Another round of selling hits the ASX – AMP sinks 25%

WHAT MATTERED TODAY

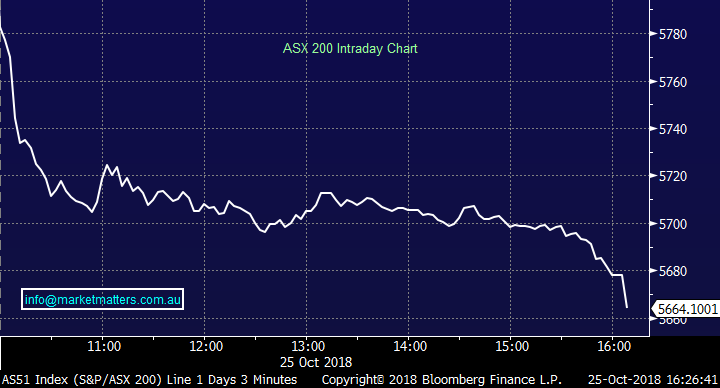

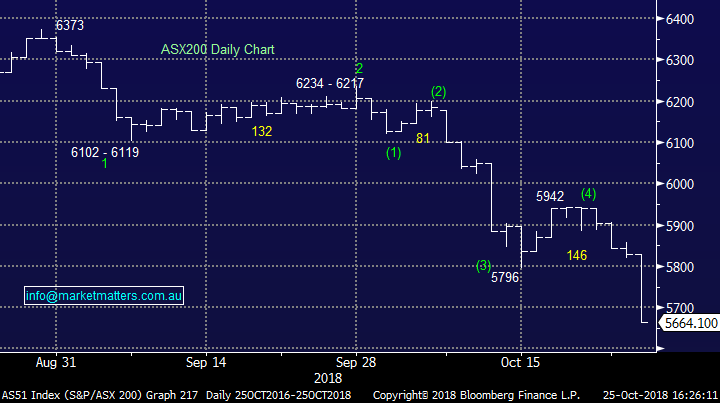

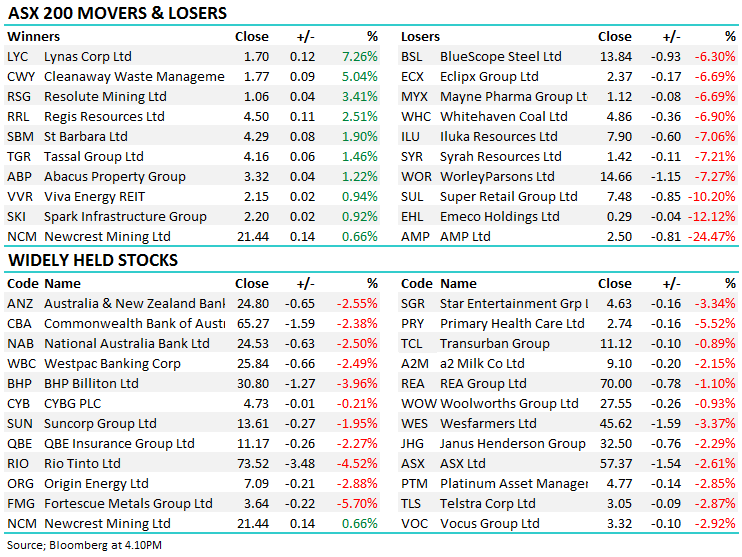

It’s hard to put a positive spin on the market today with the index opening down around 70points, it tried hard to rally when Asian markets came online but failed and selling ticked up into the close – the index closing on the lows of the day. From the ASX 200 10 of the 11 sectors closed in the red, 186 stocks from 200 down on the day, the biggest point contributor was BHP which fell 4% dragging the material sector down 3.2% - ouch! Apart from the odd flicker of green in the Gold space (NCM +0.66%) it was all a sea of red with the ASX 200 down -8.75% this month with 5 trading days remaining…

