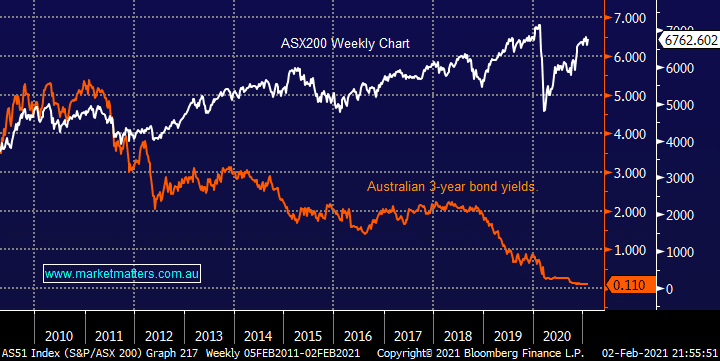

The correlation between the local 3-year bond yield and ASX200 is not surprisingly very clear, since yields started grinding lower from the 4-5% area equities have become a relatively more attractive asset class. The song remains the same, as term deposits pay under 0.5% stocks like heavyweight CBA yielding 3% fully franked with upside potential remain very attractive, especially as they enter an earnings upgrade cycle, the first since 2015, a theme we’ll cover in more detail in the Income Note today.

NB the risk to stocks is ultimately likely to come from the longer dated 10-years.