A bullish way to start the shortened week (APT, SFR, QBE, WBC)

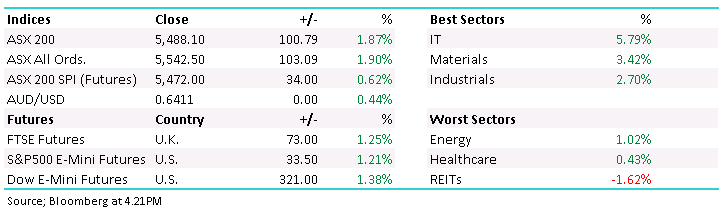

WHAT MATTERED TODAY

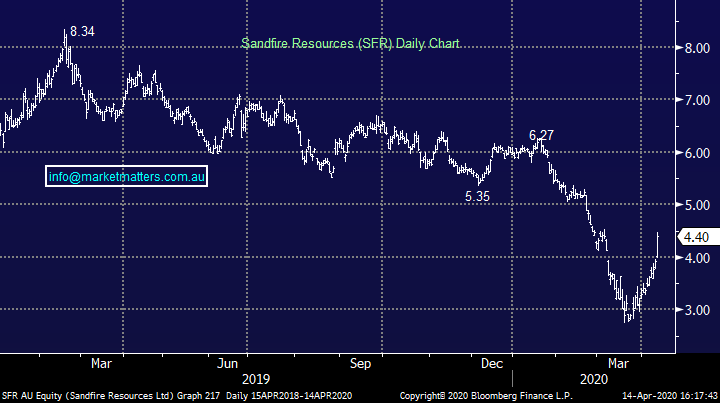

A positive start to the shortened week with the market overcoming early weakness to grind higher throughout the day, closing on session highs. The tech sector was the standout thanks to a strong trading update from Afterpay (APT) which reverberated to other names in the space, we cover this in more detail below, while Westpac’s (WBC) big $1.4bn provision thanks largely to AUSTRAC was not enough to stifle buying amongst the banks.

Interesting to see a lot of the second tier stocks starting to run, the mid-tier names that have suffered from a general risk aversion are now seeing some buying. I was just talking with our technical guy at MM about the size of stimulus that has been launched relative to the outcomes that we’re seeing from a virus perspective. It seems very plausible to think that the amount of stimulus factored in a more dire outcome from the virus perspective and we may not actually reach such a point.

Anyway, hard to know however stocks have rallied from the lows yet most fund managers I speak with remain very bearish – it implies we could ‘melt up’ here. Another interesting indicator around that is the number of capital raises that are being up scaled. Funeral operator Invocare (IVC) the latest, increasing the insto placement from $150m to $200m. I haven’t yet heard how QBE’s raise is going (more on that below), however buying a well-capitalised QBE generally pays off from experience.

As suggested above, the IT sector the standout however the materials also did well, Sandfire (SFR) the standout there. The only sector to finish in the red were the real-estate stocks, they dominated our list of stocks that are candidates to raise equity this morning. When a sector is cum-issue there is very little incentive for fund managers to buy on market (when they can buy in a discounted capital raise).

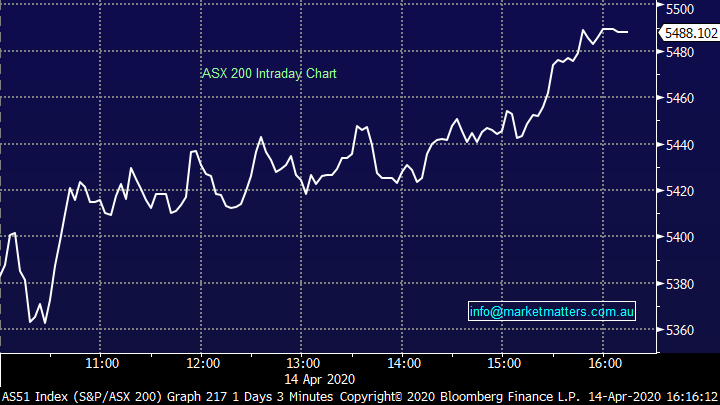

Today the ASX 200 added +100pts /+1.87% to close at 5488 - Dow Futures are trading up +321pts/+1.38%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Afterpay Touch (APT) +29.09%: This morning provided a Q3-20 trading update confirming they’ve grown strongly, although they are seeing some moderation into quarter end and year on year. $2.6Bn was spent through APT for the quarter, which is up 97% on last year. The USA continues to remain the groups largest growth engine with 263% growth (albeit of lower base) while ANZ grew at 40% in Q3-20 down from 50% YTD. Overall group active customers now at 8.4m, with ANZ up 21% YoY and adding ~100k customers since 1H20. USA largest customer base and growth engine at 4.4m customers up 283% YoY – huge numbers really.

In terms of margins and loss performance, they are advising 1% gross losses on TV in March – pretty much no difference - while margins are higher. The losses through would take time to see, and we’re not at that stage of the CV-19 cycle just yet. They went onto say they have no intention to raise capital – they have $540m in cash, $719m in liquidity and access to a range of balance sheet and off-balance sheet options.

A good update from APT today and this saw buying across the sector. Zip Co (Z1P) up +16.14% and while not a BNPL provider, Wisr (WZR) added +28.57%.

Afterpay (APT) Chart

Staying in the payment space for a sec, this time last week we looked at the weekly data put out by payments provider Tyro (TYR) to get an insight into broader trends. As a reminder Tyro is/was one of the fastest growing payment terminal providers in Australia. Tyro will give us a weekly view (in my opinion) on when retail has bottomed and likely to comp higher. 3 key points.

