- The ASX 200 recovered from an early sell-off and buyers returned at around 10.30am to push the market higher. After the unemployment numbers were released at 11.30am, the market continued to improve and at one stage was up 28 points. However, as the close approached, the sellers returned and the market closed up 3 points to 5,126.

- Santos (STO) returned to the bourse today after it raised $3.5b and the stock slumped by 27% hitting a low of $4.20. Volume today was over 59m shares, and it traded as high as $4.55 before succumbing to late selling and closed at $4.30. We will be covering STO more thoroughly in tomorrow's morning note.

- Apparently the economy created 58,600 new jobs in October, well above the expected 15,000. This surge in employment has taken the jobless rate down to 5.9 per-cent, from 6.2 per-cent. This is the first time we have gone below 6 per cent since a one-off move in May this year. The jobs number put a rocket under the Australian dollar which surged up 1 per-cent to 71.28 US cents as investors start factoring in no more rate cuts. (see chart below - source Bloomberg)

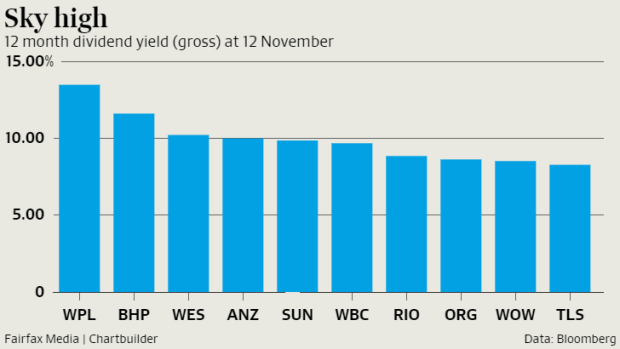

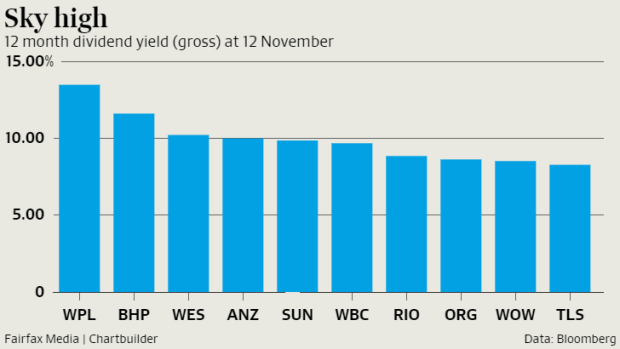

- Dividend yields in the top 20 stocks are at their highest since the global financial crisis, but their recent share price performance suggests investor concerns are growing that these dividends may have to be cut. The average gross yield of the S&P/ASX 20 index, constituting companies that have been a staple of share portfolios for decades, is at 7 per-cent, the highest since 2008, according to data provided by Morningstar. (see chart below)

The broad-based market rout, which began in April has driven up yields, but the heavyweight banks and miners have been especially pummelled, losing a quarter or more of their share price value. - BHP had another rough day amid worries about the Brazil fallout. We will look to cover this in the a.m. note tomorrow.

Best Sector – IT

Worst Sector – Energy

Winners

Computershare Ltd (CPU) +$0.53, or (+5.0%) to $11.12

Pact Group Holdings Ltd (PGH) +$0.21, or (+4.3%) to $5.15

Aurizon Holdings Ltd (AZJ) +$0.21, or (+4.0%) to $5.47

Losers

Dick Smith Holdings Ltd (DSH) -$0.035, or (-4.5%) to $0.75

AWE Ltd (AWE) -$0.035, or (-5.2%) to $0.64

Santos Ltd (STO) -$1.61, or (-27.2%) to $4.30

All figures contained from sources believed to be accurate. MarketMatters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/11/2015. 4.14PM.

Reports and other documents published on this website (‘Reports’) are authored by Market Matters. The MarketMatters Reports are based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distribution without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor.

The Reports are published by MarketMatters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

The author holds an interest in the financial products of ANN, ANZ, BEN, CBA, MQG, OSH, SUN & SEK.