A weak start to March (DMP, MYR)

WHAT MATTERED TODAY

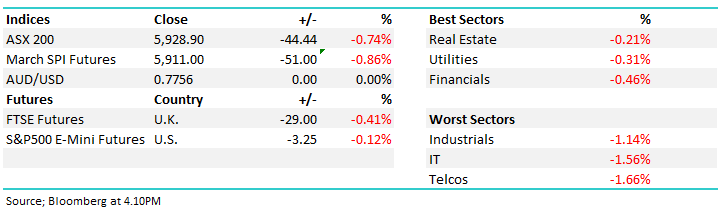

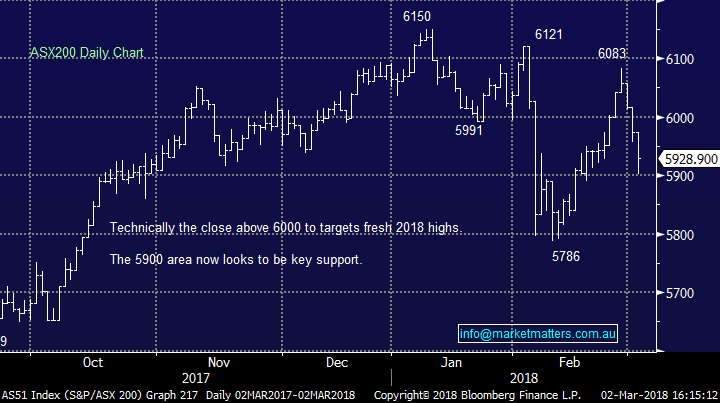

Weakness in the US market overnight courtesy of Trumps ‘protectionist’ comments flowed through into Asian trade today with the region suffering its 3rd straight session of losses. The local bourse is now down -155pts/ 2.5% from the weekly high. That said, there was reasonable buying from the lows today, mainly supported by the banks which is very typical of this time of year. We’ve maintained our short term bullish stance with the caveat that the 5900 level needs to hold on the ASX 200, and today it did with a low of 5902 before the mkt rallied +26pts into the close. US Futures were trading flat around our closing bell while Iron Ore lost ~1% during Asian trade.

Overall, the S&P/ASX 200 Index finished 44.4 points lower to 5,928.9 points - a drop of 0.7 per cent.

Reintegrating our view; At this point in time we are sticking with our short-term bullish outlook for global stocks while remaining very mindful of our medium-term view which is for a +20% correction commencing this year. We would not be surprised to see todays “Trump tantrum” create a decent swing low for March / April, remember over the last 20-years. Following a decline of -2.5%, or more, by US stocks in February the average return over March / April is an impressive to +4.7% - The S&P500 close down -3.9% in February.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATHCING OUR EYE

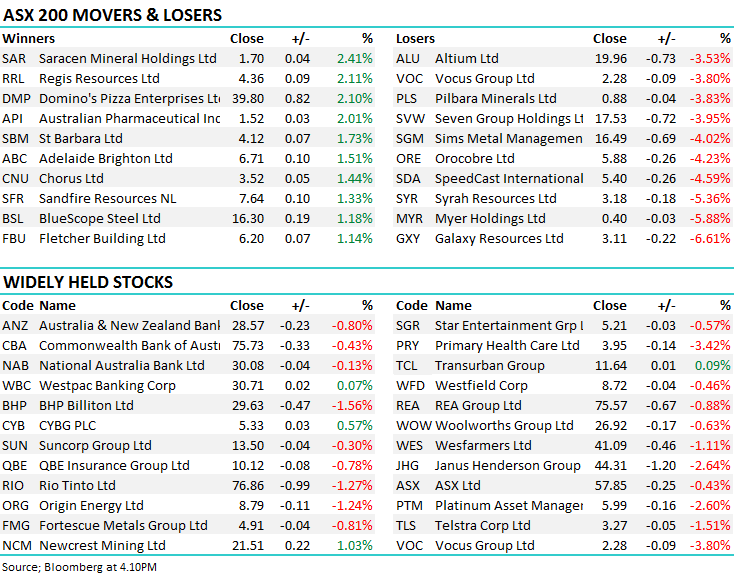

Some analysis of reporting now starting to seep out and overall the conclusion is that it’s been a good one, JP Morgan reckon the best in the last 5 years. The data probably supports that call if we look at downgrades to upgrades and the quantum of each. We’ve just seen a net downgrade of 0.1% to ASX200 earnings per share and if we compare the last 15 years, the median downgrade was 0.5% - so clearly a better than average season this time around. Expectations vary but overall they’re suggesting decent earnings growth over the next 12 months - Credit Suisse reckon 7% EPS growth for June 2018 and a further 6% in June 19.

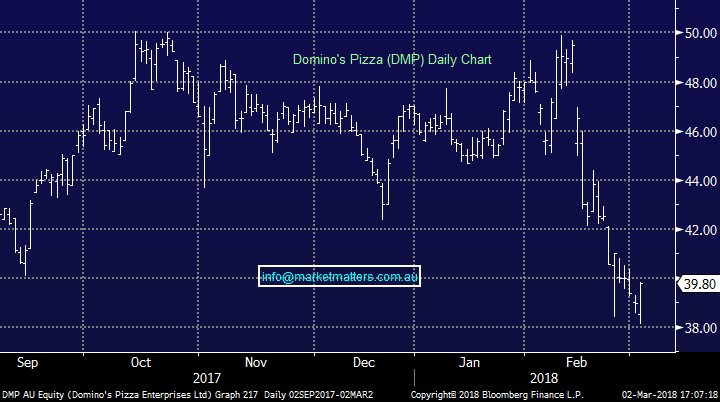

I like David Cassidy from UBS and he thinks that “While reporting season has, as always, been mixed at the stock level FY18 & FY19 estimates have on average been edged 1% higher for large caps, which is a bit better than the Australian norm.” He flags Qantas (QAN), Flight Centre (FLT), Fairfax (FXJ), A2 Milk (A2M), Resmed (RMD), Computershare (CPU), CSL, IAG and Origin Energy (ORG) as the large caps that reported well, while on the flipside, weakness was obvious from Star entertainment (SGR), Domino’s (DMP), Harvey Norman (HVN) and Tabcorp (TAH) amongst others.

We wrote about Dominoes this morning questioning the multiple that it trades versus the level of complexity / uncertainty playing out the moment + we think they will struggle to meet full year guidance, however, there was some decent buying stepping in from today’s low that caught our attention and we may just see a short term bounce play out from here – it’s had a lot thrown at it this week + it got hit hard after a poor result and today the selling looks to be exhausted.

Dominoes (DMP) Chart

Another stock catching our eye for the wrong reasons was Myer (MYR) – smacked hard again today and closed at just 40c. It was near ~70c in early Feb and selling here has just become very aggressive. There have been a lot that have tried to buy into this ‘turn around’ deep value opportunity that have just been steamrolled – including the biggest shareholder Solomen Llew through Premier Investments.

He bought ~88m shares at $1.15 less than a year ago which is now worth ~$35m – Ouch!

This one smells, sort of like Retail Food Group (RFG) smelt and I also think Silver Chef (SIV) has a stench at the moment….

Myer (MYR) Chart

OUR CALLS

No trades on the MM Portfolios today

Have a great Weekend all

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/03/2018. 5.07PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here