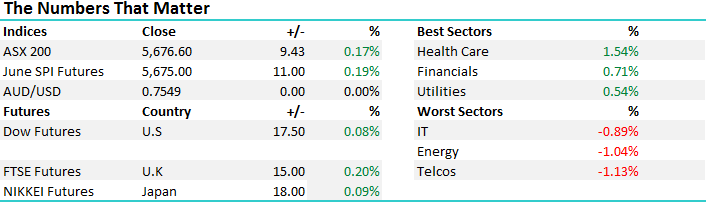

Are we headed for a big correction – here’s our take?

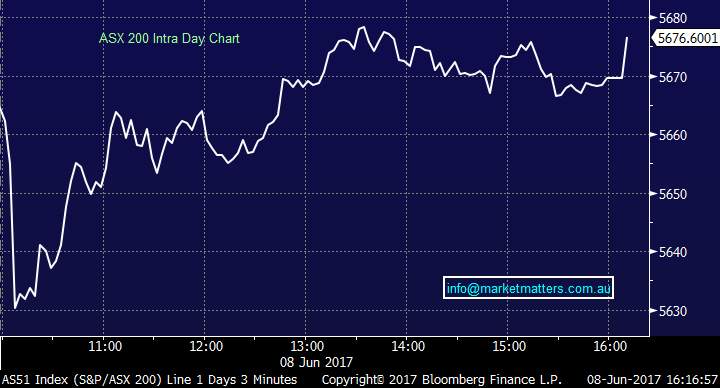

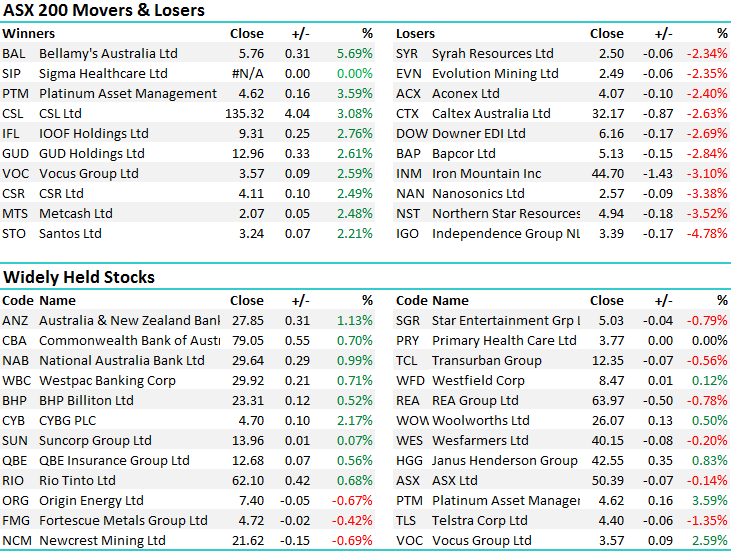

The AFR is running an article this afternoon touching on a few stock calls – one of them being Domino’s that we covered in our morning note today – click here – while there’s also talk about bearish predictions for the market providing some history around seasonality, a topic we often speak about – and then around the potential for a bear market from current levels, which is defined as a correction of 20% or more. I’ll touch on these topics in this afternoons note but before I do, a quick recap of our weekly video done yesterday…We talked the usual stuff like the banks, materials, and touched on Vocus, which is trading above the bid price of $3.50 – closing at $3.57 today which implies another bidder might be sniffing around. More on that bellow as well.

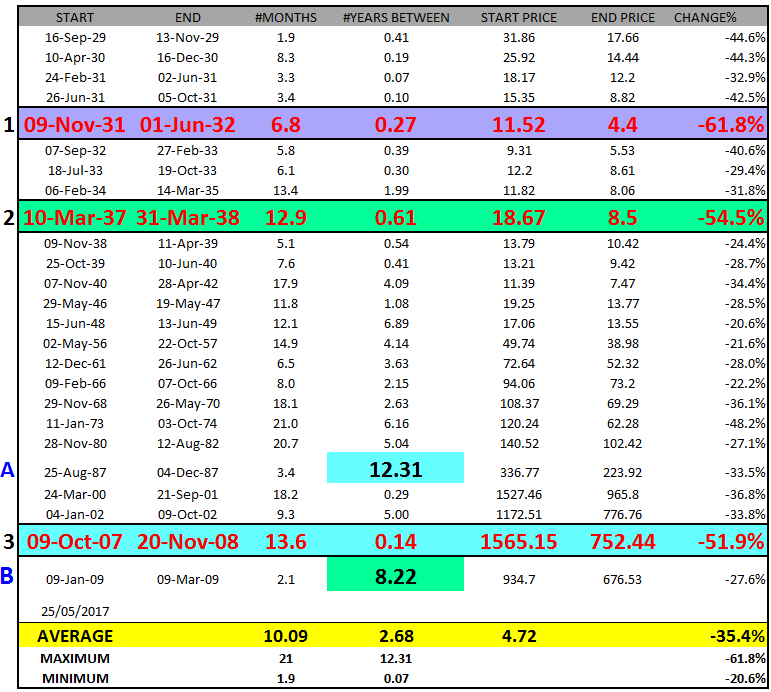

A decent session today with the broader market opening weak but recovering – particularly the banks and the energy plays, which saw some bargain hunters come in – the energy coys were interesting - Santos and the like which have looked v average in recent times copped a big bid post early weakness, and although we have no interest there at this stage, STO looks good on the charts after putting in what looks to be a good low. Short term contrarian traders should keep this on the radar over the next few days!

