All about the Telco’s today…

More resilience shown by the market in general today as it continues to brush off reasons to drop and grinds onwards and upwards. April the most seasonally strong period for stocks and thus far it’s playing to script, up +1.18% in the first 12 days, keeping pace with its average gain of +2.79% . Statistically, we should see 6000 by month end!

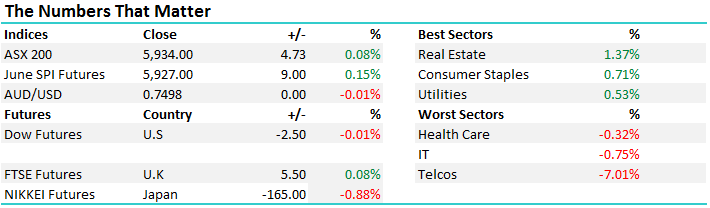

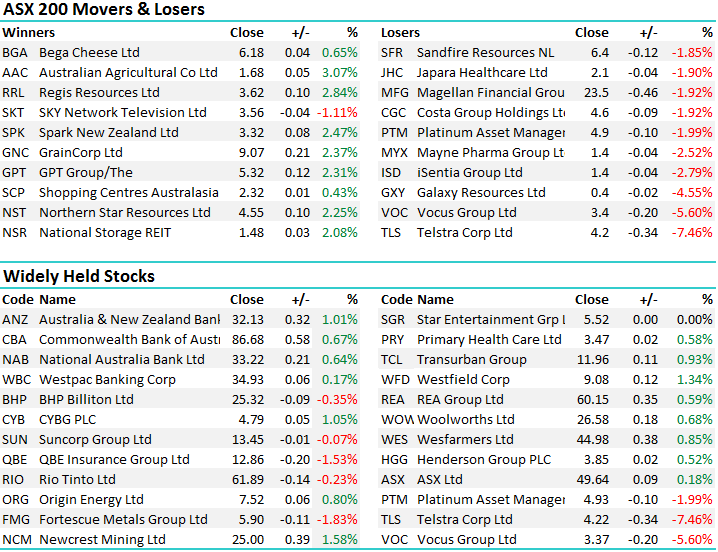

The market chopped around par for most of the session in a range of +/- 31points, a high of 5944, a low of 5913 and a close of 5934, up +4pts or +0.08%. Telstra (TLS) the standout from an index perspective detracting 13 index points from the market after dropping more than 7%. More on that below

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

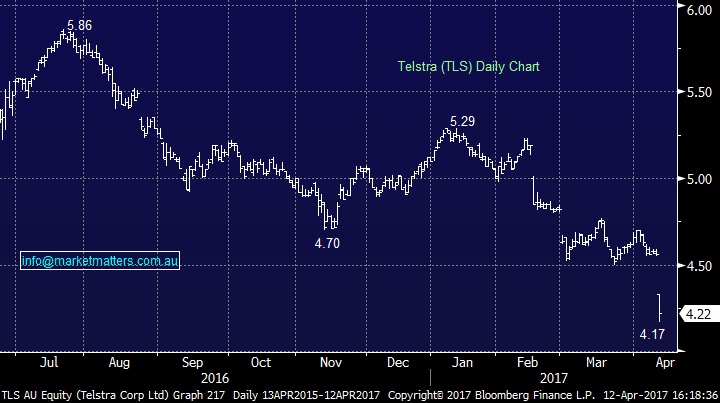

A very poor day for the Telco sector with Telstra (TLS) down -7.46% to close at $4.22, its lowest level since 2012, Vocus (VOC) continued its poor form falling by another -5.6% to close at $3.37 (ouch!) while TPG Telecom (TPM) was in a trading halt after the announcement this morning which proved the catalyst for all this carnage. Telstra did a massive 209m shares today which is the biggest volume day I can see.

