A bit of a yawn of a session

What Mattered Today

A bit of a yawn of a session really with the market opening higher, drifting back into lunchtime before spending the afternoon in a tight range. Ratings agency Fitch downgraded Aussie Banks to a negative outlook sighting an increase in ‘macroeconomic risks’ and slower profit growth. They reckon that low interest rates will continue to hurt margins however also believe that higher funding costs and a rise in loan impairments will also hurt. The scatter gun approach to highlighting risk that on balance doesn’t quite balance! Anyway, as you’d expect the news had very little impact on bank share prices today confirming that ratings agencies have about as much relevance as Alf Stewart on Home and Away. If you don’t get that analogy, give yourself a pat on the back, you’re in a better place than I am.

The US is on holidays tonight for Martin Luther King Jr Day, so no trade in bond or equity markets. King was the driver of the Civil Rights movement in the US, successfully protesting against racial discrimination before his assassination in 1968. He was shot on a hotel balcony in Memphis Tennessee on April 4th with many of the King family believing that the assassination was carried out by a conspiracy involving the US Government!

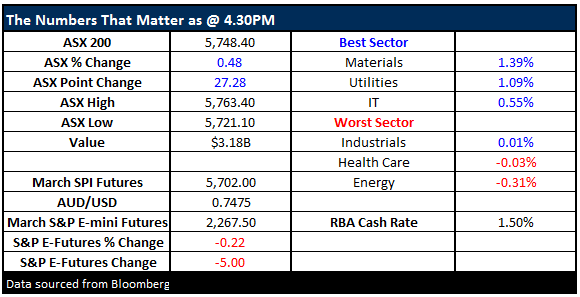

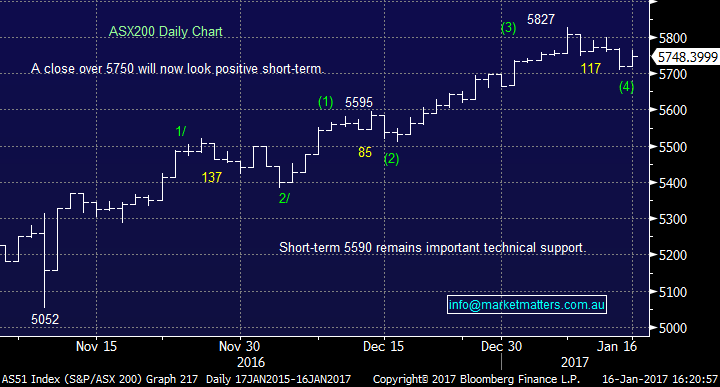

On the market today we had a range of +/- 42 points, a high of 5763, a low of 5721 and a close of 5748, up +27pts or +0.48%. Volume was about 25% lower than the 20 day average

ASX 200 Intra-Day Chart

ASX 200 daily chart

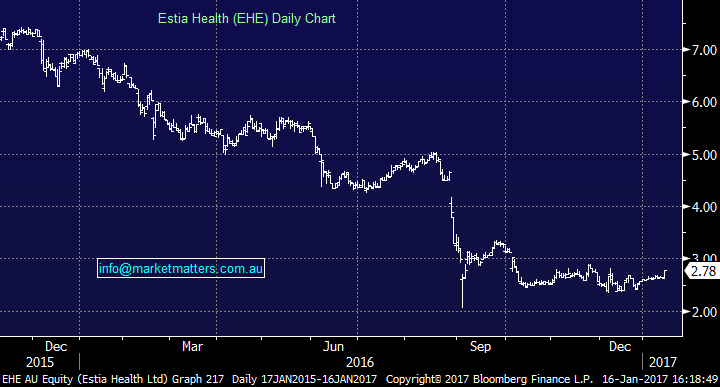

Estia Health (EHE); Rallied +4.91% today after they successfully completed the retail component of their capital raising. Importantly, there were only 7.2m shares that were not taken up equating to around $15m. The offer was underwritten so they’ll be taken up by the underwriters at $2.10. Not a bad result really given the issues the company has faced of late. The seemed pleased with the outcome. Clearly EHE is in a better financial position and has some flexibility going forward. We were keen to BUY EHE on a move nearer to ~$2.00 however it didn’t make it.