Overall we had a range of +/- 50 points, a high of 5679, a low of 5629 and a close of 5667, up +9pts or +0.17%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Firstly VOC – and this was a response I gave from a Q that posed to me this this morning . Obviously no silver bullet here and we exited the stock for a loss around $3.80 – a poor pick from us at the time however for those that may still be holding…Looks prudent to hold for the next few days - see if a competing bid is tabled. If not forthcoming within say a week, the chances then increase that one won’t come, and given the current bid is a conditional one (premised on VOC meeting earnings guidance) then there is a greater risk that the bid may fall over if earnings slip. They’ll be a lot of scrutiny on VOC during the DD process and if anything is not above board, KKR will likely walk. Expect a response from VOC board shortly however they’ll have to engage as the offer is a credible one.

Vocus (VOC) Daily Chart

Secondly – we know May is a weak month and the mkt dropped 3.3% - June is also weak however July is strong. Currently, the Market Matters portfolio sits in 10% cash, whilst we hold 15 individual stocks, a number that is high for us given we generally run a more concentrated approach. If we look back, at the start of May we held 11 stocks and ~30% cash and have been clear buyers into weakness.

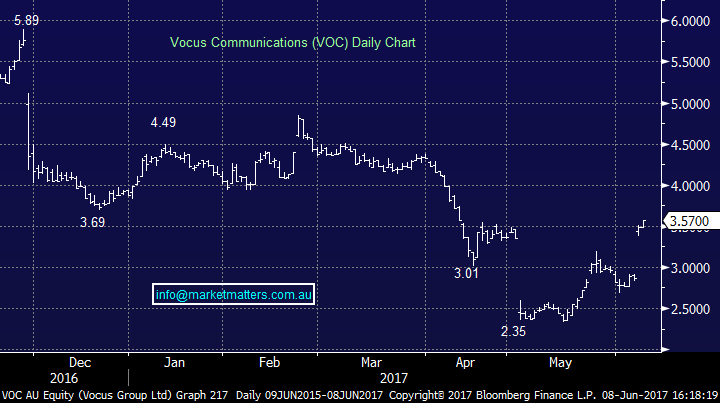

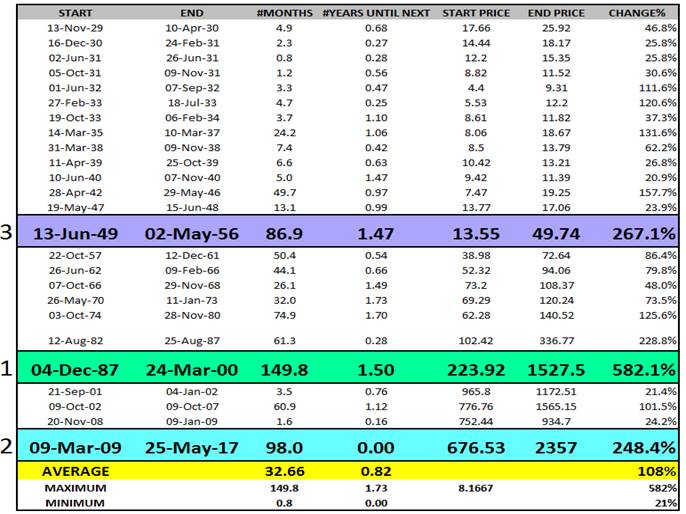

We retain this view at the moment given high cash levels / high caution from investors which is typically not conducive to a major market top. That usually happens when optimism is high, cash levels are low etc – which will come but we’re simply not there yet. We do think a 20+% correction will play out at some stage, but that’s not a big call if we look at history. Here’s a table we put up at the event highlighting bear markets since the early part of the century.

History of bear markets in the US

Key takeout’s are that a 20% correctly plays out every 2.68 years, however the data is skewed somewhat early in the century – so if we strip out that we get a bear market around every 5 years. We haven’t had one for over 8 years, and we’re in the second longest bull market in history (following the one that ran from 1987 to 2000). So clearly, we’re in the mature stages of this current rally, the US is up +250% since March 2009 so we need to be cautious here – and content to increase cash levels / position with a more bearish stance when more signs start to materialise.

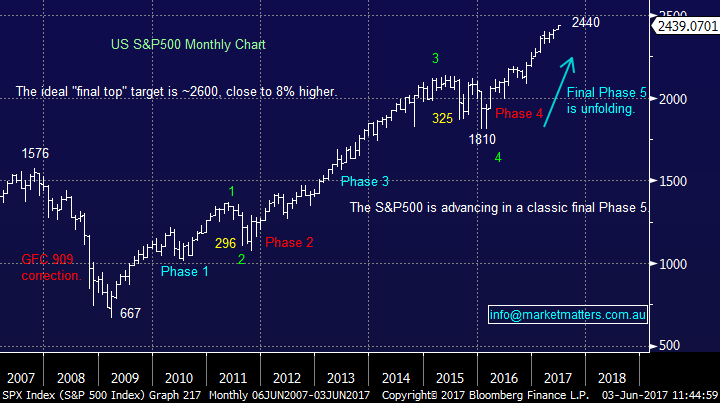

History of bull markets in the US

For those that follow our morning note, this chart of the S&P 500 will be very familiar to you – which highlights the maturity of this current run.

S&P 500 Monthly Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here