A wild day, here’s why (WSA, AMP)

WHAT MATTERED TODAY

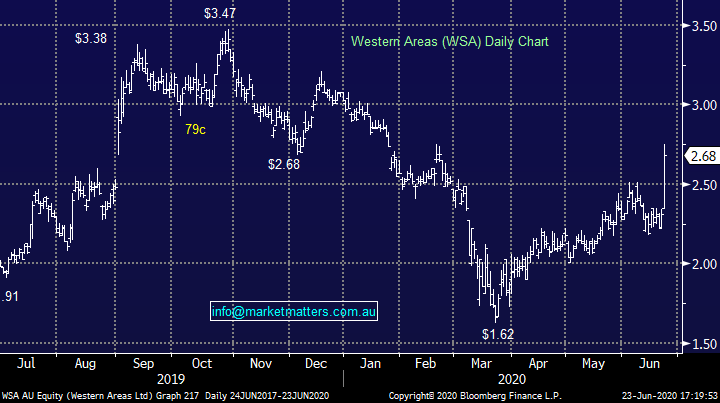

A wild day for stocks thanks to a wayward interpretation of an interview by White House trade adviser Peter Navarro on Fox News, with the outcome being reported that the China / US Trade deal was caput. The ASX was testing the 6000 level, up ~50pts looking strong when the news hit US newswires, flowed pretty quickly into a large turnaround in US Futures which saw global ‘risk off’ hit currencies, commodities & stocks, the ASX 200 losing ~115pts in 20mins. The sell-off was short lived though as Trump quickly reconfirmed all was okay, nothing to see here and the markets rallied off the lows, closing about mid-range.

The reaction by markets was instant risk off which shows how skittish they are to negative news, particularly given how unlikely it would be for Navarro to be the one to terminate the deal, that would be very unTrump like, however it does speak to a general increase in anti-China rhetoric by the U.S. administration in recent weeks; a theme that can be expected to intensify in coming months ahead of the U.S. election.

By the close of trade, stocks had recovered locally, US Futures were back trading marginally higher while Asian markets ended higher.

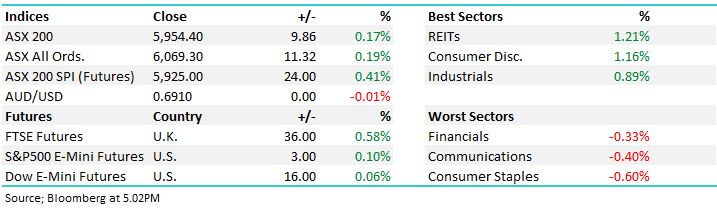

Overall, the ASX 200 added +9pts / 0.17% today to close at 5954 - Dow Futures are trading up +25pts/0.10%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Ausbiz this AM: Quick chat on Ausbiz this morning covering overnight markets, AMP, CGF and the banks...CLICK HERE

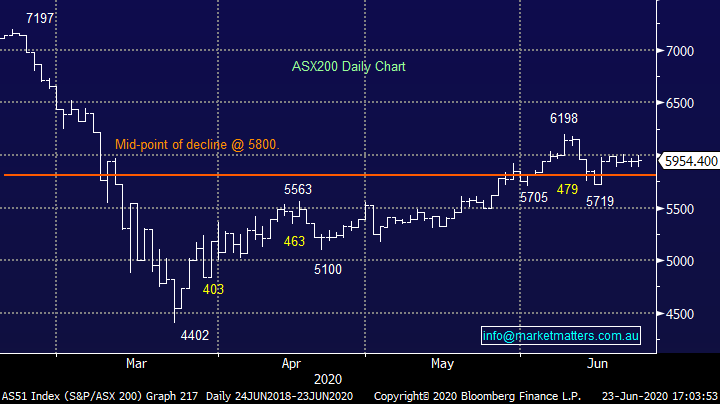

Western Areas (WSA) +16.02%: the best performer on the 200 today on some positive drilling results at the South Australian Western Gawler Project. The initial drill results have the project on course for a similar set up as Oz Minerals key development project at West Musgrave. We spoke about Nickel in the AM report today eyeing off Western Area’s recent purchase of Panoramic (PAN) as a potential M&A lead. The price of nickel has been under pressure over recent years but as we increasingly turn to the use of batteries, the demand profile over the medium term looks positive and prices should adjust accordingly.

Western Areas (WSA) Chart

AMP +7.93%: announced to the market that the sale of AMP Life had received all necessary regulatory approvals after the RBNZ secured capital commitments from the buyer, Resolution Life. AMP had targeted 30 June for the completion of the sale, and today’s approval paves the way to meet that goal just a week out from the end of the financial year. The sale will bring back over $1b in capital for AMP, money which can be used to clean up the final customer remediation claims. Shareholders may also see a dividend after it has all settled – the last AMP dividend was paid in February last year. While the stock popped, the AMPPB hybrid – which we own in the Income Report – was fairly muted. It looks particularly good value now that the AMP capital position has been improved. More to come on the Life sale when details come through next week.

AMP Chart

BROKER MOVES:

Bells have been a supporter of CGF for a long while and today Laf cut the rating to sell, with a $4.30pt. The stock today closed at $4.80, down 9.77% and importantly below the $4.89 underwritten placement price. In terms of Bells note they sighted the weak demand environment for annuities which is likely to remain depressed and Challenger’s life book is seen declining through until the end of FY22 as new sales prove elusive.

RATING CHANGES

· Northern Star Raised to Equal-Weight at Morgan Stanley

· Galaxy Resources Cut to Underweight at Morgan Stanley

· IGO Cut to Equal-Weight at Morgan Stanley; PT A$4.95

· Evolution Cut to Underweight at Morgan Stanley; PT A$4.40

· Mineral Resources Cut to Equal-Weight at Morgan Stanley

· Incitec Resumed Overweight at JPMorgan; PT A$2.60

· Nick Scali Raised to Overweight at Wilsons; PT A$7.70

· Treasury Wine Raised to Buy at Morningstar

· Stockland Raised to Buy at Jefferies; PT A$3.81

· James Hardie GDRs Raised to Hold at Jefferies; PT A$27.20

· Challenger Cut to Sell at Bell Potter; PT A$4.30

OUR CALLS

No changes today

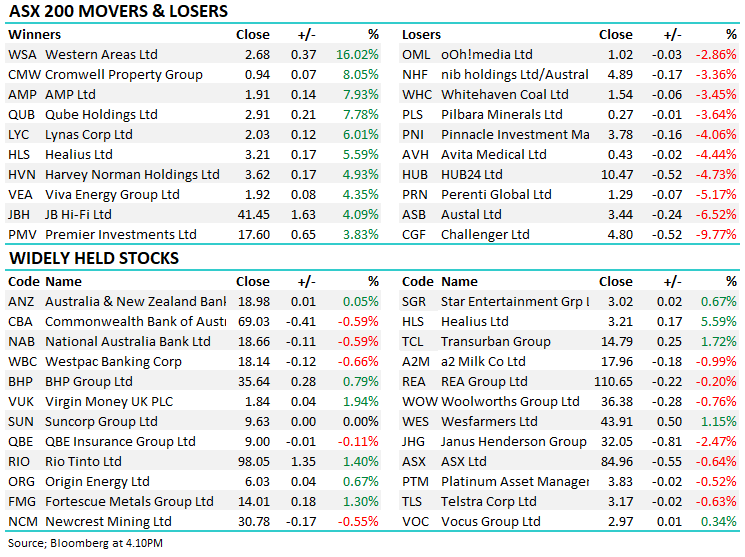

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.