An uneventful day on the market (APT, AMP)

WHAT MATTERED TODAY

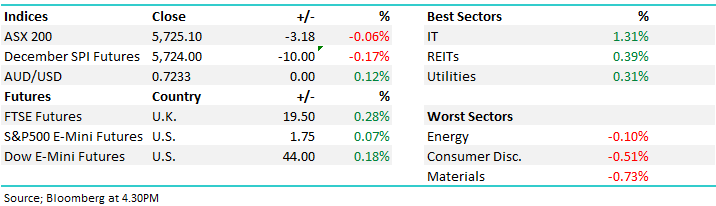

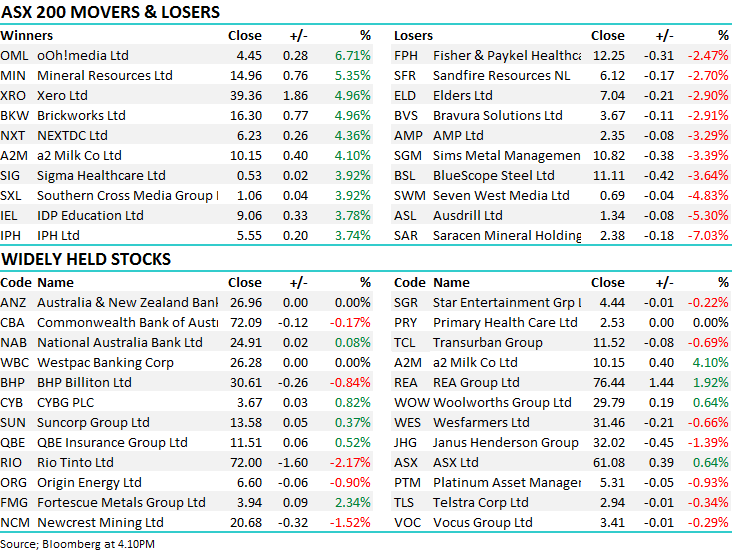

The market hovered just lower on the day for most of the session, never really threatening the 5700 level, but also never looking likely to push higher. It seemed the Sydney storm forced plenty to stay home and stopped them from pushing the big buy button. Resources continued their slide today, although oil & the energy names were somewhat supported as the slump took a breather. Banks were slightly lower, in line with the broader market, while the tech space lead the market winners.

Despite the uneasiness around the market, some of the growth names did particularly well. Xero (ASX: XRO), which we bought for the Growth Portfolio not long ago, added an impressive 4.96% on no real news – although fund manager Blackmore Capital was spruiking the stock today, as well as Macquarie (ASX: MQG), Ramsay Healthcare (ASX: RHC) & Cleanaway Waste (ASX: CWY). Also in the winner’s circle was a stock we touched in this morning’s report, oOh!Media (ASX: OML) added 6.71% after it confirmed the Brisbane city council would be renewing their contract with Adshel which was acquired by oOh!Media back in September.

Overall, the ASX 200 closed down -3 points or -0.06% to 5725. Dow Futures are currently up +47 points or +0.19%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

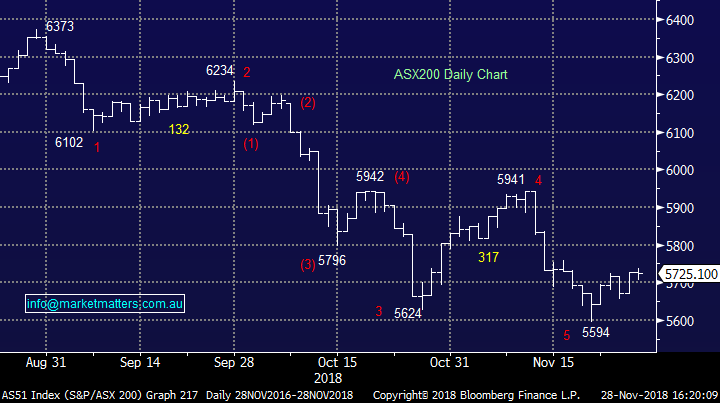

Broker Moves; Fortescue bucked the soft resources environment today despite a soft iron ore market, adding +2.34% thanks to a note penned by Goldman Sachs suggesting the Iron Ore price is closer to the end than the start of its slide. Iron ore in general has come under pressure recently with a lot of it thanks to steel margins being squeezed as global construction eases. Certainly one to watch and a potential play for MM with our aim to increase resources exposure.

