Hi Ron,

The trends for stocks on the upside has been strong, one defining factor here was in May when the market started to slide begrudgingly down ~3.5% at it’s worst only to put on a very quick ~5%. That to MM implies an impressive level of underlying strength. While it’s the bus that you don’t see that kills you, at the moment the momentum on the upside is strong and I believe we’re in a Goldilocks sort of environment of accelerating economic growth and supportive policy hence being hedged now is counterproductive.

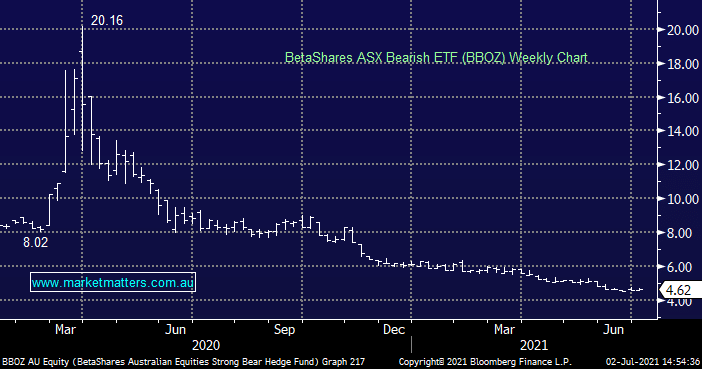

At some point that will end and we are very conscious of looking daily for signs of this. When the backdrop changes, MM may well apply a hedge such as the BBOZ.

One aspect to highlight in the BBOZ is that when it goes against you, value can be lost fairly quickly given it’s leveraged nature. Also worth noting that when the market rallies, the ETF provider is continually trimming exposure to keep the product within the stated exposure bands outlined in the PDS. Hence, when the market turns, you have a smaller exposure than you did originally. For that reason, we think it’s important to be quick to cut things like BBOZ when they go against us.