Estia (EHE) Daily Chart

Rio Tinto (RIO); Was higher today on the back of strong Iron Ore prices in Asia which rallied ~6% during trade. We have a short term options position on RIO looking for a move up to $65.

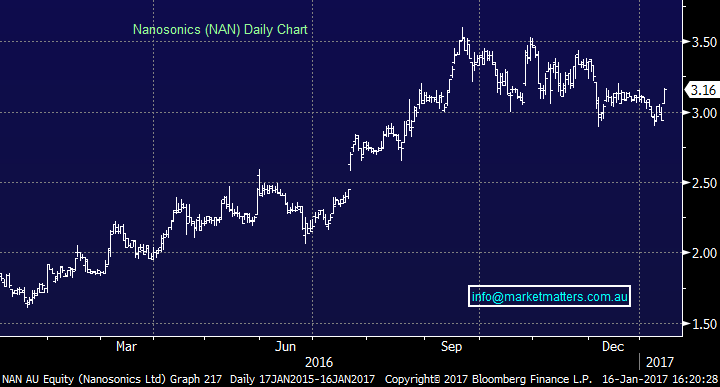

Nanosonic (NAN); NAN reported its 2Q17 sales of $18.3m up 101% on this time last year. For those that don’t know, NAN is a good mid cap healthcare equipment provider and they’re now ramping up sales of their Ultrasound Device. Although no forward looking statements were announced ahead of their 1H17 result due in February, NAN is only scratching the service in terms of product sales and earnings - good things are expected from this company. Look for the stock to make new highs above $3.60.

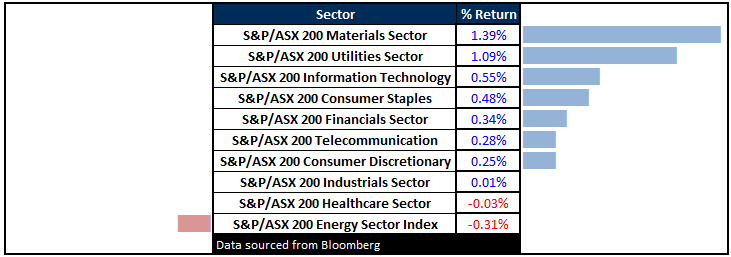

Sectors

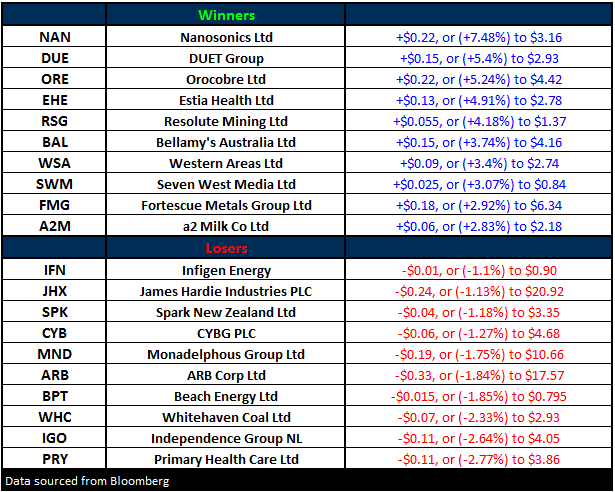

ASX 200 Movers

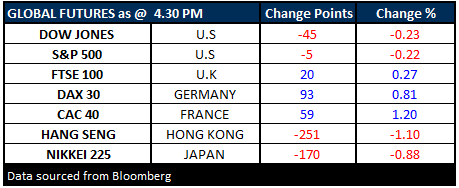

What Matters Overseas

All the best

James, Nick & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/01/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here