Fortescue Metal (ASX: FMG) Chart

RATINGS CHANGES:

- Coca-Cola Amatil Downgraded to Sell at Citi; PT A$8.90

- Santos Resumed at Macquarie With Outperform; PT A$7

- Saracen Mineral Downgraded to Neutral at Macquarie; PT A$2.60

- Qantas Downgraded to Sell at Morningstar

- Bendigo & Adelaide Downgraded to Hold at Morningstar

- Sydney Airport Downgraded to Hold at Morningstar

- Beach Energy Raised to Positive at Evans and Partners; PT A$1.87

- ALS Upgraded to Overweight at JPMorgan; PT A$8.29

- NextDC Rated New Buy at Goldman; PT A$8

- Automotive Holdings Downgraded to Neutral at JPMorgan; PT A$1.90

- BWP Trust Downgraded to Sell at Shaw and Partners; PT A$2.95

- St Barbara Rated New Sector Perform at RBC; PT A$4

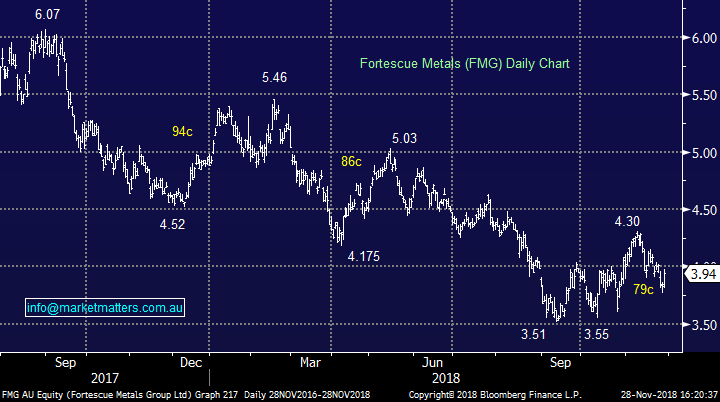

AfterPay Touch (ASX: APT) $12.76 / -1.62%; the buy now pay later names received some good news from ASIC this morning with the regulator concluding that it wasn’t necessary to include these companies under the National Credit Act (NCA). Under the NCA, these companies would be forced to do more thorough credit checks, including verifying income & expenses which would require serious investment into systems. ASIC had this to say – “we consider that ASIC’s proposed product intervention power should be extended to all credit facilities regulated under the ASIC Act … it may be that buy now pay later providers should be required to comply with the National Credit Act. ASIC has not yet formed a view that this is necessary.”

In essence, although ASIC do want further regulatory power over the lenders, it hasn’t deemed it necessary to enforce their practices under the more stringent NCA. Despite this better than expected release, Afterpay’s early strength soon vanished and the stock ended lower on a ‘no-news’ AGM which they also held today. Investors were positioned for an upgrade in the presentation and were given more inline commentary, hence the afternoon weakness. Zip Co (ASX: Z1P) on the other hand closed higher, adding +0.48% on the session.

AfterPay Touch (ASX: APT) Chart

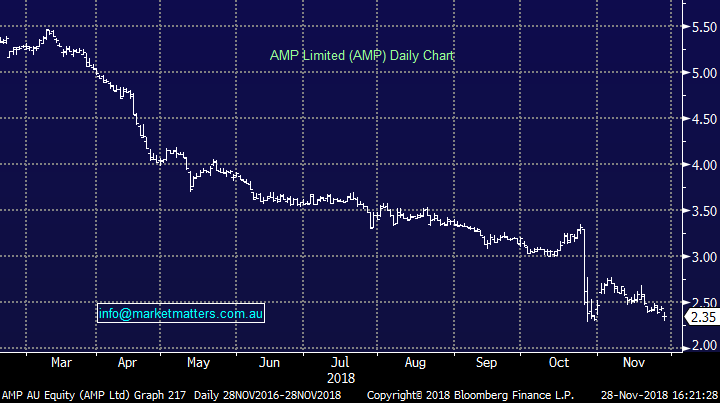

AMP Ltd (ASX: AMP) $2.35 / -3.29%; The battered wealth advisory firm suffered another weak day today as more revelations of potential misconduct were paraded at the Royal Commission. The company launched an audit into fees charged to corporate super clients, potential costing the company over $1b as well as taking the better part of a decade to remediate. Another ticking time bomb potentially uncovered here, just prior to the new CEO, Francesco de Ferrari taking the reins on Monday. If history is anything to go by, a new executive team will look to clear the decks and lower market expectations by dampening market expectations.

AMP Ltd (ASX: AMP) Chart

OUR CALLS

No changes today.

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.