Stocks in the ASX 200 that made 52 week lows today

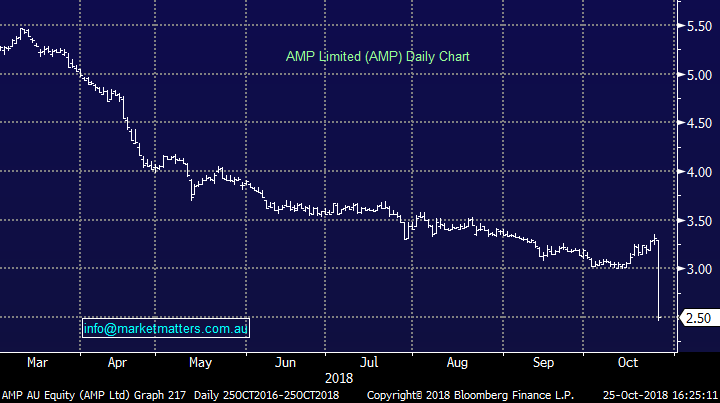

AMP was hit the hardest down -25% after they sold a whack of assets to raise capital, but ultimately by doing so it strips away around 30% of their earnings. More on that below from Harry however it seemed the reaction was about right given the earnings impact. The stocks closed at $2.50 – a far cry from its June 2001 high of $14.07.

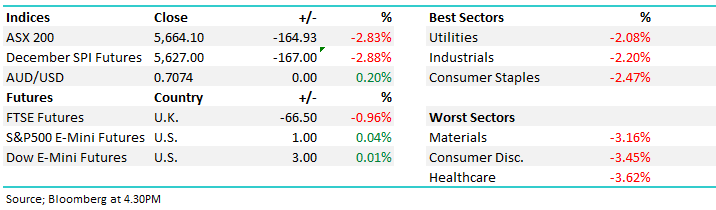

Not a pretty sight today with the ASX 200 down -164 points or -2.83% at 5664. Dow Futures are up a touch +44pts/0.17%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves;

· AGL Energy Downgraded to Reduce at Morgans Financial; PT A$16.89

· Super Retail Downgraded to Neutral at Macquarie; PT A$8.70

· Super Retail Upgraded to Overweight at JPMorgan; PT A$9.50

· Super Retail Upgraded to Neutral at Credit Suisse; PT A$8.39

· Super Retail Downgraded to Sell at Bell Potter; PT A$7.35

· Nufarm Upgraded to Buy at Morningstar

· Rio Tinto Downgraded to Hold at SocGen; PT 38.30 Pounds

· Myer Downgraded to Underweight at JPMorgan; Price Target A$0.43

· Cleanaway Upgraded to Add at Morgans Financial; PT A$1.89

· TPG Telecom Upgraded to Neutral at JPMorgan; Price Target A$7.90

· Senex Upgraded to Neutral at JPMorgan; Price Target A$0.47

· Bellamy’s Downgraded to Hold at Morgans Financial; PT A$8.75

· Harvey Norman Reinstated at Goldman With Sell; PT A$2.70

· JB Hi-Fi Reinstated at Goldman With Neutral; PT A$21.30

AMP Limited (AMP) $2.50 / -24.47%; announced the sale of their wealth protection + a few other mature businesses as they called it, in transactions totalling $3.45b. The sales come at the end of the portfolio review the company embarked on 12 months ago as AMP looks to simplify the business and ease balance sheet stress. The deal will see around $2b of cash for AMP, allowing the company to reduce debt by $800m, reducing the need for a capital raise, whilst also having left over funds to redeploy into cost cutting programs (but also likely to be chewed into by fines and further customer remediation).

The deal certainly takes some pressure off the balance sheet, but also will significantly reduce earnings in the years ahead. The divested assets contributed around $340m of AMPs 2017 earnings, or over 30%.

On top of this news, AMP announced a $1.5b net outflow over the third quarter. This is clearly a big number and along with a 30% earnings hit, it’s easy to see why the stock got .

AMP Limited (AMP) Chart

OUR CALLS

Growth Portfolio; We looked to add WSA today, however it never reached our target of around $2.20 which implies +/- 1%.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.