APRA & the RBA help the local market shrug soft leads (LYC, HLS)

WHAT MATTERED TODAY

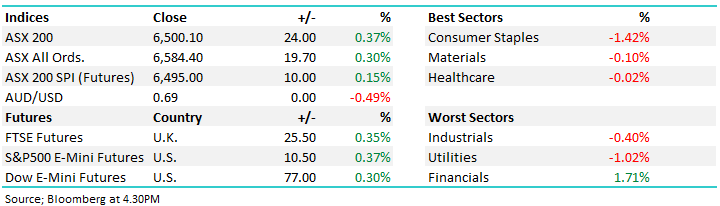

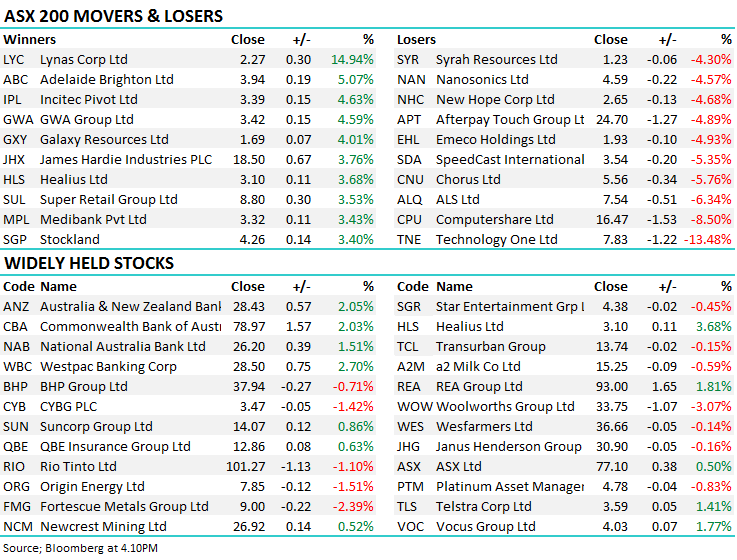

A second day of good news for the Australian banks as APRA to reduce lending requirements on new mortgages to better reflect the low interest rate environment. The regulator proposed a relaxation of serviceability measures that would effectively relax the serviceability requirements and increase borrowing capacity . In practical terms, all borrowers were assessed on their ability to repay a loan at 7% however given rates are low, the regulator has now proposed that a gap of 250 basis points be applied to the prevailing lending rate. For example, an achieved rate of 3.7% would be tested on serviceability at 6.2% increasing borrowing capacity. This is bullish for bank lending volumes, and bullish for house prices. The chorus is growing that Saturday was the low in Aussie housing.

The banks liked the news today, led once again by Westpac which added 2.7% to close on the day’s high.

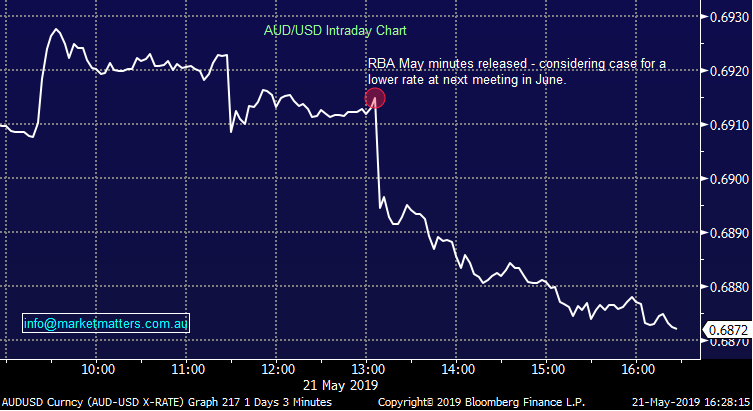

RBA minutes out today from the last meeting where rates were kept on hold, however the language clearly implies they're ready to act. The Aussie Dollar was sold off post minutes and the market rallied on the prospect of lower interest rates. Another bullish undertone for the market today which underpinned the recovery from the early lows and closing on the intraday high to just sneak above 6500!

AUD Chart

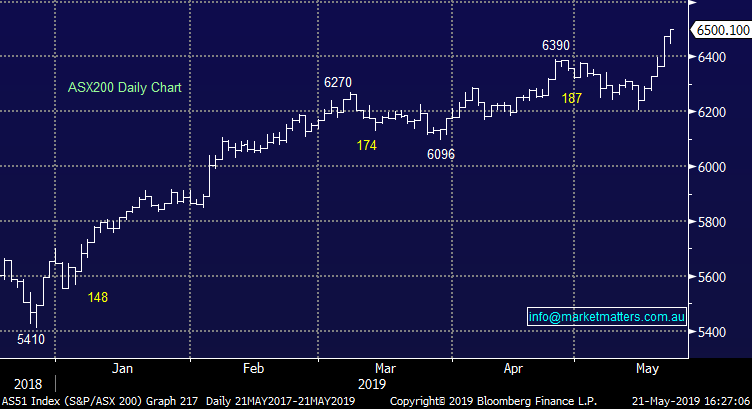

Overall today, the ASX 200 added +24 points or +0.37% to 6500. Dow Futures are trading up +64pts / +0.25%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Lynas (LYC), +14.94%, was the best on ground today with the stock surging thanks to positive comments out of its investor day. The company presented its plans out until 2025 which includes a huge $500m investment across the business including a new upstream processing plant to the company’s WA mine to remove any radioactivity, while also increasing capacity at downstream processing facilities. The company reiterated it had the support of its major lender JARE, and confirmed licence renewal application is progressing on a normal timeline. A great presentation from the company today, although they were placing into a trading halt late in the session to clarify some comments from the presentation.

Lynas (LYC) Chart

Healius (HLS) +3.68% – an article in AFR Street Talk this morning saying that Jangho, HLS’s major shareholder was assembling a new DD team to revisit the HLS takeover. They now have KPMG as their accountants working alongside Minter Ellison and Macquarie. Seems like something is progressing here, although clearly, it’s now become a pretty poorly kept secret. We own HLS and remain hopeful of a bid eventuating.

Healius (HLS) Chart

Broker moves:

· Steel & Tube Downgraded to Underperform at Forsyth Barr; PT NZ$1

· Steel & Tube Cut to Neutral at First NZ Capital; PT NZ$1.21

· Kiwi Property Cut to Neutral at First NZ Capital; PT NZ$1.52

· Woolworths Group Downgraded to Underweight at JPMorgan; PT A$31

· Westpac Upgraded to Buy at Bell Potter; PT A$28.30

· Paradigm Biopharma Rated New Speculative Buy at Bell Potter

OUR CALLS

No changes today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.