A look at the retail sector as Goliath enters the fray!

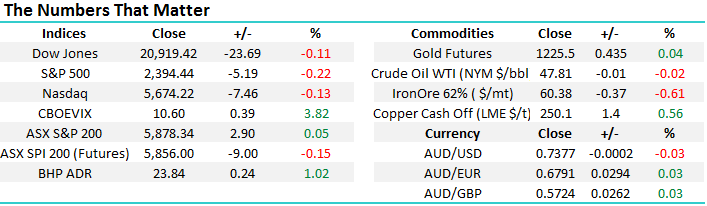

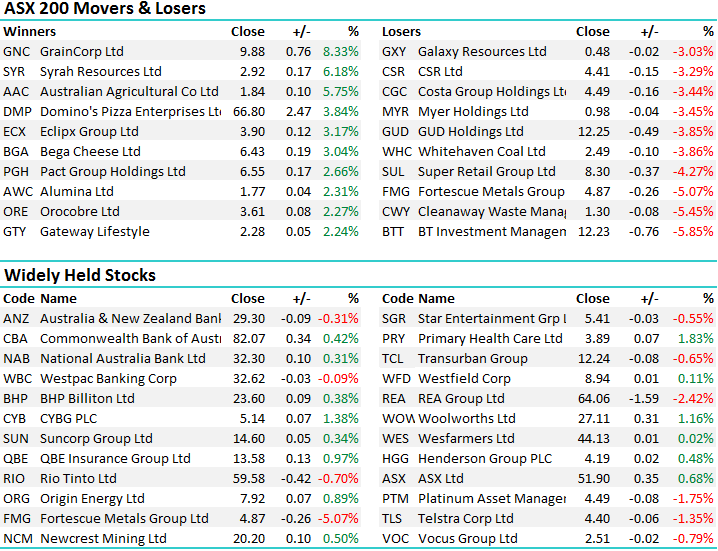

Yesterday afternoon’s optimism flowed into early trade this morning with the market opening strongly, buying continued in the banks while resources copped a strong bid following strength overnight in commodity markets, however the market wavered from around 11.30 onwards and trended lower into the close – finishing more than 40pts from the session highs. We had a range today of +/- 49 points, a high of 5922, a low of 5873 and a close of 5878, up +3pts or +0.05%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

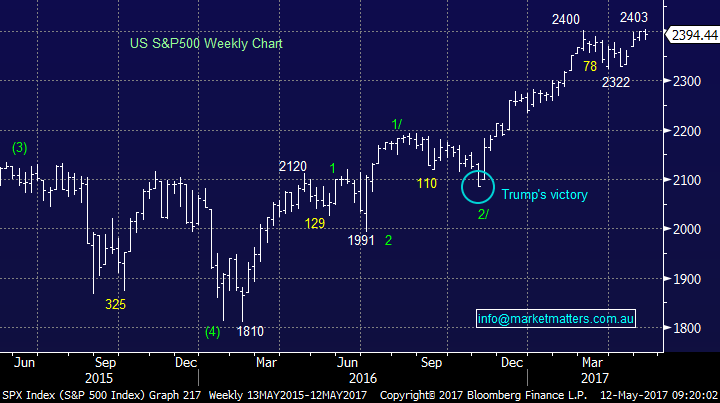

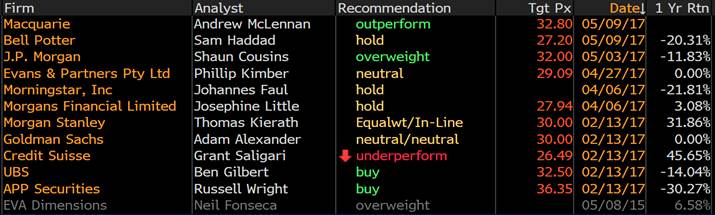

A couple of interesting aspects to think about this afternoon, with particular interest in the retail sector following a big drop by Vita Group (VTG), down 30% early on and a bearish note on the retail sector put out by Citi this morning that targeted JB Hi Fi and Harvey Norman. Here’s an extract from Citi ‘s analysts Bryan Raymond who cut earnings and valuations on JBH & HVN 30-40% after looking at the the Amazon effect, which he now factors into his long term base case.

