A2 Milk & Clydesdale disappoint (A2M, CYB)

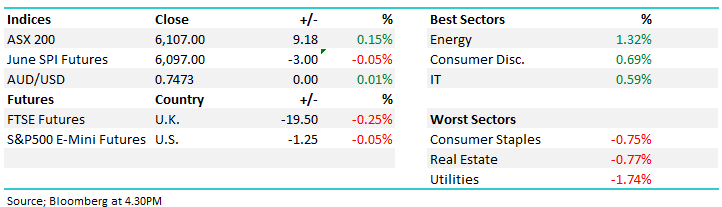

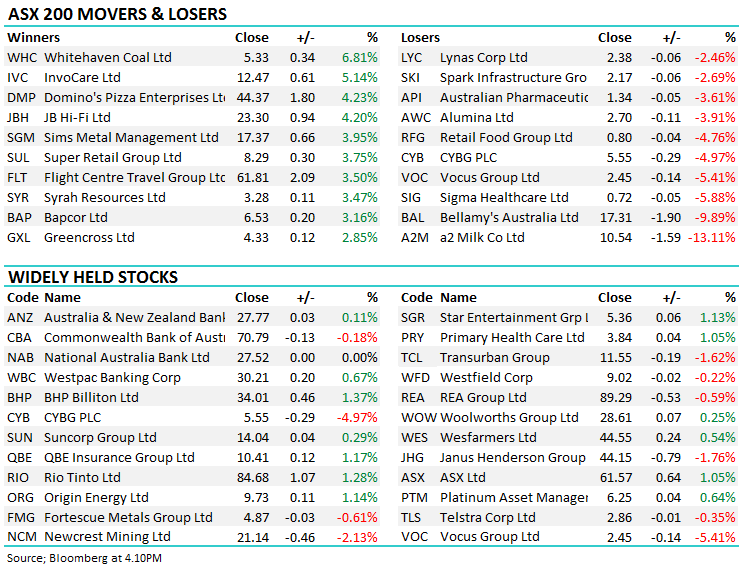

WHAT MATTERED TODAY

Sitting tapping the AM report this morning, it was shaping up to be a fairly tough day with CYBG slipping up with some negative news overnight and A2 Milk (A2M) trading down 20% in New Zealand this morning after a weaker than expected trading update. We added to our position in A2 on open this morning under $10 with the stock closing up +7% from the opening whistle but still down -13% on the day. In terms of CYB, the London based bank ended down 4.97% but up +1.6% from the daily lows. We’ll cover these stocks below however suffice to say, we thought the selling in A2 was too aggressive so we added to it, however we sat tight on CYB for now.

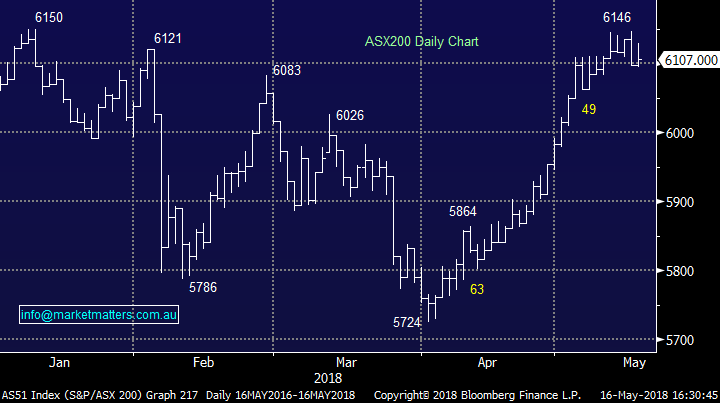

Overall, the ASX 200 added 9 points or 0.15 percent to close at 6,107.00, outperforming our Asian counterparts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

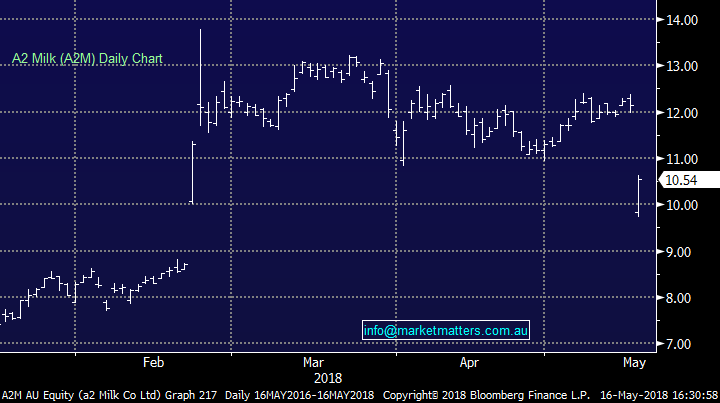

A2 Milk (A2M) $10.54 / -13.11%; Two main parts to the update from A2 this morning - revenue for the first 9 months of the year was NZ660m with the company guiding to NZ$900 million to NZ$920 million for the full year which compares to consensus of ~$950m – so it’s a downgrade of 3-5%. They’ve also said that marketing spend would be higher by around NZ$20m which the market didn’t like. A high PE stock like A2 has the potential to get hit hard on an update such as this and they did, but more so in the morning with a blanket of sell orders on open. Given the reduction on revenue expectations (albeit slight) amplified by higher marketing spend, the hit to earnings was big, but really, it comes down to whether or not they’re spending more on marketing to maintain current sales, or they see an opportunity to grow further – we think the latter.

A2 Milk Chart

Clydesdale (CYB) $5.55 / -4.97%; the stock was smashed in the UK market following a soft half year result released after the local market closed yesterday. The headline numbers were solid, with underlying profit jumping over 20% to £152M, however the quality of the result was questioned with much of that growth being generated from a tax adjustment. Costs were seen lower, which is one of the key reasons we like CYB, however some one-off restructuring items were also impacted the market’s view of the result. Most concerning from our perspective was the falling net interest margin – CYB needs to do more to get funding costs down and a good place to start would be their credit rating, currently just a BBB+, but we do expect the net interest margin creep higher as interest rates rise. Overall some disappointing signs in the result, however we do like the bank and the UK exposure + although it traded lower today, a reasonably bounce from the lows was encouraging.

Clydesdale (CYB) Chart

OUR CALLS

We added to A2 Milk in the growth portfolio as discussed above.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/05/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here