ANZ kicks off banks reporting

ANZ Bank (ANZ) -3.26%; the first of the banks to report this season and it certainly didn’t set the bar high. Net Interest Margin (NIM) decline accelerated in the second half, with the margin dropping 8bps as a result of increasing customer remediation as well as funding costs falling at a slower rate to lending rates. Income fell 1% as the home loan book struggles, and expenses rose 2% with compliance costs continuing to bite. There were some signs of life with the business lending growth of 10% in 6 months (if you need a business loan – go to ANZ for approval by the look!!) however this also drags NIM given the tighter market. Bad debts were flat half on half, however this masks rising past due loans in a sign credit is starting to be squeezed.

All this added up to a 5% fall in profit in the half, and a soft result. ANZ were able to keep their dividend however they did have to drop the franking amount to just 70% - the first time a dividend from ANZ wasn’t fully franked this millennium. A soft result, and rightfully hit on the back of it. Other banks were sold off however the main issues here are ANZ specific. Our ANZ position will likely be cut.

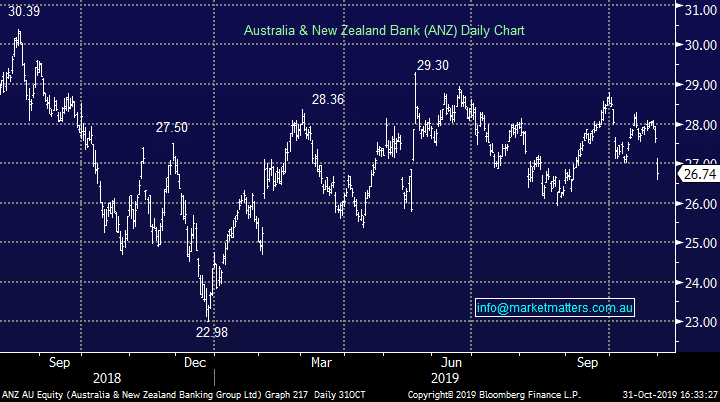

ANZ Bank (ANZ) Chart