Afternoon Report Friday 6 November 2015

- The ASX200 finished the week on a better note with the index finishing up 22 points to 5,215 after being sold off in the morning to intraday lows of 5152. For the week though it finished down 24 points or 0.5%.

- The banks performed well, having been sold off terribly all week. Yesterday we saw National Australia Bank (NAB) hit savagely after going ex. dividend; but today Australia New Zealand Bank (ANZ) go ex. dividend 95c and the stock fell just 68c to close at $25.97. NAB closed today up 9c to $28.65. It is positive to see a day of stability with the aggressive selling we have seen of late through the big four banks.

- In corporate news, the market awoke to find that Brookfield Infrastructure; currently attempting a takeover of Asciano Ltd (AIO), had bought 14.99% of AIO yesterday at $8.80, bringing their holding to 19.99%. Qube Holdings (QUB) already holds 19% of AIO and was due to vote down the proposal from Brookfield in Tuesday’s meeting. AIO has now postponed next week’s vote. The board is still recommending the Brookfield offer of $6.94 cash plus 0.0387 shares in Brookfield – currently worth ~$9.22.

- BHP Billiton (BHP) had a poor finish to the week. News of possibly up to 16 people dying in a burst dam accident in Brazil put extra selling pressure on the stock, following on from its weak performance last night in London. BHP finished the day down $58c to $22.70; recovering from a low of $22.02. We have identified BHP as a potential trading opportunity in the coming weeks, as it has historically bounced $4 of levels just below where it closed. (see chart 2 below)

- The Reserve Bank said today in its statement that rate cuts this year and the currency's depreciation are supporting growth, indicating interest rates are likely to remain on hold. As we have continually said rates will be lower here for longer.

- The energy sector was the weakest link today with Woodside Petroleum (WPL) down 2.1% to $29.98; Santos (STO) was down 1.7% to $5.91. Oil-search (OSH) which we hold managed to poke its head above ground, and closed 1 cent higher at $7.91.

- Traders are now heavily focusing on the latest US non-farm jobs data, due Friday night, as a key indicator for whether the US will lift rates from their zero levels. We are of the opinion that this is a healthy thing for markets, and is inevitable.

- Look out for the weekend report. Have a great weekend!

Best Sector – Food, beverage and tobacco

Worst Sector – Energy

1 Winners and Losers Bloomberg

Winners

Asciano Ltd (AIO) +$0.67, or (+8.1%) to $8.95

Fortescue Metals Group Ltd (FMG) +$0.1, or (+4.7%) to $2.23

Ramsay Health Care Ltd (RHC) +$2.08, or (+3.4%) to $64.06

Coca-Cola Amatil Ltd (CCL) +$0.26, or (+2.9%) to $9.33

Losers

WorleyParsons Ltd (WOR) -$0.38, or (-5.6%) to $6.39

Liquefied Natural Gas Ltd (LNG) -$0.04, or (-2.7%) to $1.42

OzForex Group Ltd (OFX) -$0.08, or (-2.8%) to $2.75

BHP Billiton Ltd (BHP) -$0.58, or (-2.5%) to $22.70

2 BHP Billiton (BHP) Daily Chart

3 ASX 200 Day Chart

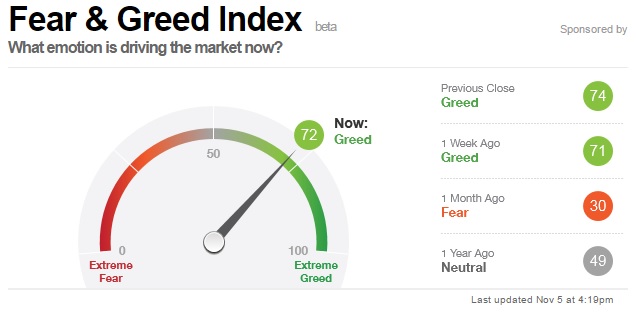

4 Fear and Greed Index CNN