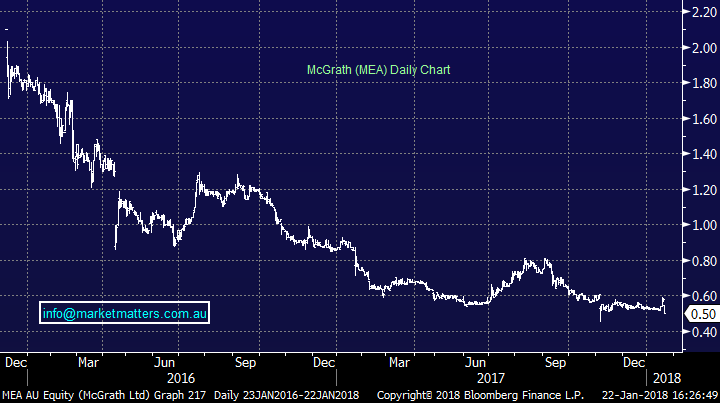

As safe as houses…! McGrath & Domain in the firing line (DHG, MEA)

WHAT MATTERED TODAY

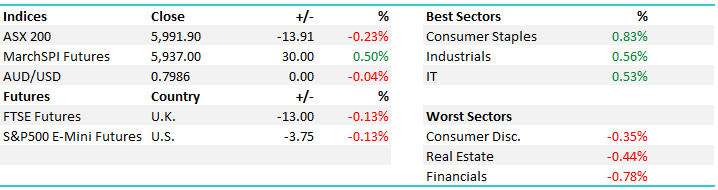

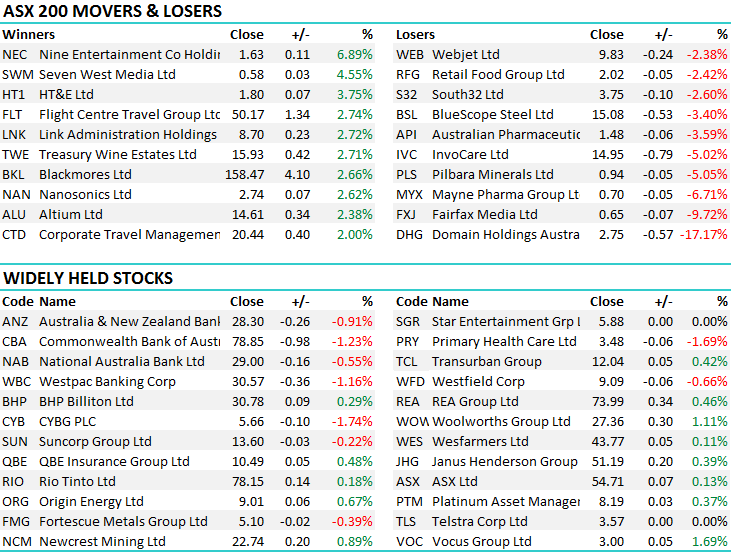

The ASX 200 ticked back below above 6000 mark intra-day today, only to fade lower and close lower at 5991. Some interesting corporate news primarily around the property stocks today with the surprise departure of Domain’s very well regarded CEO while John McGrath has had to contend with another profit downgrade and resignation of the entire board amid continued poor performance for Sydney’s Premier Real-Estate brand…! John will now step back into the fray on an executive level, has a clear plan to turn the business around and will let the numbers do the talking – so he says. More on that later.

