this morning upgrading CBA to a BUY however it failed to ignite buying in the stock. TS Lim, Bells banking analyst reckons painted a fairly negative picture for the Bank then upgraded to a buy saying…"The impact of the Australian government’s financial inquiry, combined with lower fees and commissions and higher operating expenses, seen hitting Commonwealth Bank earnings for next four years, Still, with CBA shares trading below A$70 and an expected total stock return of more than 15% the bank “is now regarded as a trading buy”: Bell Potter

RATINGS CHANGES: Not a lot else out today

· Fairfax Media Upgraded to Buy at UBS; PT A$0.80

· CBA Upgraded to Buy at Bell Potter; PT A$73

Wesfarmers (WES) $47.18 / -0.32%; The conglomerate released an impressive retail sales report for the first quarter of their financial year today, driven by solid growth out of Coles, as well as growth out of their convenience and liquor segments. Coles life-for-like (LFL) sales grew a huge +5.1% thanks to the ‘Little Shop’ promotion, as well as the delay in the plastic bag ban (Coles ban begun a fortnight after Woolworths). Also notable in the result was as price inflation not seen since 2017, while Wesfarmers also benefitted from an increase in transaction growth and basket size as Coles gains ground on Woolworths in these areas. Coles online also helped drive the sales growth, which jumped 30% for the quarter.

Liquor added 1.3% on a LFL basis, which was lower than the previous quarter, while convenience was a standout (+3.4%) despite a significant decline in petrol (-15.9%) suggesting the work Coles express have done in store is having an impact, with the company pointing to food-to-go offerings as key to the growth.

Wesfarmers will become a different beast once the demerger of Coles is completed. Much of their performance will be driven by Bunnings which would become around 50% of the new entity’s earnings. We don’t have any interest in the current Wesfarmers, seeing more competition in the supermarket space as an issue, however the post demerger company would be compelling if we see a rebound in the housing market.

Wesfarmers (WES) Chart

Clydesdale (CYB) $5.26 / -3.66%; In more of a formality than a milestone, the UK court has given its approval for the CYB takeover of Virgin Money that was announced 4 months ago with Virgin Money shares to be cancelled and new CYB shares issued before UK trade opens tonight. We may see those non-natural holders of the combined entity sell stock putting pressure on the shares – which could be an opportunity to step up and re-buy into CYB after we flicked it around $6.

The deal is a good one and sees a largely online & personal focussed CYB join forces with a business & branch focussed Virgin Money. CYB has been soft of late, falling $1.10 / -17.3% since early August, a heavy decline and one that’s certainly caught our eye. The fall, in our view, relates to the ongoing BREXIT problems, as well as the proposal to tax foreign buyers on multiple properties which creates a head wind for potential loan growth.

For the first time in a long time, CYB is trading below net tangible assets and is screening very cheap. To go with this, the Virgin money deal will add further upside to the cost out story which the bank has already begun, with synergies set to increase the benefits of the takeover. Another benefit to the takeover will be significant increase to the bank’s capital position, with the tier 1 ratio to grow to 16% as the risk weighted assets fall. This could free up £700m paving the way for special dividends to boost shareholder returns.

Clydesdale (CYB) Chart

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.