1. TV April to date of $301m. Tyro has over 32,000 merchants with largest category being retail and hospitality = 77% collectively.

2. Currently delivering ~$28.4m in transaction value (TV) a day, versus $62m in February; and

3. YoY growth rate was 27% in January, 30% in February and this has continued to deteriorate with April TV on a daily basis down 45% on March versus 34% a week ago. Notably Z1P TV is up close to 10% in April on March and APT on the conference call today advised something similar (although global).

There was also a good chart in the AFR today that looked at spending via cards up until the 9th April from Illion – focussing on categories of spending, not just the volumes. Gyms / Fitness down 95%, travel down 78%, public transport down the same, however online gambling up +67% (ALL), Home Improvement up 64% (WES), Food Delivery up +63% and online retail +61% (KGN)

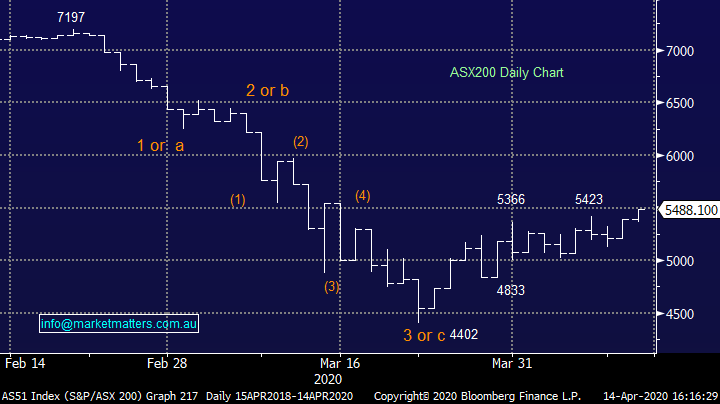

Sandfire (SFR) +11.96%: It’s been a long wait but SFR’s US development project is now fully permitted. SFR now has the two very interesting development options available in the US & in Botswana. Timing given the current Covid-19 will likely remain uncertain for a while however the development is a good one given the markets concern around SFR’s short mine life. Funding plans will be a likely focus next, especially with two interesting projects lining up. Copper stocks look bullish here. We own Oz Minerals (OZL)

Sandfire (SFR) Chart

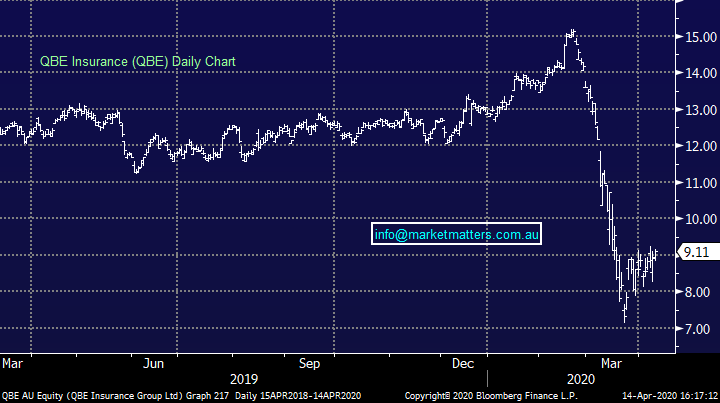

QBE Insurance (QBE) HALT: didn’t trade today after announcing a $750m institutional equity placement along with an SPP for current shareholders to raise an additional $75m. The placement has been underwritten at $8.25 a share, around 9.4% below the last traded price and will see about 145m shares issued, or around 11% of the current issued capital in QBE.

The money will be used to increase the cash buffer ahead of what is expected to be a heightened period of claims with COVID related shutdowns. Along with the placement, QBE announced it has seen strong premium growth of 8% in the 1st quarter, up from 4% a year ago while gross written premiums were 9% higher with volumes remaining strong. We are keen on QBE and may be interested into the post raise pain.

QBE Insurance (QBE) Chart

Westpac (WBC) +1.94%: moved ahead of their fist half results due out in the next few weeks to spread out some of the bad news. Today they announced a total of $1.4b of provisions will be included in the result, with the bulk, $1.03b, to be set aside for costs related to the AUSTRAC investigation. The remainder relates to further customer remediation, a reduction in the value of a number of assets and changes to the group’s life insurance.

Despite the bad news, Westpac was higher today, along with the rest of the banks, given the news was for the most part baked in. The focus of pain to be felt at the upcoming half year result will turn to the bad debt charge recorded, which could drag earnings below the $1b mark for the half and as a result shareholders appear unlikely to see an interim dividend. Commentary on the impact of the banks’ collective leniency on loan repayments will also be of interest with the long tail economic impacts of COVID-19 to significantly impact the second half as well. We own and see a lot of downside / negativity already price in.

Westpac (WBC) Chart

BROKER MOVES:

- MyState Raised to Buy at EL & C Baillieu; PT A$5.05

- G8 Education Raised to Neutral at Macquarie

- Marley Spoon GDRs Rated New Buy at Foster Stockbroking

- Netwealth Cut to Hold at Ord Minnett; PT A$7.70

- Corporate Travel Raised to Sector Perform at RBC; PT A$9.50

- G8 Education Raised to Outperform at RBC; PT A$1.60

- James Hardie GDRs Cut to Neutral at Credit Suisse; PT A$21.50

- GWA Group Cut to Underperform at Credit Suisse; PT A$2.20

- ANZ Bank Cut to Underperform at Jefferies; PT A$12.55

- Bendigo & Adelaide Cut to Underperform at Jefferies; PT A$4.46

- CSL Cut to Hold at Jefferies; PT A$300

OUR CALLS

No changes

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.