ACCC says no to TPG tie up – it seems (TPM, TLS, VOC, TWE, HUB, CSR)

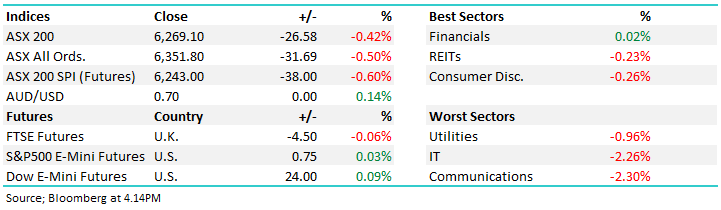

WHAT MATTERED TODAY

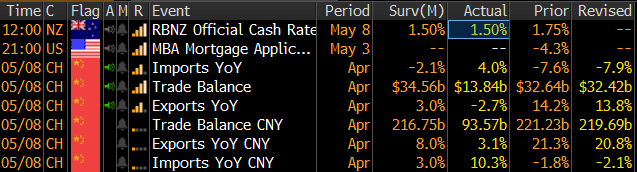

The Trump / China trade hangover lingered over the market this morning and we’d expect that theme to continue for the remainder of the week, however it wasn’t all one way traffic with more green about than US trade would have implied. Banks were mostly higher on the day, resources were down but finished off their lows while some of the high beta growth stocks felt the pain. At its worst, the index was down more than 50pts near the open this morning before buyers stepped out of the shadows – the market closing up around +20pts from the lows.

On the economic front, our friends over the ditch cut rates, with the RBNZ taking the benchmark from 1.75% to 1.50% putting more pressure on the RBA to do the same next month, while Chinese trade data showed stronger import numbers against a backdrop of weaker exports.

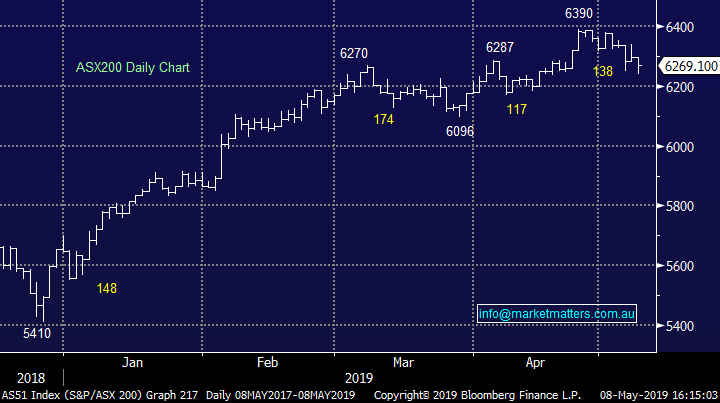

Economic Data Today

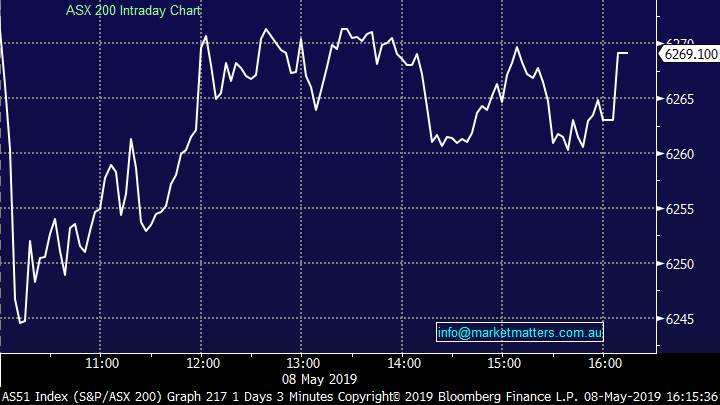

Overall today, the ASX 200 lost -26 points or -0.42% to 6269. Dow Futures are trading up +8pts / +0.03%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Telcos - Big news this afternoon with the ACCC inadvertently posting their determination on the proposed deal between TPG Telecom and Vodafone Hutchison Australia, opposing the deal. The announcement was dated 9th May - Bloomberg reported the following…. Australia’s competition regulator issued a post dated May 9 on its website Wednesday saying that it would oppose the * “ACCC announced it would oppose the proposed acquisition,” read the May 9 post on the regulator’s website which provides a timeline of the proposed deal.

- Minutes later, after Bloomberg News phoned the ACCC to query the posting, it was removed from the website and replaced with an entry, also dated May 9, that reads “Proposed date for announcement of ACCC’s decision.”

- Representative for TPG Telecom said he was not aware of any decision, while a representative for Vodafone Hutchison didn’t immediately reply to a voicemail message. (Source Bloomberg).

