A weak session – 5600 now in play?

The bulls started to wobble today with the best of the session seen early before sellers took hold and the market drifted into the close. The banks were a major drag on continued ructions regarding the bank levy and who will actually pay for it, while the ratings downgrade of the regionals saw both BEN and BOQ in the crosshairs. The one notch downgrade will hit earnings by around 0.5%, so it’s small but another headwind none-the-less – more on that below.

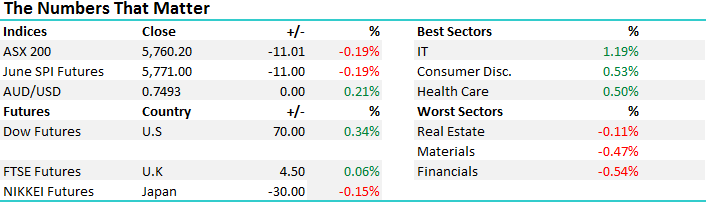

On the market today, we had a decent open however sellers took control and the index finished in the red - a range of +/- 42 points, a high of 5808, a low of 5759 and a close of 5771, down -11pts or -0.19%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

We had a decent session on the market yesterday, however todays price action was very weak. Looking back, last Friday we had a very strong close even though the market finished in the red it was a long way from the lows and the subsequent two days were strong. The strength early today and weakness late and close a long way from session highs leads us to believe the market will continue to suffer its “sell in May and go away” correction – and the chances of getting a new low for the month below 5700 has now just firmed.

ASX 200 Daily Chart - now expecting a text of 5600

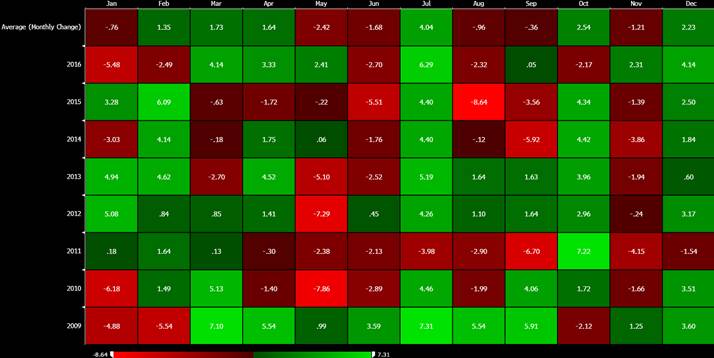

Remember the two simple statistics we are watching to put May’s recent weakness into perspective:

1. The average decline for the ASX200 over May / June since the GFC is 6.9%, this eventually targets the 5550 area i.e. 3.8% below yesterdays close

2. The average pullback for CBA during May / June since the GFC is over 10% which targets the $79 area – so far CBA has hit $79.53.

So, we know May/June is a weak period, and we’ve now had a pullback of around -4.3% from high to low. Given today’s price action and seasonal stats for this period, 5600 now comes into play. That said, seasonal weakness during that period is a ‘known known’ and that tempers investors’ appetite to BUY, generally until the completion of the ‘usual’ decline. We still believe further weakness over this May-June period is an opportunity to buy, not panic sell, and this is how we will be approaching our own portfolio.

We also know that since the GFC, July is the best month of the year for the ASX and more so from 2012 onwards often adding more than +4%. So, retain higher cash levels in May/June before deploying for the July bounce!

Source; Bloomberg

Stocks catching our eye; The first off the rank is OFX, the old Oz Forex which reported some reasonable numbers pre-market and the stock jumped on open and continued to see buying throughout the day. This stock has been a shocker for over the past few years however the result today looks very much like a low for a couple of reasons; Earnings came in line which was good and settled some nerves given the CFO resigned earlier in the year (just after providing guidance), the volume of transactions were up strongly, while the value was down around the same amount, however the real kicker was around the number of new accounts opened which takes the total number to around 157k. That’s good and is some validation for the big $$ they are spending to acquire customers. Still a lot of risk in this one given new management, unproven strategy etc, however it’s cheap and has big leverage if they get it right. Keep this one on the radar.

Also worth noting that 8.3% of the stock is short sold, or ~20m shares – if the stock gets a riggle on it will continue to go.

OFX Daily Chart

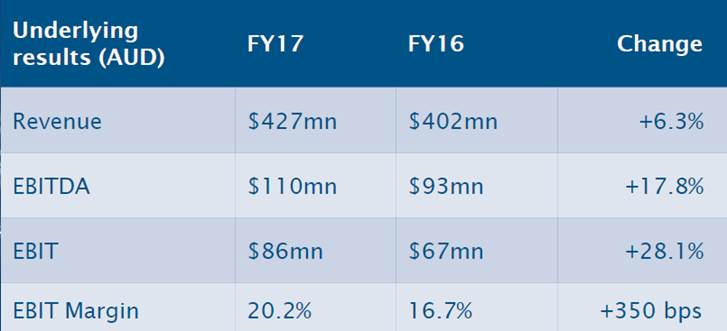

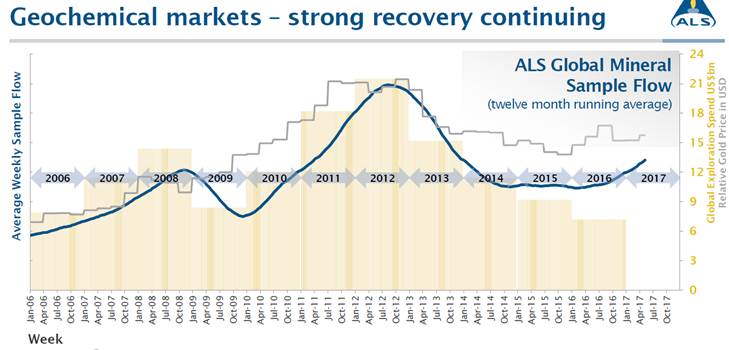

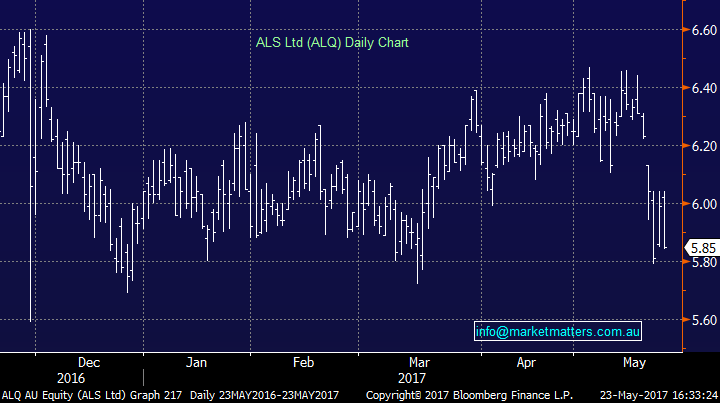

Another stock dishing up results today was ALS (ALQ), which used to be Campbell Brothers for those with a good memory. Traditionally exposed to mining through their lab business, they’ve gone more into the food testing / life sciences area to try and smooth earnings. Now that division accounts for the bulk of earnings which is good, but not that interesting. The main area of interest for us is around commodity business and specifically around the trends happening here. More drilling = more testing = more mining = more production. The results here have improved and the commentary was more upbeat.

Revenue up, earnings up, margins up – the read through for the broader mining sector is good for now

Global flow of samples – bottomed in 2015/16 and now ticking up!!! Mining is coming back

That said, the ALS share price looks woeful and a clear ‘short’ technically. The above is not about highlighting the strength of the stock, but more about the trends in the mining sector.

ALS (ALQ) Daily Charts

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here