A strong start fades (WOW, FMG, HUB, ANN)

WHAT MATTERED TODAY

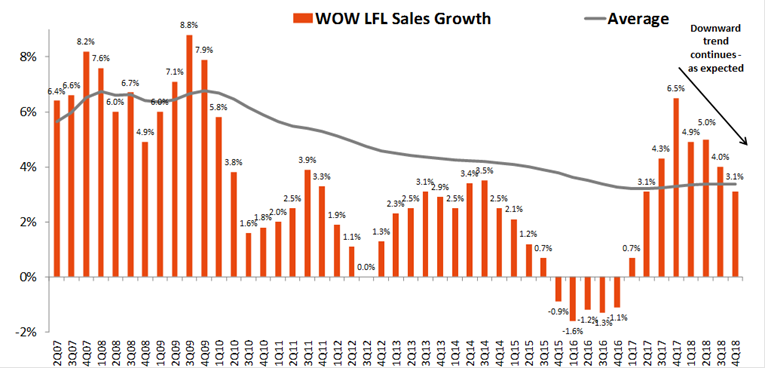

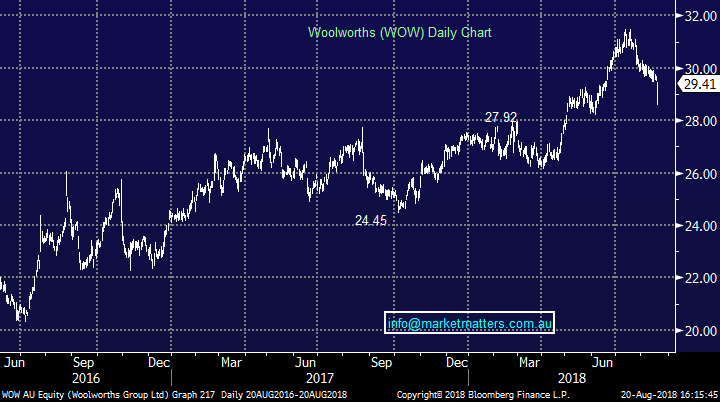

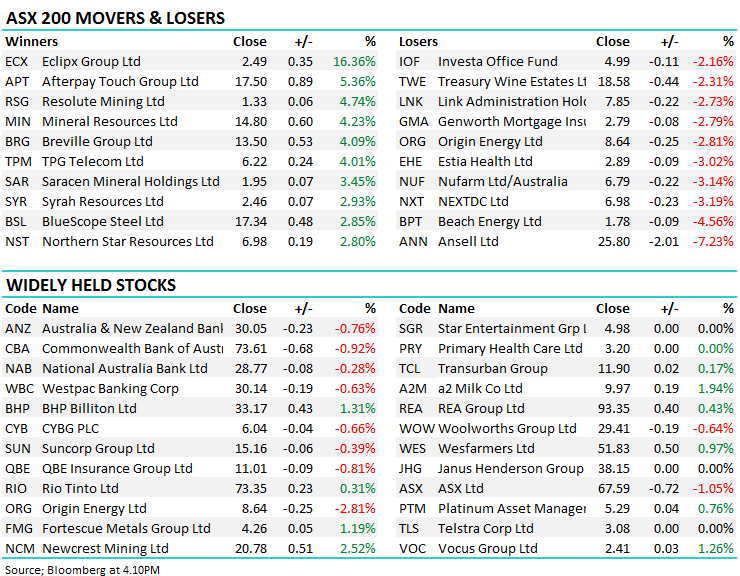

A fairly lethargic day on the index front however reporting season threw up a few curlies at the stock level. HUB24 (HUB) produced a good set of results and announced their madden dividend, the stock up +9.05% on the session while on the flipside, Ansell (ANN), a stock we’re keen on into weakness fell by 7.23% after missing expectations by 4.9% at the profit line and was more downbeat about FY19 guidance than the market was. Elsewhere, Fortescue (FMG) was a slightly confused result on first read through and that ensured the stock was volatile throughout the session, however as calmer heads prevailed, the Iron Ore miner edged higher into the close, While Woolworths (WOW) was down early, but recovered from the lows to close out the day down -0.64% at $29.41. More on these results below.