Overall, the Consumer Staples were strong, while on the flipside, the Retail and Financials had another poor day capping off a fairly soft weak. An overall range today of +/- 26 points, a high of 6017 and a close to its low of 5991, down 13pts or -0.23%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

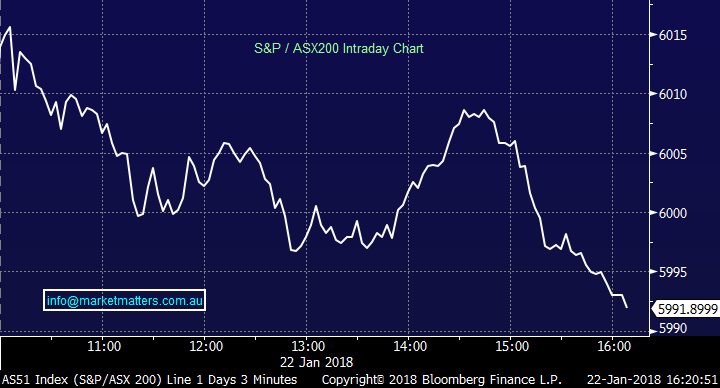

1. McGrath (MEA) 0.50c / -13.79%; Without sounding overdramatic, the listing of MEA has been a complete debacle and the downgrade today seems to be a result of an AFR article that exposed a pre-Christmas internal update highlighting poor performance. That closely followed a November 6 2017 downgrade which cut expected earnings by 25% - the shares plummet on that day – but rebounded fairly quickly. Will the same play out now?

The shares listed at $2.10 in Dec 2015 and closed today at 50c – John McGrath still owns 26m shares after cashing in $37m in the original float, which saw his stake go from 58.4% down to 26% today. As with most businesses, but more so a real estate agency, earnings rely on agents driving them and it seems that McGrath has become too focussed on running a listed company, than on the things / people that drive earnings. That will change, there’s nothing that spurs action like an entrepreneur losing a lot of $$ and John McGrath is a very talented operator. The drop today in share price is small relative to the earnings miss, with some holders reluctant to sell given the potential for a privatisation of the stock with the help of private equity. The last block trade was done by departing agents with 15% of the company being sold at 65cps.

McGrath Daily Chart

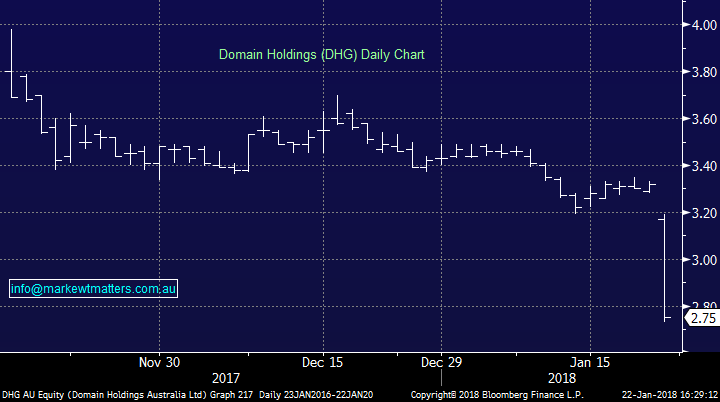

2. Domain (DMG) $2.75 / -17.17%; the announcement of high profile CEO, Antony Catalano, sent investors packing today in both Domain and its, old controlling company Fairfax (FXJ), off 9.72% to 65c. Antony is leaving for ‘family reasons,’ opting for a quick break up with no handover period, and the heavy fall today may well be due in part to investors not buying the excuse, although Antony does have 8 kids. The weakness also reflects that Antony is Domain. Catalano, first fired from Fairfax in 2008, set up his own Real Estate publication with which he was bought back into the Fairfax set up just 3 years after being walked out. Since being appointed CEO in 2013, Domain has gone from strength to strength, culminating in the company being spun off late last year. Now just 3 months later, the mkt is bound to be sceptical of the CEO exiting stage left. We do not own FXJ or DHG.

Domain Holdings (DHG) Daily Chart

OUR CALLS

No amendments on the portfolio today however we have CBA on our radar around $78 and NAB around $28 if we see a spike down there. We trimmed 5% Westpac at higher levels before Christmas and may look to re-allocate in CBA/NAB into further weakness. We’re also watching Iluka (ILU) for a move towards ~$9.

Z1P - remains a BUY for now at 84cps or better, however we will look to pull this order should it not reach our level this week.

ORE – Traded back to $6.45 today, hitting a $6.435 low

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/01/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here