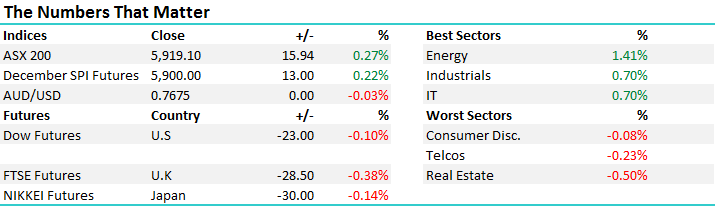

A slow start to the week (OZL, BOQ, FMG, STO)

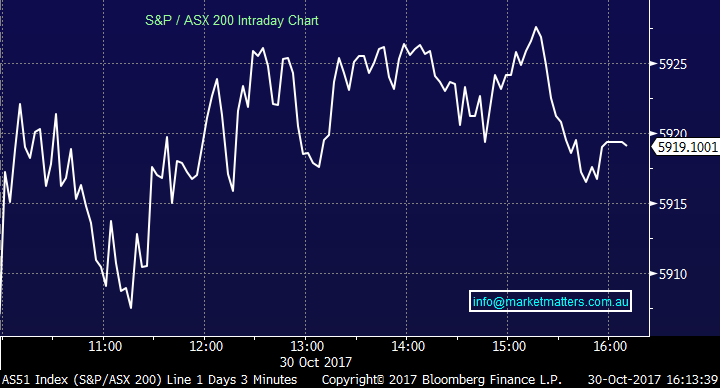

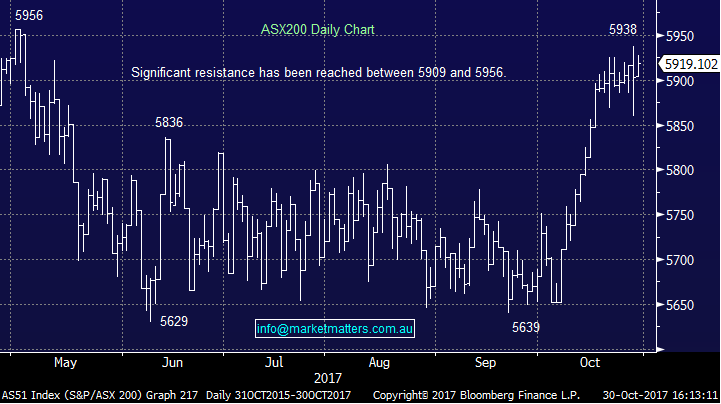

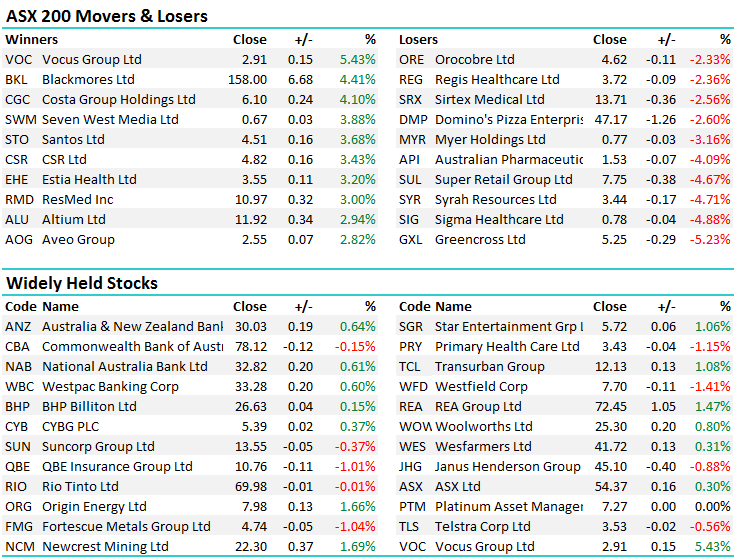

A subdued day to start the week, the market crept higher testing the 5950-resistance level again, but there we mixed fortunes at a stock and sector level. Real Estate stocks fared the worst, telcos fell as well despite Vocus ralying 5.4%. Energy stocks were the best performers in the market today after oil jumped 2.9% on Friday night. Overall a very tight range today of +/- 24point, a high of 5927, a low of 5903 and a close if 5919, up 15pts or +0.27%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

We pulled our buy order for Oz Minerals (OZL) before market today on the back of a weak lead from Copper. As the underlying metal fell below $US300/lb, it changed the short term technical picture. We are not completely off OZL however, and if fortunes turn this weakness may present an opportunity to buy at lower levels than our original target while the outlook still looks good medium-term.

