A lacklustre session ahead of reporting season which klicks off Monday

WHAT MATTERED TODAY

A fairly lacklustre Friday and first day of February – always a big month with domestic reporting season kicking off on Monday. Today the market opened higher, made a low around lunchtime then edged up into the close – all in all a fairly muted session which is understandable, why buy stuff today!

To us, the index still looks tired and we’re targeting a pullback below 5800 from here, however the banks will be a big swing factor (RC report out Monday with recommendations) + obviously reporting season will be a driver. Our cash levels are now high around ~30% given the markets strength during January + specific stock moves that created opportunity to cash in. I’m a firm believer of selling into strength this year leaving us the capacity to buy into panic sell offs. While easier said than done, I suspect that the local reporting season will also throw up some opportunities over the next month or so

Chinese data was again on the soft side today with the Caixin PMI (manufacturing) printing 48.3 v 49.6 forecasted. Hearing from companies with exposure into China will be very interesting this reporting season.

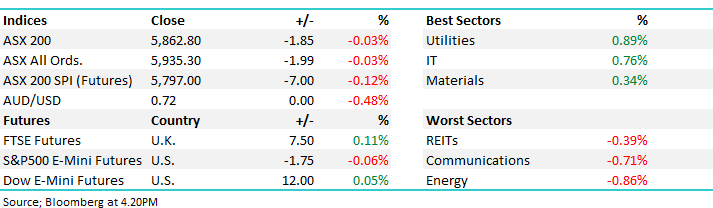

Overall, the index closed off -1pt or -0.03% today to 5862 and was flat on the week. Dow Futures are trading up 8 points / 0.03%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

I was on BUY HOLD SELL for www.livewiremarkets.com.au during the week with the 3 min video below. Afterpay (ASX:APT) is a stock we cover, which I suggest as a sell. To be clear, I think this is a phenomenal business and the run rate they’re achieving in the US is strong, however I simply believe the market is pricing too much upside in a stock that is now incredibly well owned by domestic growth orientated fund managers. They upgraded midway through January meaning that the Feb 22nd report should be fairly muted. Click to watch

Reporting; Kicks off on Monday and runs for all of February. To view a reporting calendar – CLICK HERE – I’ll be covering companies as they drop on Your Money and Channel 95 each morning, Tuesday to Friday at 9am plus, Harry, myself the team will be writing reports up on a daily basis. The afternoon report will include them. The market is negative going into this reporting period – trading on just 15.15x forward which is the cheapest forward multiple in 8 years – hardly demanding.

Of the companies we own, we have Janus (JHG) on Tuesday and CBA on Wednesday while NAB has a trading update on Friday.

Iron Ore; Has clearly had a cracking week as the below chart shows, now we’re getting a lot of brokers upgrading their commodity price decks and that’s flowing through to increases in price targets for the miners. Credit Suisse had forecasted the following…$65/ton for 1Q, $61 for 2Q, $60 for 3Q and $58 for final quarter for 2019 – so clearly they’re behind the curve with the price at ~$90, as is the most of the mkt.

Iron Ore Active Contract

CS wrote today…To give some context here, even if Vale SA manages to fully offset the 40 million tons/year of suspended production with other mines after dam burst, iron ore market may be tighter. There’s upside risks to bank’s forecast of an easing price. NSS! While There is 11 buys on the stock – consensus PT sits at $5.17 – Morningstar still bearish on the stock! FMG closed today at $5.84

Fortescue Consensus

Healthscope (ASX: HSO) +3.81%; Australia’s second largest hospital operator has today confirmed another bid from Canadian based Brookfield worth around $4.5bn, or $2.50 a share. The HSO board is supporting the deal - it’s in the best interest of shareholders say the board, unanimously. Shares closed today at $2.45. There has been a rival consortium including BGH and AustralianSuper sniffing around HSO and they say they’ll pay more. They’ve already made 2 prior bids with both being rejected plus they already speak for 19.13% of the stock. I tend to think one more bid will come, or at least, AustralianSuper will talk it up further to get the best deal on their 19% holding. HSO also re-confirmed FY19 guidance today which is pleasing.

Healthscope (ASX: HSO) Chart

Sectors this week;

Stocks this week;

Some of the specific events we covered during the week…

Production Reports from a number of our local miners; including (ASX:FMG), which delivered a strong report – click here

Telstra (ASX:TLS); Stormed higher this week after TPG pulled the pin on their network build . I can’t recall the last time TLS topped the leader board, however it did on Tuesday up more than 7% - click here

Credit Corp (ASX:CCP); A decent earnings report however strength on the day was met by broker downgrades – click here

Reliance Worldwide (ASX:RWC); Plumbing product manufacturer Reliance slumped today, giving back some of the strong rally it experienced this week.– click here

OUR CALLS

No changes to the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.