Afterpay (APT) highlights its not all gloom for retailers

Afterpay Touch (APT) +29.09%: This morning provided a Q3-20 trading update confirming they’ve grown strongly, although they are seeing some moderation into quarter end and year on year. $2.6Bn was spent through APT for the quarter, which is up 97% on last year. The USA continues to remain the groups largest growth engine with 263% growth (albeit of lower base) while ANZ grew at 40% in Q3-20 down from 50% YTD. Overall group active customers now at 8.4m, with ANZ up 21% YoY and adding ~100k customers since 1H20. USA largest customer base and growth engine at 4.4m customers up 283% YoY – huge numbers really.

In terms of margins and loss performance, they are advising 1% gross losses on TV in March – pretty much no difference - while margins are higher. The losses through would take time to see, and we’re not at that stage of the CV-19 cycle just yet. They went onto say they have no intention to raise capital – they have $540m in cash, $719m in liquidity and access to a range of balance sheet and off-balance sheet options.

A good update from APT today and this saw buying across the sector. Zip Co (Z1P) up +16.14% and while not a BNPL provider, Wisr (WZR) added +28.57%.

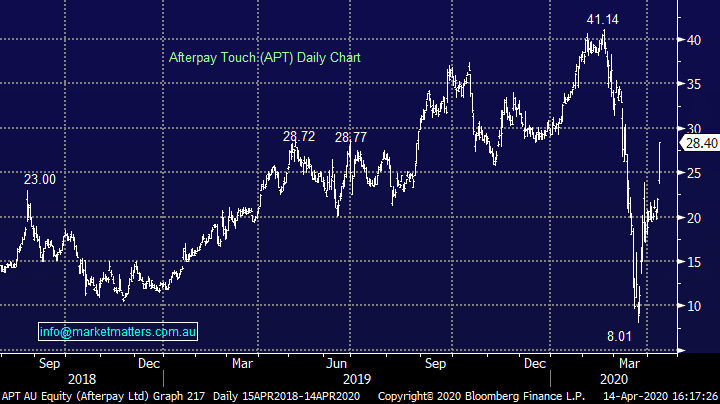

Afterpay (APT) Chart

Staying in the payment space for a sec, this time last week we looked at the weekly data put out by payments provider Tyro (TYR) to get an insight into broader trends. As a reminder Tyro is/was one of the fastest growing payment terminal providers in Australia. Tyro will give us a weekly view (in my opinion) on when retail has bottomed and likely to comp higher. 3 key points.

1. TV April to date of $301m. Tyro has over 32,000 merchants with largest category being retail and hospitality = 77% collectively.

2. Currently delivering ~$28.4m in transaction value (TV) a day, versus $62m in February; and

3. YoY growth rate was 27% in January, 30% in February and this has continued to deteriorate with April TV on a daily basis down 45% on March versus 34% a week ago. Notably Z1P TV is up close to 10% in April on March and APT on the conference call today advised something similar (although global).

There was also a good chart in the AFR today that looked at spending via cards up until the 9th April from Illion – focussing on categories of spending, not just the volumes. Gyms / Fitness down 95%, travel down 78%, public transport down the same, however online gambling up +67% (ALL), Home Improvement up 64% (WES), Food Delivery up +63% and online retail +61% (KGN)

Staying in the payment space for a sec, this time last week we looked at the weekly data put out by payments provider Tyro (TYR) to get an insight into broader trends. As a reminder Tyro is/was one of the fastest growing payment terminal providers in Australia. Tyro will give us a weekly view (in my opinion) on when retail has bottomed and likely to comp higher. 3 key points.

1. TV April to date of $301m. Tyro has over 32,000 merchants with largest category being retail and hospitality = 77% collectively.

2. Currently delivering ~$28.4m in transaction value (TV) a day, versus $62m in February; and

3. YoY growth rate was 27% in January, 30% in February and this has continued to deteriorate with April TV on a daily basis down 45% on March versus 34% a week ago. Notably Z1P TV is up close to 10% in April on March and APT on the conference call today advised something similar (although global).

There was also a good chart in the AFR today that looked at spending via cards up until the 9th April from Illion – focussing on categories of spending, not just the volumes. Gyms / Fitness down 95%, travel down 78%, public transport down the same, however online gambling up +67% (ALL), Home Improvement up 64% (WES), Food Delivery up +63% and online retail +61% (KGN)