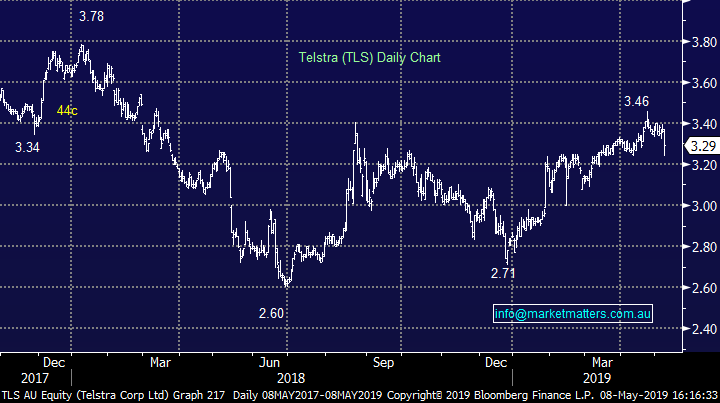

Stocks in the sector were whacked with TPG Telecom (TPM) -13.53% to $6.06, being hit from ~$7.20 just prior to the news while Telstra (TLS) fell by -2.08% to close at $3.29 – it lost 10c in short order post the release.

TPG Telecom (TPM) Chart

Telstra (TLS) Chart

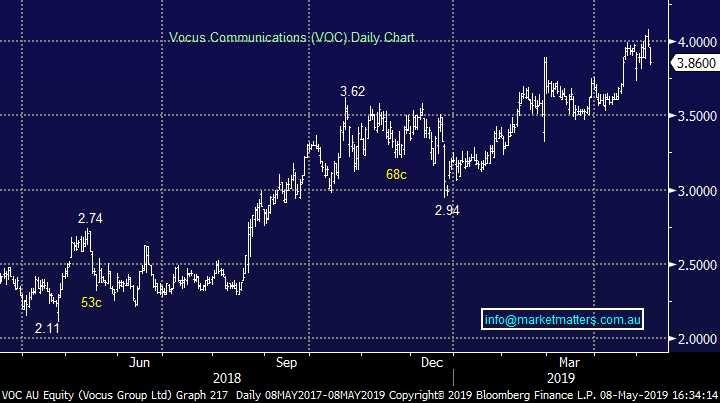

The telco sector rallied on the original news back in Augist of 2018 on the expectation that consolidation in the sector would alleviate some of the aggressive pricing pressures playing out. Before the proposed deal played out (August 2018), TPM was trading below $6 while Telstra (TLS) was around $2.85. Vocus (VOC) however has been the big mover, trading up from ~$2.40 in August to above $4.00 yesterday – before closing at $3.86 today.

Vocus communications (VOC) Chart

Insider selling – Treasury Wine Estates (TWE) hit -6.62% today after reports that CEO Michael Clarke sold 400k shares between the 1-3rd May – the news out pre-mkt today. Interestingly enough, no lame excuse provided by the CEO for the sale (which is refreshing), although selling 400k of a 942,994 total holding (+ performance rights) is a big line valued at just under $7m. This also came on the heels of a US hedge fund slamming TWE at a conference saying they inflate sales and key win brands are actually in decline - a double whack for TWE which is a much loved / highly rated stock.

Treasury Wines (TWE) Chart

….also on the insider sell list was HUB24 (HUB) with the Chairman Bruce Higgins flicking 20% of his shares on Monday at $15.15 - about $3m worth. A very good price given the stock closed today at $13.59 down -6.66% on the session.

HUB24 (HUB) Chart

CSR -1.47% - This morning they reported FY19 results booking a 14% decline in profit from continuing operations to $181.7m and a final dividend of 13cps franked at 50%, taking the full year dividend to 26cps. The market is clearly expecting very little from the company and while todays result was weak, it was within 2% of downbeat market expectations. At the top line, revenue was up 4% across the group with growth in all businesses. The talked about weakness in housing persisting for the next 12 months, although the decline to be at a slower pace. On 10x and a yield ~7% yield this is starting to look interesting.

CSR Chart

….and finally, AP Eagers (APE) has been given the green light to acquire AHG with the AHG board backing the takeover. We covered the sector in a recent report (here)

Broker moves:

· Credit Corp Downgraded to Hold at Canaccord; PT A$22.58

· G8 Education Upgraded to Buy at Morningstar

· Perpetual Upgraded to Hold at Morningstar

· NRW Holdings Downgraded to Hold at Wilsons; Price Target A$2.50

· Ainsworth Game Downgraded to Sell at Wilsons; PT A$0.67

· Aristocrat Downgraded to Hold at Wilsons; PT A$27.51

· Harvey Norman Cut to Neutral at Macquarie; Price Target A$4.20

· JB Hi-Fi Downgraded to Neutral at Macquarie; PT A$25.83

OUR CALLS

No trades today.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.