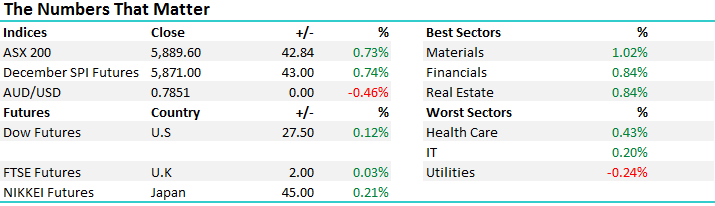

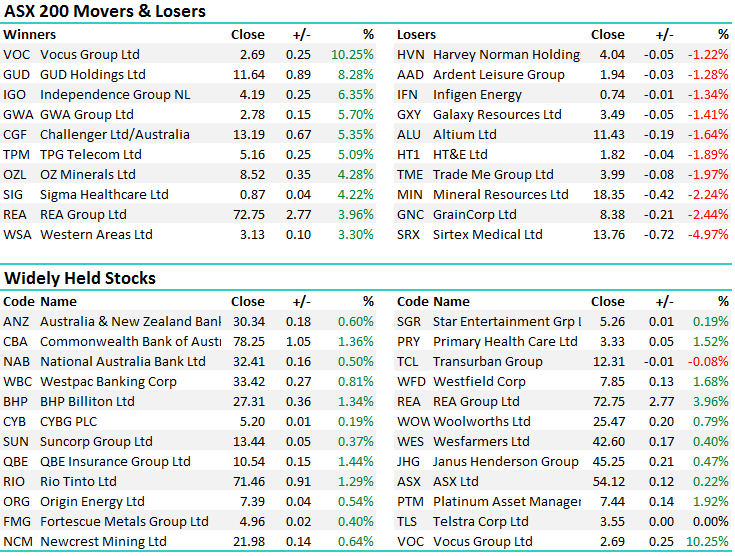

A ‘melt up’ playing out in Aussie Equities (CGF, RIO, QBE)

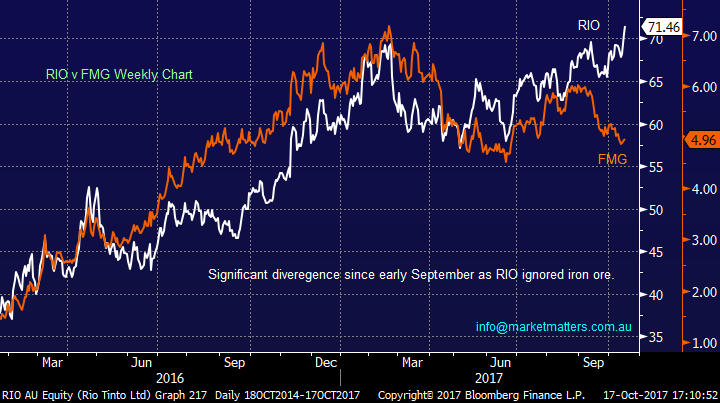

Another day of dominance from the buyers today with the ‘melt up’ in equities continuing to play out and as suggested in this morning’s AM report, a new trading range between 5850-5950 looks likely to be the near term range, before a test of 6000 plays out. Coordinated buying across the two major sectors (Financials & Materials) is sure to push the index strongly higher and that’s how trade played out today with the only sector lagging in the red being the interest rate sensitive Utes. RIO out with production numbers (good), Challenger Group Financial (CGF) out with annuity sales numbers (great) and Telstra with their AGM (ho hum!) were some of the headlines across the ticker today.

Overall, a range of +/- 50 points, a high of 5896, a low of 5846 and a close of 5889, up +42pts or +0.73%.

ASX 200 Intra-Day Chart

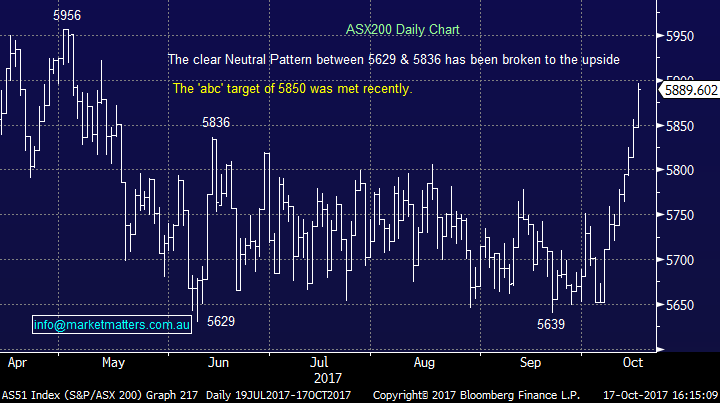

ASX 200 Daily Chart

Challenger Group Financial (CGF) – A very good set of annuity sales for Q1 out today and the stock jumped on the back of it putting on +5.35% to close at $13.19 and we’re now up ~11% on our holding in the stock. Today they announced 1Q18 sales of $1097m up 6% on pcp and well ahead of what we / the market was expecting hence the pop in share price. The thought was that they were forgoing volume for better margins but the numbers today show that volumes were also good. Anyway, a good set of good numbers and we remain happily long the stock…

Challenger Daily Chart

Rio Tinto (RIO) – out with production numbers today that looked Ok. As always, a lot of data and a lot of noise but overall a good result. In RIO, the money is made in iron ore, aluminium and copper with Iron Ore and Aluminium doing well while Copper was a tad light on however Escondida is due to come back with a wet sail over the next few quarters. Amazing to look at the relative performance of RIO v FMG in the last few months, with RIO benefitting from the announced share buy backs. Surely this gap has to close with either RIO coming back or FMG bouncing?

RIO v FMG

Interestingly, Iron Ore typically has a decent time of it towards the back end of the year which could be interesting for FMG.

RIO Daily Chart

QBE Insurance (QBE) - Allan Gray, the value investor is creeping up the register on QBE and we agree with their rationale. The short term trends in QBE are clearly volatile however the backdrop in the medium term looks a lot more appealing and we think the business is in good shape – just needs some positive macro trends to kick….which we think will happen. We own it and will stay long.

QBE Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/10/17. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here