Asian markets lead the region higher (CAR, IEL, BKL)

WHAT MATTERED TODAY

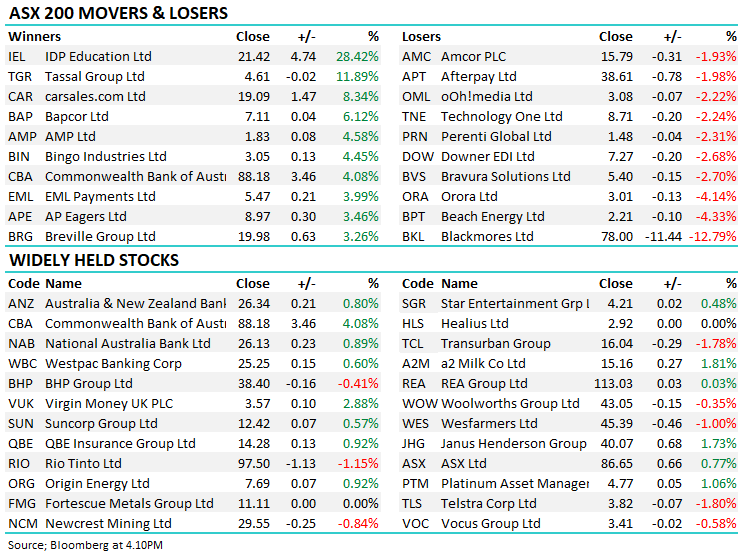

The local market outperformed overnight leads today with the bulk of the work being done by the banks piggybacking off a good result from Commonwealth Bank (CBA). The big 4 added ~26pts to the index – CBA alone was 19.9 of them, hitting levels not seen since July 2015. The market now turns to NAB’s quarterly report which is due out tomorrow morning. CSL, which we wrote about in today’s Income Report along with a number of other results, briefly challenged for the biggest market cap stock on the back of their own half year result to add more than 3pts to the index. Idp Education’s 28% rally also added more than 3pts – impressive from such a small market capped stock which we discuss below.

Despite all the good news around and the market moving higher, there was a big drag from resources and energy, while IT, telcos and industrials sectors all finished lower. Telstra was sold off throughout the day ahead of their half year expected tomorrow, while AMP caught a rare bid into their result.

Reporting season continues locally with a reporting schedule available: CLICK HERE

Tomorrow we have a huge volume of reports including: AGL, AMP, ASX, MFG, NAB, NCM, S32, TLS and WPL

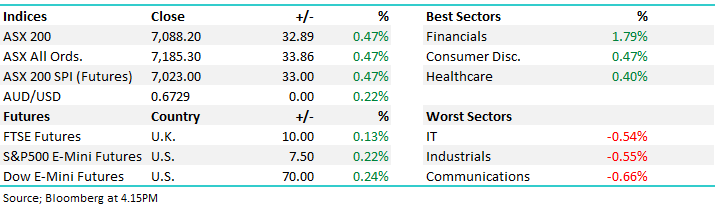

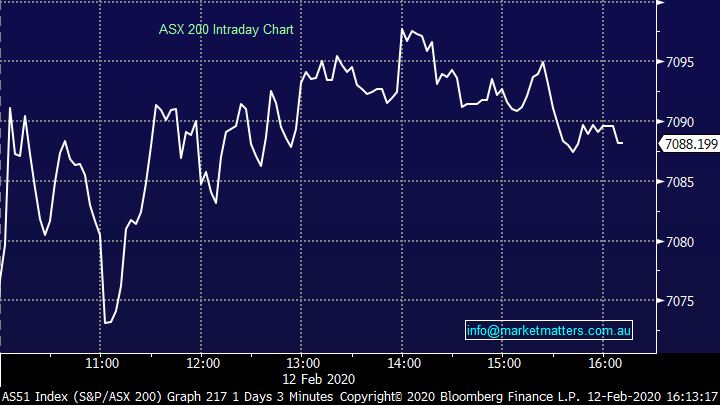

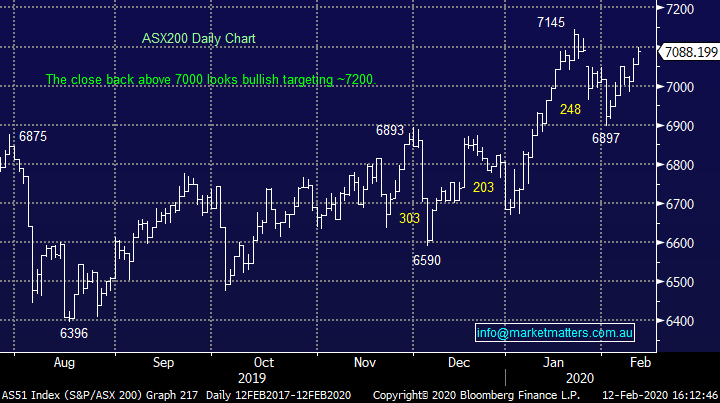

Overall, the ASX 200 added +32pts / +0.47% today to close at 7088. Dow Futures are trading up +70pts/+0.24%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