Telstra (TLS) Daily Chart

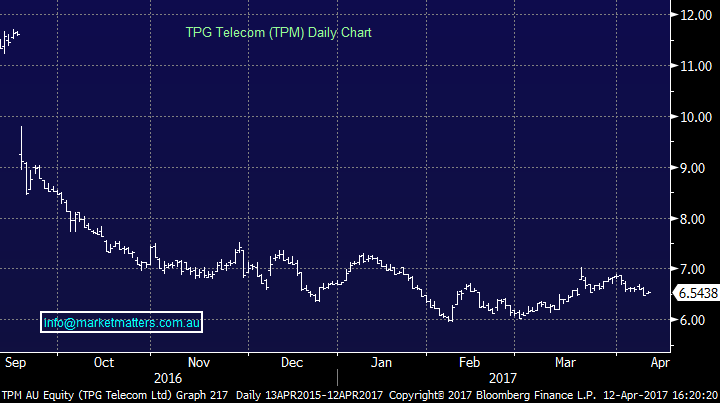

Firstly on TPG; They announced they’ve successfully bought Spectrum for around $1.3bn and plan to build their own mobile network over the next three years, spending around $600m. They’ll fund it via a combination of operating cash flows, debt and an $400m equity raise which was launched today. This was the issue we were concerned about in terms of our TPG holding recently, and it’s the reason we liquidated that positon around $6.60.

The equity raise is via a non-renounceable entitlement offer, on a 1 for 11.13 basis, so existing holders will get the opportunity to BUY 1 share for every 11.13 they already own at $5.25, however it’s non-renounceable which means if if you don’t take it up, then you get nothing for it. The stock will drop when it comes back online on or before Tuesday 18th April – probably below $6.00 in our view. They paid a BIG price for the spectrum given the reserve was set at $860m and they’re now the 4th mobile network in Oz.

TPG Telecom (TPM) – in a trading halt until the 18th April – will get hit when it comes back online

Clearly this changes the market structure and competitive dynamics of the industry, with TPG to come in as an aggressive price discounter. This is obviously not positive for TLS, Optus or Vodafone – hence the big decline in TLS shares today. ARPU is what the industry talks about, which is Average Revenue Per User. Currently, TLS ARPU on post paid product is $59, assuming a 10% reduction to that given competitive pressures, and we’re only speculating here, that equates to ~7.5% hit to TLS earnings. That said, this is in three years’ time and what has occurred today is not new news.

Speculation on TPG’s likely bid into this auction has been rife and shouldn’t come as a surprise. TLS has been sold down from $5.30 in January to $4.56 yesterday – a drop of -14% pre-empting this issue. The decline of another 7% today takes the total drop to ~21%. This could well be a case of sell the rumour, buy the fact!!

We stepped up and bought Telstra today, allocating 5% of the MM portfolio to the stock. At current pricing and assuming 31cps dividend, that’s 7.3% plus franking or 10.49% gross, which is compelling + they have a war chest to diversify their future earnings away from the competitive local telco space. We do acknowledge there is a high degree of uncertainty in the telco space at the moment, and if we continue to see TLS slide away, we will cut our losses and move on, however risk / reward at current levels stakes up.

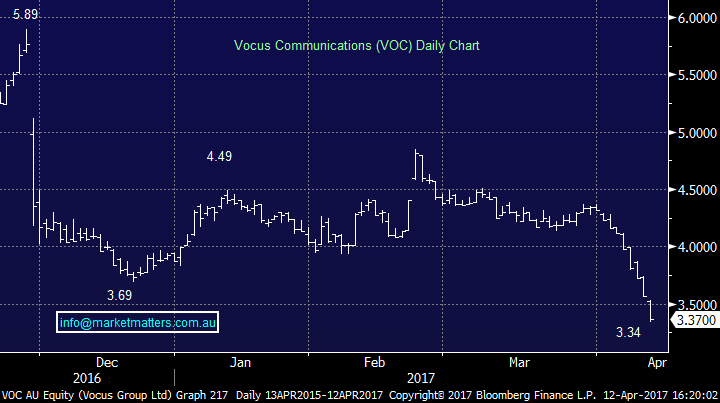

In terms of Vocus, we sold this early in the week and the stock has continued to slide. It looks ugly and price action is suggesting all is not good with that business. We sold on concerns around earnings and continue to think a downgrade could be looming.

Vocus Communications (VOC) Daily Chart

We discussed these and some other trends on our weekly video update today…click to view

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here