Eclipx (ECX), our weakest holding in the Income Portfolio rallied +16.36% today as the company confirmed an approach from its main competitor SG Fleet (SGF). ECX hosed down profit growth expectations a few weeks ago, and the stock dropped sharply down to a $1.66 low, before recovering strongly. Today the stock closed at $2.49 thanks to the SGF interest. The highly conditional bid is said to be $2 cash plus 0.15 SG Fleet shares for every ECX share held. The detail equates to around $2.55 at time of writing and is clearly an opportunistic approach, given ECX’s recent woes, scale is very important in these sorts of businesses – something the deal would provide for the two operators.

Overall, the ASX200 rose 5points today or 0.09% to close at 6345– Dow Futures are currently trading up 18pts / 0.07% at the time of writing.

Results tomorrow headlined by BHP and Oil Search. For a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Mineral Resources (MIN) – a very topical position of ours at the moment released a ‘Presentation Pack’ today offering more information than they released last week when they announced results. That also coincided with a broker initiation from Bells, the stock initiated with a BUY call and $20.71 PT. Bells have now become the most bullish on the street followed closely by Morgan Stanley who also have it on a BUY and $20.60 PT. The stock was up +4.23% today to close at $14.80

Elsewhere:

· Vita Group Upgraded to Buy at Canaccord; PT A$1.75

· News Corp Downgraded to Underweight at Morgan Stanley; PT $12.50

· CSR Upgraded to Equal-weight at Morgan Stanley; PT A$4.75

· OZ Minerals Upgraded to Hold at Bell Potter; PT A$9.05

· Westpac Downgraded to Neutral at Macquarie; PT A$32

· Bank of Queensland Cut to Underperform at Macquarie; PT A$10.75

· Link Administration Cut to Underweight at JPMorgan; PT A$7

· Link Administration Cut to Neutral at Credit Suisse; PT A$8.10

· Webjet Downgraded to Neutral at JPMorgan; PT A$13.80

· Helloworld Upgraded to Overweight at JPMorgan; PT A$6.10

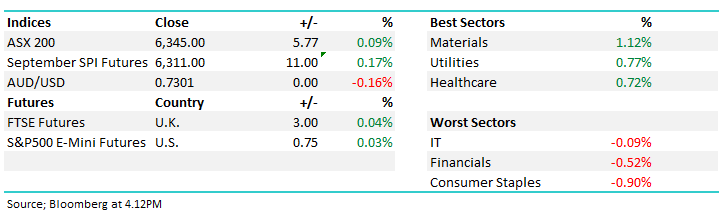

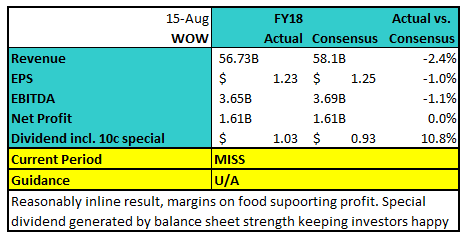

Woolworths (WOW) $29.41 / -0.64%; This morning Woolworths reported their full year results and they were marginally below expectations, although in fairness, as was the case with Wesfarmers they were messy. WOW had lots of one-off discontinued operations in the results (Petrol, Masters) that led to FY17 restatements and FY18 normalisation. The special dividend of 10cps was a surprise to the market.

The food business remains front and centre in the result, and the downward trends in terms of like for like sales growth was still evident (as shown in the chart below). For 4Q18 LFL sales growth fell to 3.1% just in line with the markets expectations of somewhere in the range of 3-4% – clearly the lower end. They sighted food and veg deflation which is pretty normal of late however they also said (specifically) that infant formula sales took a hit. It seems Coles are ‘dropping their pants’ to support better growth while Woolies are maintaining prices to defend margins.