OZ Minerals (OZL) Daily Chart

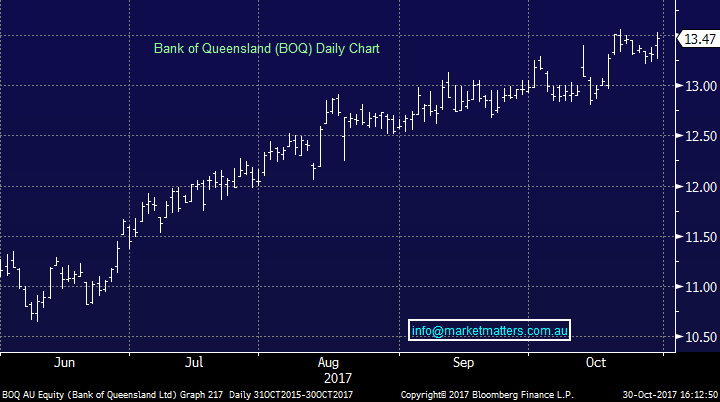

Bank of Queensland (BOQ), which goes ex-div on Thursday for $0.38 + $0.08 special FF, was the pick of the financials. It was a similar story in the big 4, with the three banks that go ex-div in November finishing higher - ANZ, NAB, WBC - while CBA was off slightly. Clearly some seasonality work playing out here as money moves towards the healthy dividends set to come out of the banks in November. This is an area we will likely take some profits in in the coming few weeks - we own BOQ, CBA, NAB, WBC in the Growth Portfolio, and CBA & NAB in the Income Portfolio.

Bank of Queensland (BOQ) Daily Chart

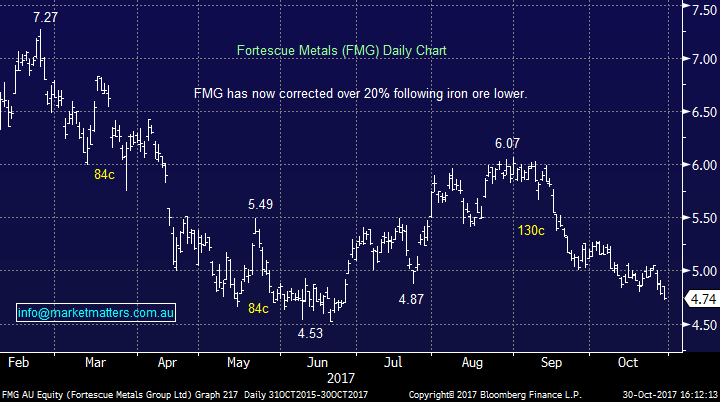

Fortescue (FMG) was weaker today after Iron Ore stockpiles in Chinese ports increased to the highest level in two months. Policy makers have moved to limit the Steel production through the Chinese winter as it has a significant effect on air quality. Iron Ore has entered a bear market for 2017, falling 24%, and we are looking for a signs of a bottom before allocating further to the resources space. It is likely we will look to some of the bigger names in BHP or Rio Tinto if weakness plays out, preferring to have some diversified exposure against the volatile Iron ore price.

Fortescue Metals (FMG) Daily Chart

Santos (STO) continued its strong run today, climbing 3.7% in line with Oil’s performance over the weekend. Trading in Santos was 40% greater than the 30-day average, while 4 times the 20-session average of STO call options exchanged hands throughout the session. We recently sold our Santos holding in the Growth Portfolio, and while we are disappointed to have missed out on some upside, we are also satisfied with the profit we took and happy to leave some on the table for what is a volatile stock.

Santos (STO) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/10/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here