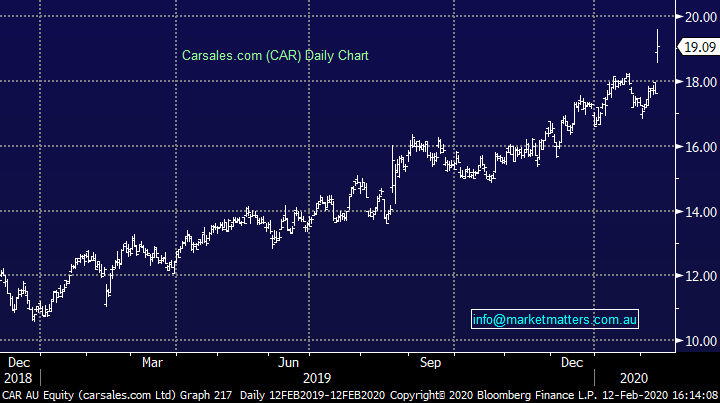

CarSales.Com (CAR) +8.34%: saw earnings rising in the first half after taking a hit in the first half of 2019, with revenue growth of 5% dropping down to adjusted NPAT growth of 7%. Continued strength in the Australian arm has underpinned decent returns on investments in international markets to see the group’s earnings higher despite a largely weak time in car sales. The company reiterated its guidance commentary given at the AGM back in October, anticipating “solid” NPAT growth. Cracked all-time highs today, one to watch if it can hold the level.

CarSales.Com (CAR) Chart

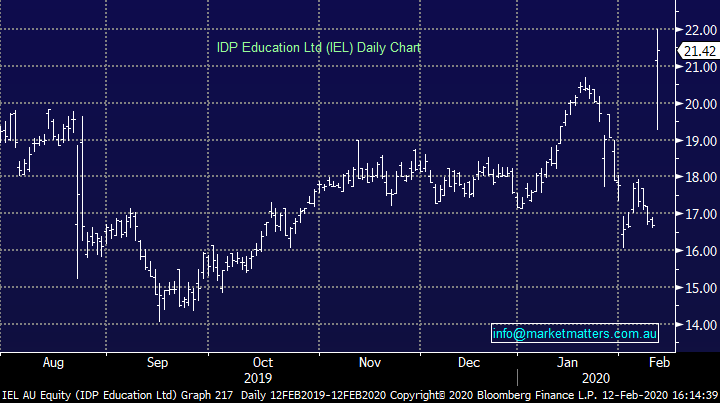

IDP Education (IEL) +28.42%: surged into new all-time highs today with a solid half year result more than offsetting the coronavirus related weakness of the past few weeks. The student placement services, and English language testing operator saw a 42% lift in NPAT in the first half on the back of decent revenue growth across the segments, and growth in margins. The market was looking for just $86.5m NPAT for the year, and with $57.7m already covered off, IDP are well ahead of expectations even with a normal skew to the first half. Key to the stocks move today though was the market’s take on comments around the corona virus. The announcement said that the company was managing the impact of the virus such that it “is not currently have a material impact on the financial performance.” Hard to chase the stock given the little commentary, but it was something that got the IEL bulls excited.

IDP Education (IEL) Chart

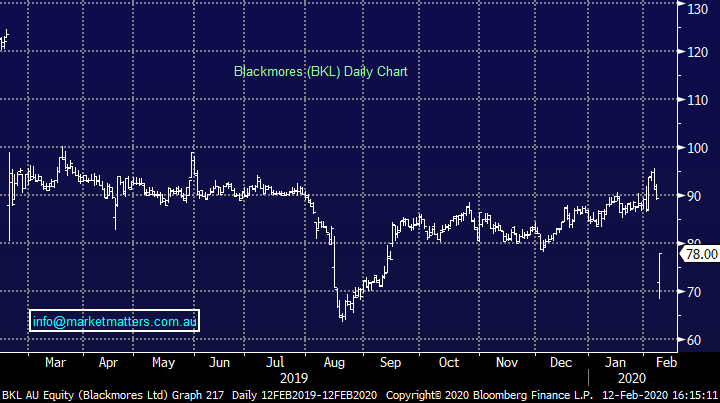

Blackmores (BKL) -12.79%: the vitamins stock came out of a 2-day trading halt today, dropping sharply on the open after the company updated the market on impacts from the corona virus. The company expects first half revenue at $303m and NPAT at $18m when results are released later in the month, with earnings down on the first half of 2019. Costs are expected to rise into the second half on the back of corona virus disruptions adding to higher cost of goods given a variance in the product mix. The company now expects little to no earnings in the second half with the full year result well behind consensus estimates. So, despite the increasing demand for vitamins products with the heightened disease awareness, Blackmores won’t be able to capitalize given the disruptions and cost creep.

Blackmores (BKL) Chart

Broker moves;

· Northern Star Cut to Neutral at UBS; PT A$14

· Northern Star Cut to Sector Perform at RBC; PT A$12.50

· Nearmap Rated New Buy at Goldman; PT A$2.25

· Fletcher Building Raised to Buy at Morningstar

· Avita Medical Cut to Hold at Morningstar

· Beach Energy Raised to Buy at Morningstar

· Beach Energy Raised to Positive at Evans & Partners Pty Ltd

· Challenger Cut to Sell at Morningstar

· Alacer Gold Raised to Buy at Stifel Canada; PT C$7.75

· Suncorp Cut to Hold at Morgans Financial Limited; PT A$12.47

· Macquarie Group Raised to Buy at Bell Potter; PT A$158

· FBR Rated New Speculative Buy at Bell Potter

· Rio Tinto Cut to Underperform at RBC; PT 3,300 pence

OUR CALLS

We sold CBA in the Growth Portfolio today, taking a 14% profit inclusive of dividends. The stock rallied into the result and was bid up on a good first half. It looks reasonably full up here in the high $80s, so we took some money off the table.

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.