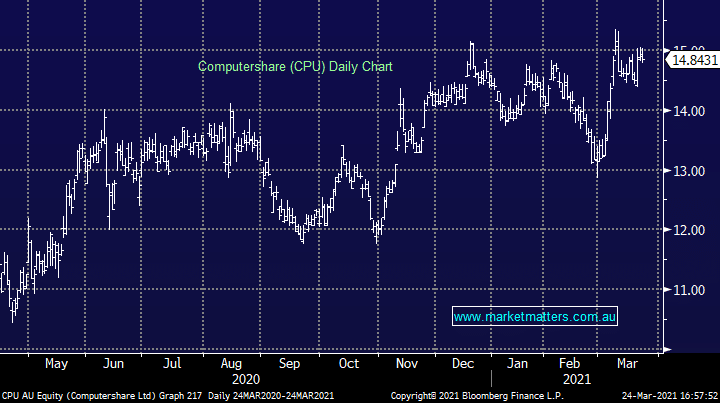

(CPU UNCH): The registry and corporate administration business has agreed to pay $US750m for US listed Wells Fargo (WFC US) Corporate Trust Services (CTS) business. The purchase will see CPU take a top 4 position in the North American corporate services market, adding over 26,000 mandates to their already significant exposure. The deal put its on nearly 9x trailing EV/EBITDA, but is expected to be 15% EPS accretive post synergies. The company launched a $A835m 1 for 8.8 renounceable entitlement offer to fund the deal with new shares offered at $13.55, a 9.6% discount to last. Large, but smart deal for CPU, adding significant market share and expertise in a key market

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

We like the deal, CPU looks interesting into a pull back

Add To Hit List

Related Q&A

What are MM’s current thoughts on CPU?

Computershare

Targets for PPT, CPU & CSL

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.