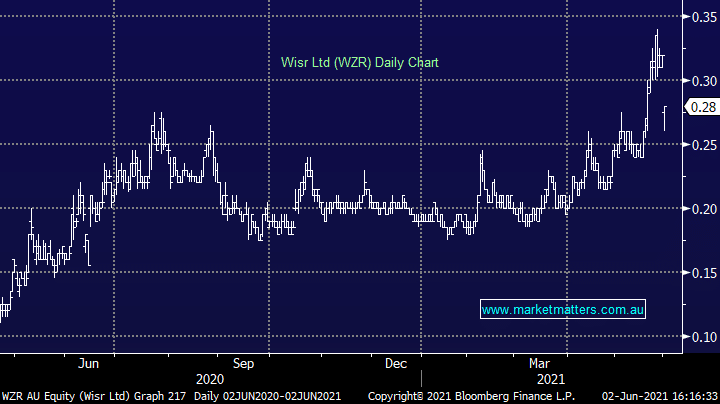

WZR -12.5%: the neo-lender came out of trading halt today after raising $50m through an institutional placement with the stock hit hard. The raise was done at a steep 21.9% discount to last at 25c, apparently a cut rate price after bookrunner Goldmans failed to get the full placement covered at a higher price. One concern is that the $50m cheque doesn’t come with a great deal of detail in terms of tangible targets for what the new capital could bring. While this is concerning, the company has proven it can hit targets and has flex in the model to grow substantially which new capital will support. Retail holders will have the opportunity to participate in a Share Purchase Plan (SPP) to raise an additional $5m at the same offer price of 25c. We are keen to add to the current position and will participate in the SPP if WZR shares are trading above 25c when the offer closes on the 21st of June.

scroll

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Close

Close

MM remains bullish WZR

Add To Hit List

Related Q&A

WZR

Switching from Wisr to Liberty?

What’s up with Wisr (WZR)?

Australian Strategic Materials & Wisr- MM’s take

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

JB Hi-Fi (JBH) historical PE multiple – source Bloomberg

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.