They have downgraded JBH to Sell, while reiterating the existing SELL on Harvey’s. Bryan’s work looks at US, UK and German retailer performance around Amazon Prime launches and surveys of price differentials in key categories, which shows Amazon is 15% cheaper than Aus retailers across major categories. Citi reckons that ASPs need to contract by ~10% to narrow this gap to ~5%. This will drive ~180bps – 250bps declines in long term EBIT margins. Retailers typically see margins begin to recover 5yrs+ after Amazon launches Prime. We expect the electronics industry to likely consolidate further, as retailers rationalise store footprints. We expect JBH to become more efficient, likely closing one of their 2 Melb head offices and upgrade their synergy targets to $50m (currently $15-20m). The market is likely to look through upside risk to FY17e earnings as a further PER de-rating is likely as peak cycle earnings occurs.

Here’s what the rest of the Broker world thinks of JB at the moment… Current consensus price target of $29.42 representing upside of 22.4% - which suggests that most remain keen on it and there’s probably room for disappointment. Often a stock will bottom when the analyst community hate it – they rarely bottom when the mkt is still long and wrong!!! Which seems to be the case with JB and HVN at the moment. As we covered in the AM report earlier in the week, we have no interest in the sector at this stage (we also discuss this view in the Video done today)

JB Hi Fi (JBH) Daily Chart

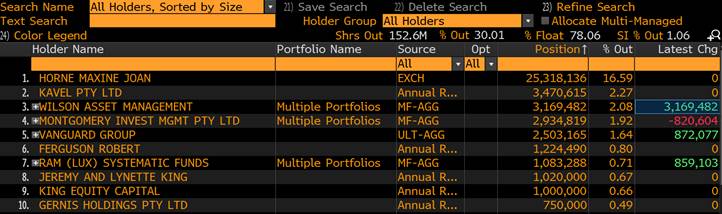

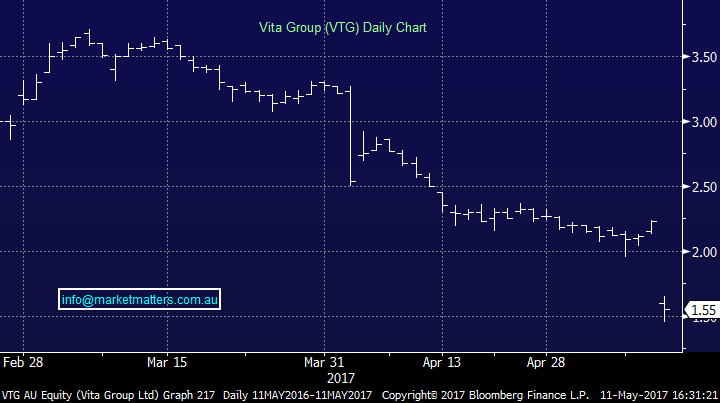

Vita Group (VTG) is a stock MM has traded last year, and it was actually one of bigger short term wins…however today the coy announced more detail around it’s Telstra (TLS) licensing deal (it runs more than 100 Telstra branded retail outlets) and it wasn’t good. These guys are no doubt very good retailers and have done an exceptional job over time however they’ve always been at the mercy of a bigger brand and when that bigger brand is hit with increasing competitive pressures as is the case with TLS right now, that pressure gets transitioned down the chain and VTG has felt the brunt of it today. The other interesting aspect here is that Director and biggest shareholder Maxine Horne sold 10m shares at the end of last year at $4.95 – they now trade at $1.55…

Horne is still the major shareholder however some of the better known aussie investors in Wilson Asset Management and Roger Montgomery’s fund are big holders…We have no interest in VTG at current levels.

Vitagroup (VTG) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here