Source; Shaw and Partners

Looking forward, WOW has weaker momentum than Coles in the first 7 weeks of the new financial year, with the company saying that sales have continued to “slow”, unlike Coles who said they were increasing to above 2.0% helped by the Little Shop promo. If you’ve got young kids, you’ll understand how popular this has been! However, the bright spot of the result continues to be good margins in food which still remain strong at 4.7% (well ahead of Coles 3.7%) vs 4.5% last week.

In terms of the outlook, nothing quantitative but capital management may be considered post exit of Petrol.

Woolworths (WOW) Chart

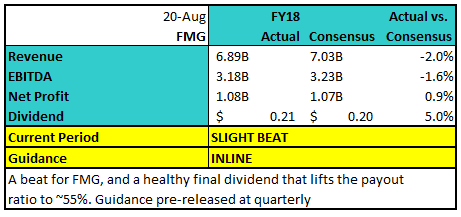

Fortescue (FMG) $4.26 / +1.19%; Fortescue’s FY18 numbers were released to the market this morning to little fanfare despite the reasonable result as well as adding a chunky dividend to help the Income portfolio. There were no real surprises in the result as much of the data could be deduced from their 4th qtr numbers from a few weeks ago which we spoke about here.

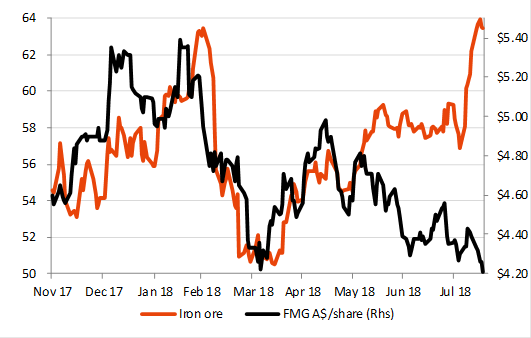

The dividend was the biggest talking point – FMG had flagged a payout ratio of between 50-80%, and disappointed the market in the first half when only 39% of profits were released in the half- likely holding some cash for their tip at Atlas Iron. They made up the difference and some today with a 12c final dividend, placing the payout ratio ~55% for the year. There was no change to guidance for 165-173Mt shipped, $12-13/wmt costs & dividend payout of 50-80% for FY19 and reiterated their plans to sell a higher grade product through blending iron ore. The below chart has caught our eye- showing the divergence of FMG away from their underlying Iron Ore price proxy, CFR China 58% A$/t:

Source; Shaw & Partners

Fortescue (FMG) Chart

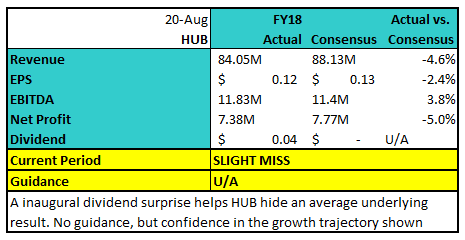

HUB24 (HUB) $13.02 / +9.05%; The platform business was strong on the market today after announcing their madden dividend, although the result seems a slight miss on expectations at the earnings line. The real ‘kicker’ though is around growth in funds under advice (FUA) over and above profit at this point in the company’s gestation, and they certainly delivered with net flows of $2.6b taking total FUA to $8.3b.

HUB24 (HUB) Chart

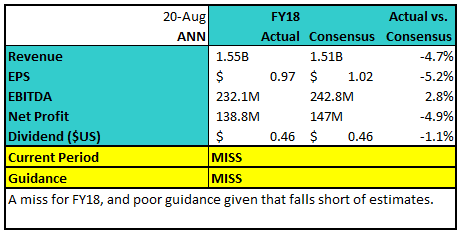

Ansell (ANN) $25.80 / -7.23%; Better ‘top line’ than market expectations however costs, largely from input prices (rubber prices are rising) was the problem and that flowed through to a miss at the profit line. This is a business positioned for growth and the guidance simply fell short of market expectations after guiding to EPS growth of 5-10% while the market was expecting around ~16% if we take into consideration todays miss - hence , the shares were weak. If the market re-rates this further then we may well get interested in ANN.

Ansell (ANN) Chart

OUR CALLS

No trades across the MM portfolio’s today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here